The Psychology Behind Consumer Decisions

The Hidden Influences Shaping Consumer Choices – How Cognitive Biases Drive Buying Behaviour

Every day, consumers make thousands of decisions -what to buy, where to shop, which brand to trust. On the surface, these choices may seem rational, driven by logical comparisons of price, quality, and need. However, beneath the surface, our decisions are often shaped by cognitive biases – psychological shortcuts and tendencies that subtly influence how we perceive, evaluate, and act.

Cognitive biases are not just quirks of human thinking; they are hardwired into our psychology, helping us make quick decisions in a world overloaded with information. But while these biases save mental effort, they also lead to systematic errors in judgment, particularly in consumer behaviour. Marketers, advertisers, and businesses – whether knowingly or not – leverage these biases to nudge customers toward certain choices, shaping everything from product pricing and branding to promotional strategies and sales tactics.

This article explores some of the most powerful cognitive biases affecting consumer behaviour, including:

- Loss Aversion – Why people fear losing something more than they value gaining something new.

- Anchoring – How the first piece of information we see influences our decisions.

- Confirmation Bias – The tendency to favour information that supports what we already believe.

- Social Proof – The influence of group behaviour on individual choices.

- Availability Heuristic – Why easily recalled information seems more relevant than it actually is.

- Status Quo Bias – The reluctance to change, even when better options exist.

- Endowment Effect – Why we overvalue things we already own.

- Framing Effect – How the way something is presented changes our perception of it.

- Scarcity Bias – The tendency to want things more when they appear to be in short supply.

- Optimism Bias – How we overestimate our chances of success while underestimating risks.

For each bias, we’ll dive into the psychological theory behind it, how it manifests in consumer behaviour, and how marketers use (or counteract) it in practice. By understanding these biases, businesses can craft more effective marketing strategies, and consumers can become more aware of the invisible forces shaping their buying habits.

Let’s explore how psychology shapes purchasing decisions—and how brands can use (or misuse) these mental shortcuts to influence behaviour.

The Marketing Made Clear Podcast

Check out the Marketing Made Clear Podcast on all good streaming platforms including Spotify:

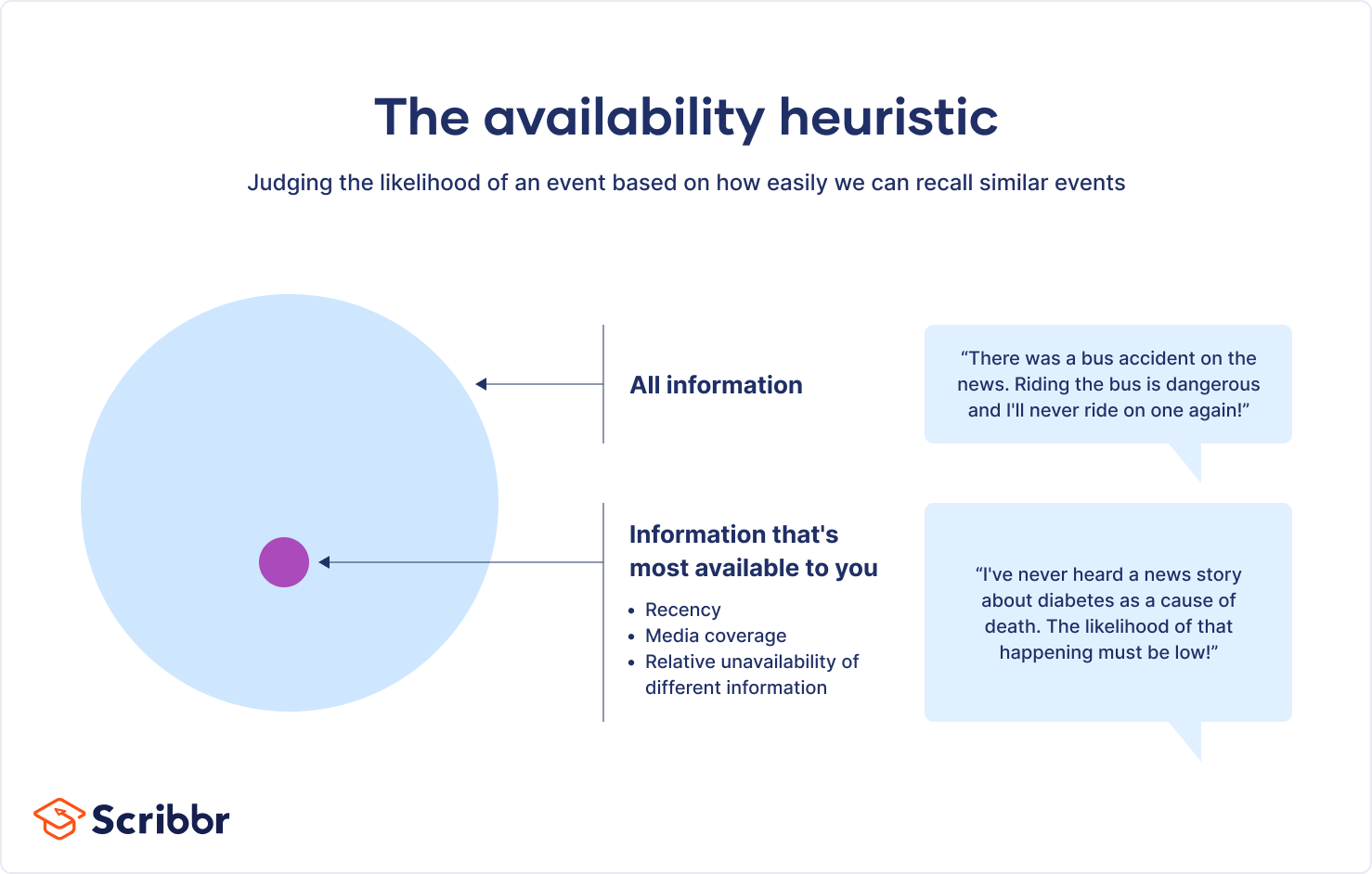

1. Availability Heuristic

Definition: The availability heuristic is the tendency to judge the frequency or likelihood of an event based on how easily examples come to mind. More vivid or recent occurrences seem more common, even if they are statistically rare.

Consumer Behaviour

- Shoppers rely on recent or memorable information when making decisions.

- A single bad experience (e.g., choking on a cookie) can deter someone from buying that brand again.

- A viral product recall may make consumers overestimate a product’s actual risk.

- Frequent advertising increases brand familiarity, leading consumers to perceive a product as more popular or trustworthy.

Marketing Applications

- Advertisers create memorable brand associations (logos, jingles, slogans) so their brand is top-of-mind.

- Stores promote massive discounts (“doorbuster deals”) to establish a reputation for low prices.

- Lottery advertising leverages this bias by showcasing winners, making consumers overestimate their own chances of winning.

2. Status Quo Bias

Definition: Status quo bias is the tendency to prefer the current state of affairs, resisting change even when a better option exists.

Consumer Behaviour

- Consumers stick with familiar products and brands even if superior alternatives exist.

- Many people stay with the same service provider (phone, internet, insurance) due to inertia.

- Loss aversion strengthens this bias – people fear losing what they already know more than they value potential gains.

Marketing Applications

- Subscription models and auto-renewals ensure customers remain subscribed by default.

- Free trials that convert into paid subscriptions bank on consumer inertia.

- Loyalty programs and habit-forming features (e.g., Amazon’s “One-Click” purchase) make it easier to stay with a brand.

- Companies position upgrades as a continuation of an existing product to avoid disrupting the status quo.

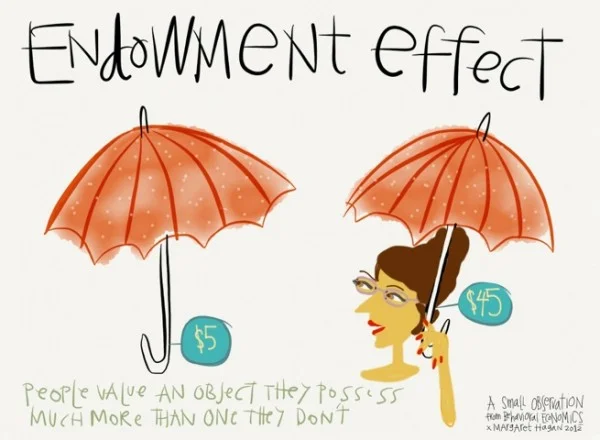

3. Endowment Effect

Definition: People overvalue items simply because they own them, demanding more to give something up than they would be willing to pay to acquire it.

Consumer Behaviour

- Owners assign emotional value to their possessions, leading to higher perceived worth.

- People struggle to part with items, even if they no longer use them.

- Customisation or personalisation strengthens the endowment effect.

Marketing Applications

- Free trials, test drives, and “try it at home” offers create a sense of ownership before purchase.

- Customised products (e.g., engraved jewellery, personalised Nike trainers) increase attachment and willingness to pay.

- Money-back guarantees make consumers more likely to buy, as they feel less risk—but often, they won’t return the item due to the endowment effect.

4. Framing Effect

Definition: The way information is presented – rather than the information itself – can significantly influence consumer perception.

Consumer Behaviour

- Consumers react differently to the same information depending on how it’s framed.

- Example: “80% lean beef” is preferred over “20% fat beef”, even though both mean the same thing.

- Risk-related messages are more effective when framed in terms of loss avoidance rather than potential gains.

Marketing Applications

- Sales promotions emphasise gains rather than losses (e.g., “Save 40%” vs. “Don’t miss 40% off”).

- Insurance companies focus on security (“Stay protected”) rather than risk (“Avoid disaster”).

- Pricing psychology: “£9.99” feels cheaper than “£10.00”, despite the negligible difference.

5. Scarcity Bias

Definition: People assign higher value to products that seem scarce or time-limited.

Consumer Behaviour

- Fear of missing out (FOMO) drives consumers to act quickly.

- Limited stock (“Only 3 left!”) increases perceived urgency.

- Scarcity suggests high demand and exclusivity, making products seem more desirable.

Marketing Applications

- Limited-time offers create urgency (e.g., “Flash Sale: Ends in 2 Hours!”).

- Retailers display low-stock warnings to push faster purchases.

- Luxury brands produce intentionally limited product runs to enhance exclusivity.

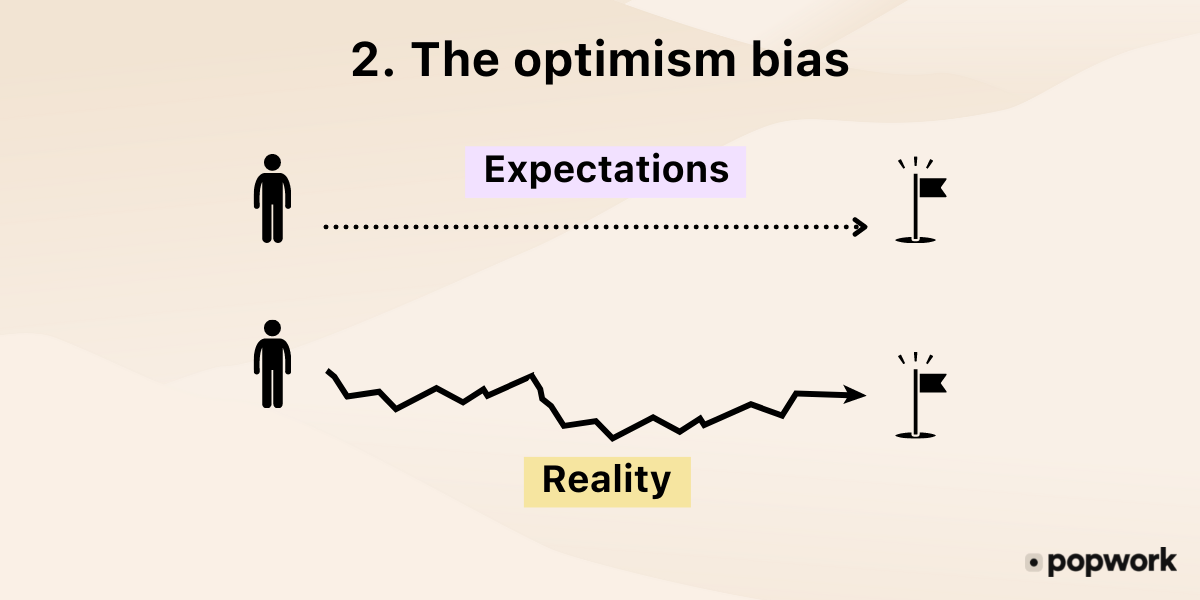

6. Optimism Bias

Definition: People overestimate the likelihood of positive outcomes and underestimate the likelihood of negative ones.

Consumer Behaviour

- Consumers believe bad things happen to others, not to them.

- Smokers may acknowledge health risks but assume they personally won’t be affected.

- Shoppers take financial risks (e.g., assuming they’ll pay off a credit purchase before interest applies).

Marketing Applications

- Lottery ads exploit optimism bias by focusing on winners, making people believe they have a good chance.

- Fitness brands showcase dramatic weight-loss stories, assuming consumers will believe they will achieve the same result.

- Brands use aspirational messaging: “Imagine the possibilities” fuels an idealised vision of success.

Conclusion: The Hidden Forces Behind Consumer Choices

Cognitive biases are deeply ingrained in human psychology, shaping how consumers perceive, evaluate, and purchase products. While these biases simplify decision-making, they also make individuals susceptible to marketing strategies that tap into subconscious tendencies.

By understanding biases such as loss aversion, anchoring, confirmation bias, social proof, the availability heuristic, status quo bias, the endowment effect, framing effects, scarcity bias, and optimism bias, businesses can create more persuasive marketing campaigns, and consumers can make more informed decisions.

In the ever-evolving battle between rational choice and psychological influence, one thing is clear: the way we think is just as important as what we think when it comes to making purchasing decisions.