The Growth of Raw Dog Food and Associated Markets

William D. P. Green MA MBA BA (2023)

We hear increasingly about the growing dog ownership in the UK and the growth of emerging pet sector brands and food types. We now have access to more food options, whilst information and research on dog anatomy and nutrition becomes more advanced and available. This global phenomenon has been driven by the changes in consumer behaviour, advancements in pet nutrition and the increase in our awareness of pet health.

We see this change first-hand in the format of all forms of pet shops and other retailers who are adopting food types that had previously been dismissed as fringe or too specialised.

This article will explore the facts, figures of the current industry and will explore some developing trends, and how they will impact the stores of the future.

Global Pet Food Markets

Global pet food markets are growing at pace, and further significant growth is forecasted. According to Grand View Research (2023), the global pet food market is worth over USD $94.76 billion. The compound annual growth rate (CAGR) is anticipated to increase to 4.4% by 2030. North America generates about 49.9% of worldwide sales. Meanwhile, Asia Pacific saw a 3% increase in pet food supply in 2021. In Europe, with almost 80 million pet owners, the CAGR is forecast to increase to 4.5%. Similarly, America’s revenue reached a height of $57,630.00 million, with projected growth of over $100 billion over the next 5 years (Statistica, 2023).

UK Market Size

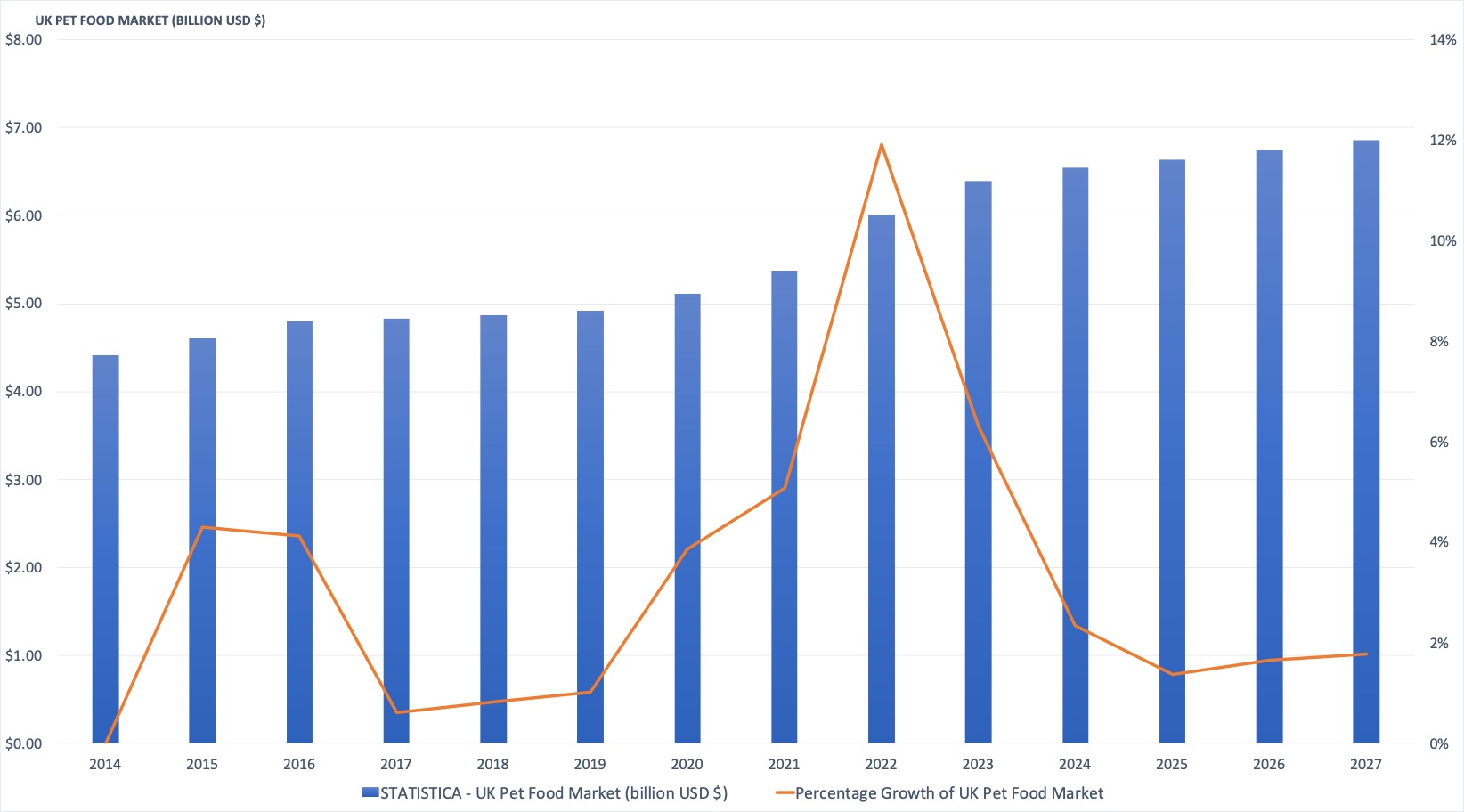

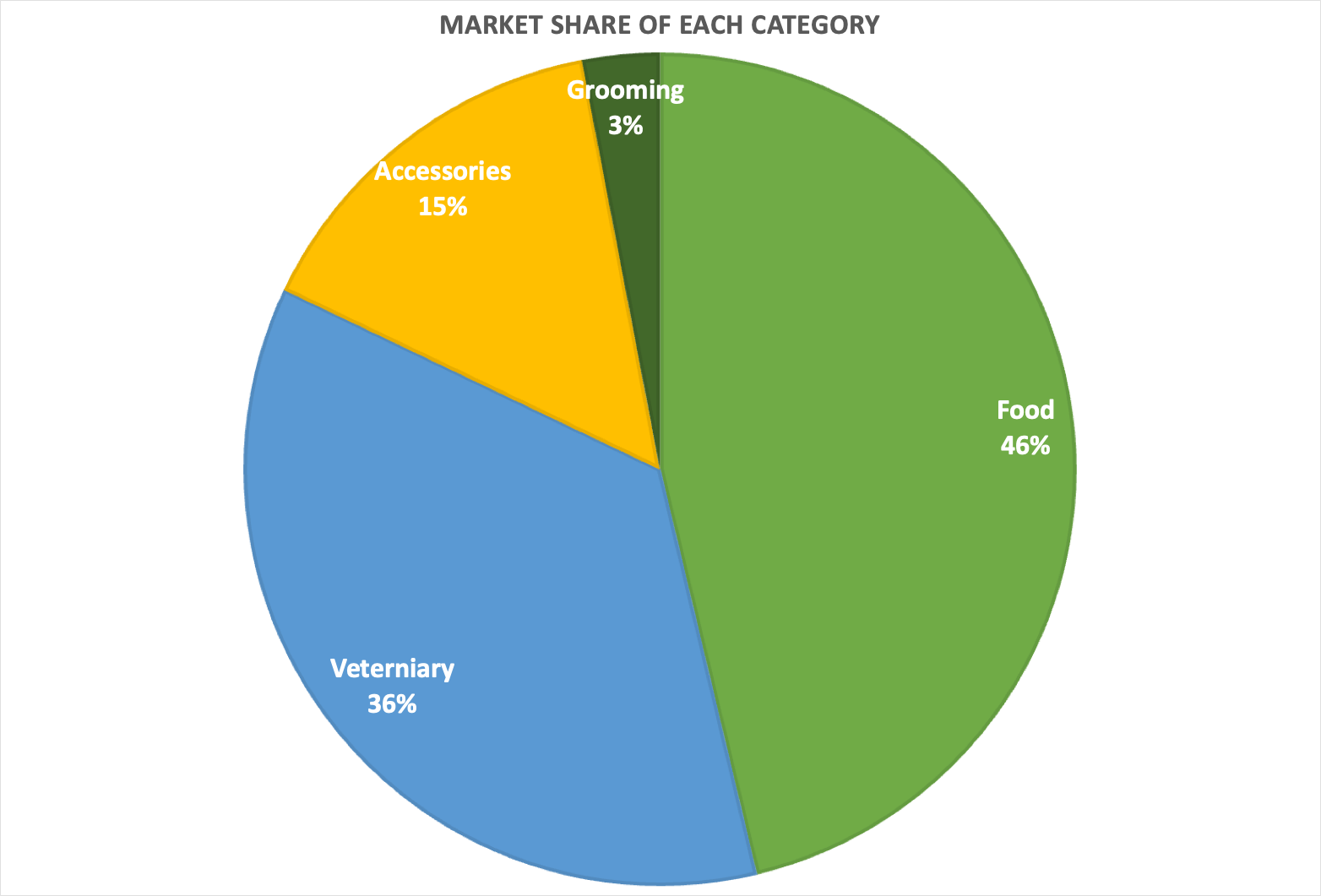

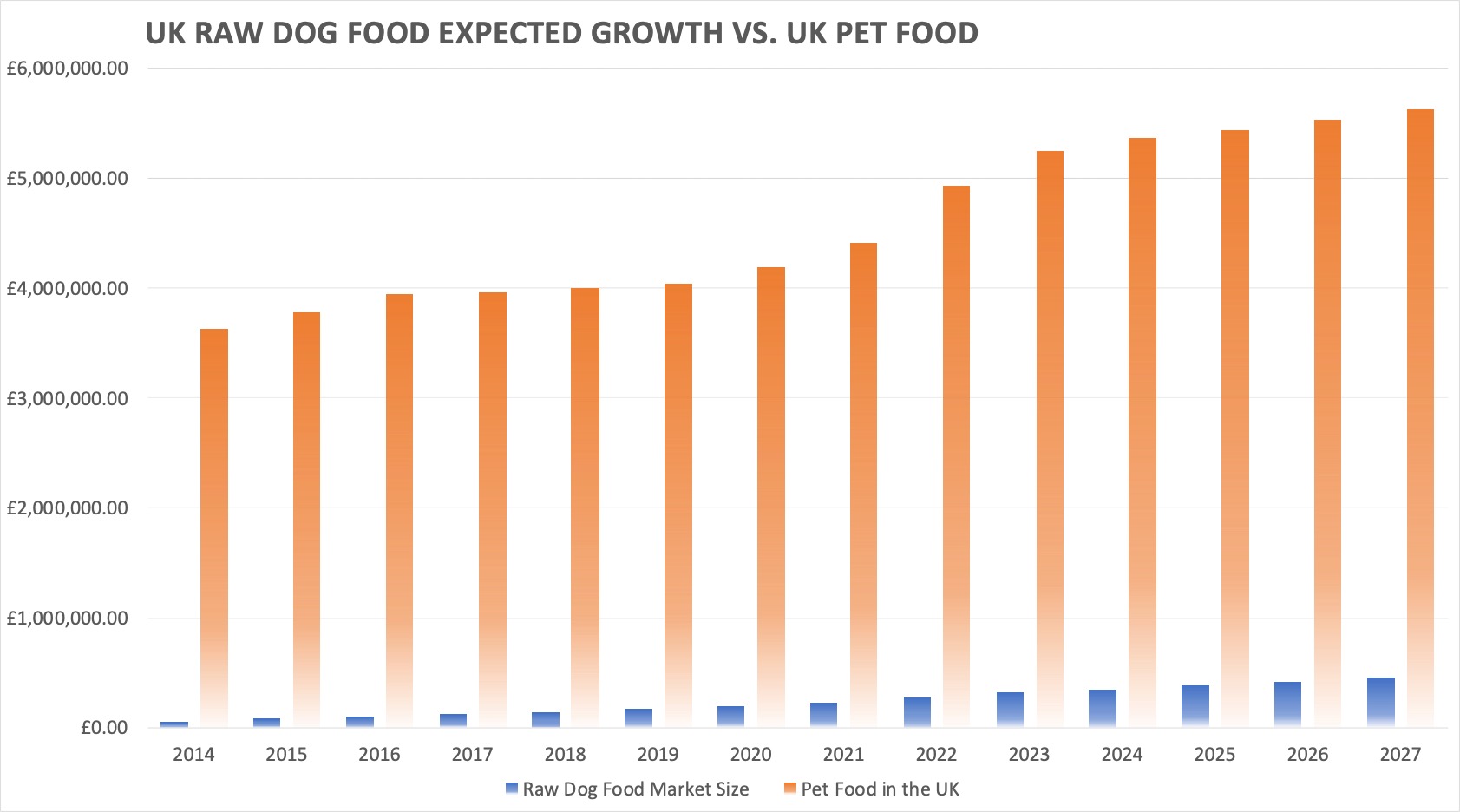

This growth has been reflected in the UK pet food market, which grew to £3.1 billion in 2020 (Statistica, 2021), with pet food accounting for 46% (Figure 2). The UK pet food market (see Figure 1) is expected to grow by over 14% over the next 5 years (Statistica, 2023). Demand for dog food is expected to increase and although growth peaked in 2021 due to the pandemic, all other major forecasts show some form of growth. The influence of premiumisation and steady inflation.

In the UK, COVID-19 increased demand in the UK for puppies, leading to the purchase of 3.2 million pets during the lockdown (BBC, 2021), which has naturally increased the demand for dog food products.). An estimated 27% of UK adults own a dog (PDSA, 2023). This has increased demand for pet foods, particularly online. E-commerce revenue in the pet sector grew by 38% year-on-year in 2021, on top of an impressive 204% in 2020 (Conjura, 2022). The growth of e-commerce has made a wide range of dog food types more accessible. Online retailers and subscription services have made it convenient for pet owners to purchase dog food and have it delivered directly to their door. This development has directly challenged retailers, with a focus on improving in-store offerings, hybrid offerings (in-store and online or click and collect) and a heightened focus on the in-store experience.

Premium segments in wet and dry dog food saw the strongest growth rates (Passport, 2021) leading to acquisitions of challenger brands by conglomerates, such as with the purchase of Lily’s Kitchen by Nestlé (Nestlé, 2020). The industry has seen a surge in premium and specialty dog food products, including organic, grain-free, and natural options. The higher price points contributing to industry growth and higher profitability for retailers, moving from commodity, to added value products.

Dog Food Categories

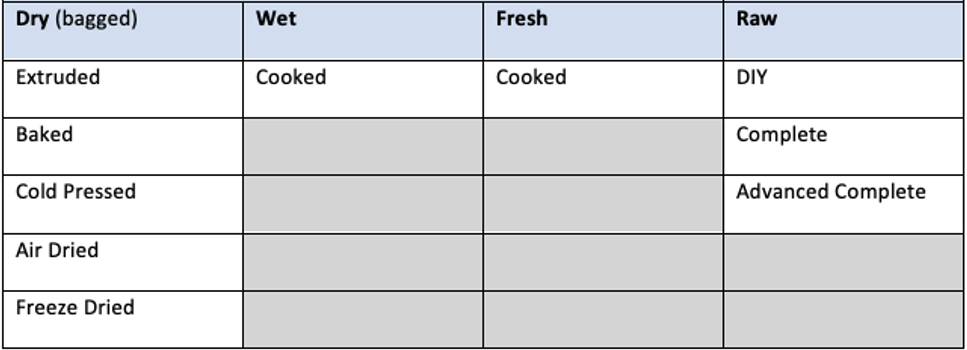

There are four predominant categories of dog food. All categories compete to some extent (Clark, 1999), and each promotes its own benefits above others.

Dry and wet dog foods are the most popular food types, with up to 80% of the market share (UK Pet Food, 2023). These foods are commercially-prepared, long-life products with synthetic additives and preservatives (Habib and Becker, 2021). This type of dog food has dominated since the invention of kibble in the late 1800’s.

The top three benefits of kibble and other forms of dry dog food include:

- Convenience; kibble is easy to feed and handle, it makes minimal mess, with no special refrigeration, it can be left out and doesn’t degrade quickly.

- Long shelf life; it takes years for most kibbles to break down naturally, so it can be purchased in bulk.

- Cost-effective; kibble is usually more cost effective than alternatives due to economies of scale and typically cheaper ingredients.

The size of the raw dog food market is immeasurable with any degree of accuracy due to the high-volume of start-ups (Sifted, 2023). Raw dog food is made from raw meat, bone and offal; considered as a “species-appropriate” way to feed dogs, based on their anatomy (Feldhamer, 2003; NRC, 2006; Akers; Denbow, 2008). Australia and USA have a more mature raw food market than the UK, following the growth of “real food” movements (Mathers, 2017), one of the fastest-growing segments of the pet food industry (Habib and Becker, 2021). Keller (2023) noted a rapid increase in new raw dog food companies, rising from 2-6.3% of turnover between 2012-16, now estimated to hold a share of 15-20% (Habib and Becker, 2021).

The top three key drivers for a move to a raw diet for dog owners is:

- Advances in nutritional research; advances in nutritional science have led to a better understanding of canine dietary needs. This has highlighted the need for dogs to be fed a meat-based diet, with fresh ingredients to improve the nutritional intake for dogs.

- Humanisation of dogs; many pet owners consider their dogs as family members, leading to a greater willingness to invest in high-quality, nutritious dog food. This development has also driven the demand for other forms of premium pet foods. Many

- Health and wellness trends; concurrent with human foods, there is a growing emphasis on health and wellness for all pet foods, especially for dogs. Known as the “real food movement”, this follows a move away from highly-processed foods such as kibble and towards fresh and frozen raw diets.

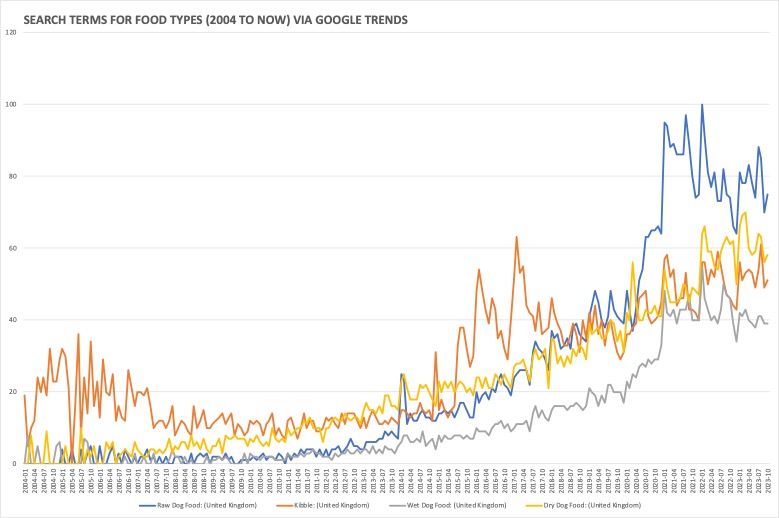

To show how this interest has grown over time, Figure 3 shows an increase of interest in raw dog food compared to traditional processed foods (e.g., kibble, wet and dry dog food).

UK Pet Food Competitive Landscape and Challenges

The rise of the “real food movement” within which consumers reject ultra-processed foods in favour of fresh, unprocessed ingredients has changed the competitive landscape (Mathers, 2017). In the UK, this contributed to the rise of raw dog food, threatening established commercial dog food companies (Harvey, 2022).

Future Forecast – What’s Next?

Over the next 4 years, the UK Pet Food Market is set to grow by £385 million, consolidating significant growth that we have observed over the past 3 years. Conservative estimates place growth in the UK Pet Food Market at 7-10% compared to ~35% growth in the previous period. (Sourced from Statistica, Mintel, Winchester University, RFVS and others, 2023)

However, premium foods are set for faster growth, with a significant increase in market share. This, coupled with a move from raw food companies that are gaining economies of scale to become more affordable, will see a significant rise in raw dog food, with further product adoption expected across retailers and pet food specialists. (Statistica and Mintel, 2023)

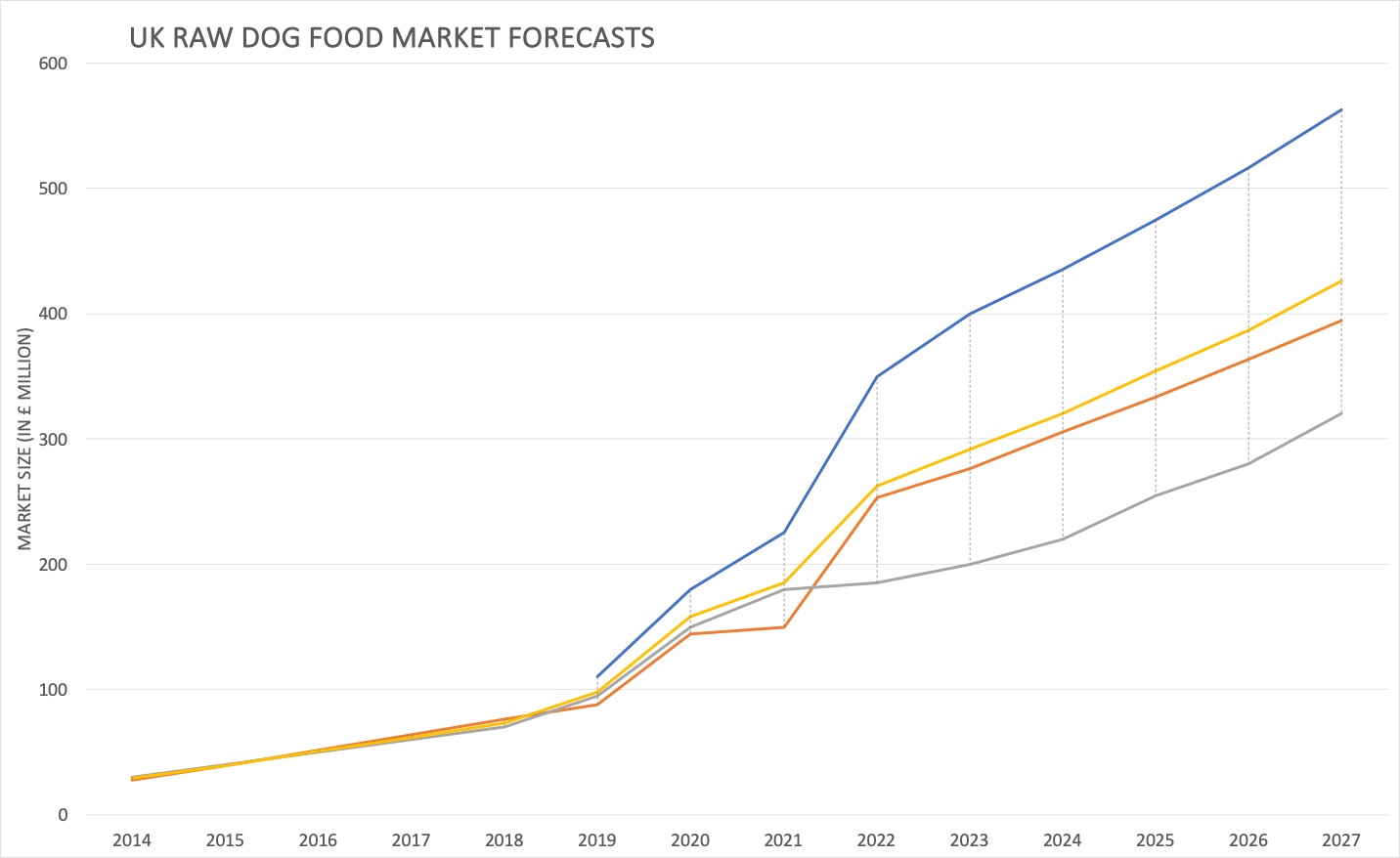

The predicted growth in market share of raw dog foods, coupled with the wider forecasts for both dog food and pet food as a whole suggest that we are only just seeing the beginning of the rise of the raw dog food segment. Combining data sources and various estimates into an extrapolation provide a series of scenarios for industry growth up until 2027. Models show sustained growth to varying degrees suggesting impressive levels of compound growth:

Other established global pet food markets show that growth will come in the form of online, and further retailer adoption of premium pet foods, including frozen and fresh minimally processed foods. The trend of consumers avoiding ultra-processed foods is increasing in line with consumer demand for their own consumption.

How can independent retailers make the most of the anticipated growth of raw dog food?

Future growth in the raw dog food sector makes it an impossible market to ignore. Independent retailers can take advantage of the anticipated growth of raw dog food by adopting strategies to meet the needs of pet owners who are increasingly adopting fresh and frozen raw foods for their dogs. There are important aspects of this strategy, including but not limited to:

- Education and training; feeding a raw diet requires product knowledge, including how to defrost and serve food, how much to feed dogs and explaining the benefits and addressing common concerns.

- Product Selection; offering a variety of raw dog foods is important, as people feeding a raw diet often are driven by “variety seeking behaviour”. Consider a “Good, Better, Best” offering that will allow you to upsell customers to added value products.

- Local sourcing; we are blessed with a variety of high-quality raw dog food brands in the UK, who source their raw materials from the UK. Make sure your supplier is supporting the UK economy and reducing unnecessary CO2 output from uneccessary transportation.

- Collaborate and build relationships; many raw dog food brands have “onboarding training” and will visit your store to help settle you in to selling raw dog food, helping cover all of the points previously mentioned. You may need to leverage this relationship in the future, getting trustworthy advice and helping to address your own customers enquiries.

By implementing these strategies, independent retailers can effectively cater to the growing demand for raw dog food and position themselves as trusted sources for high-quality, nutritionally sound options.