Marketing Consultancy Project

Back in 2008 I was studying an MA Marketing Management at Southampton Solent University. As part of the masters we (myself, Sercan Yilmazkul and Lisa Kelly) had to undertake a consultancy project. Due to my connections with the Ministry of Sound, I was able to conduct the consultancy on the now defunct house brand; Housexy.

I toured round the world with the brand Housexy, for some insights into my tours check out my blog Gig Diaries From Ministry of Sound Tours.

To help you enjoy this article – here’s one of the Housexy albums, launched in 2005.

Table of Contents

- Background

- Definition of the Problem

- Aims & Objectives

- Introduction to Concepts and sections 1, 2, 3 and 4.

- Research Design & Methodology

Section 1 – Company Analysis

- Company Background

- Research & Theoretical Models

- Conclusion

Section 2 – Market Analysis

- Market Background (Leisure & Clubbing)

- Research & Theoretical Models

- Conclusion

Section 3 – Competitor Analysis

- Competitors Background

- Research & Theoretical Models

- Conclusion

Section 4 – Consumer Analysis

- Consumer Background

- Research & Theoretical Models

- Conclusion

Section 5: Communications

Section 6: Final Conclusions & Recommendations

Bibliography

Appendices

Background

Housexy is a record label and club tours brand owned by Ministry of Sound. Housexy was introduced to the Dance music industry in 2005 as a Funky-House brand (initially) to rival the highly successful brand Hed Kandi. Since its initial induction into the Music market, Housexy has released 12 albums and has toured clubs all over the world.

In January 2006, Ministry of Sound bought its main competitor Hed Kandi for an undisclosed fee, This made Hed Kandi its main priority for Funky House. It was decided that Housexy still had enough market value to continue its operation.

Ministry of Sound started as an Elephant and Castle based nightclub in 1991. Since that point Ministry of Sound has diversified and morphed into an umbrella company that has a series of departments and brands under its name. Ministry of Sound is considered the overall market leader as Ministry of Sound and Hed Kandi are the top two most popular Dance music touring brands and both lead the market with album sales.

Housexy’s main income comes from two sources: Album releases and Tours. Albums are sold worldwide, the system is integrated into Ministry of Sound’s album release procedure, therefore the focus of the company is on the sales of tours around the world.

A common misconception is that the tours department arrange UK and International tours themselves, this is however wrong. The tours department look to source out potential clients who then apply to host a Housexy night(s). A number of variables are negotiated including which can be anywhere from £1,000 to £10,000.

Brands such as Hed Kandi and Housexy are usually bought in for a night at a nightclub to bolster underperforming nights or to compete against other branded nights that can be seen as successful. In effect, promoters wouldn’t book Housexy if their unbranded nights were selling successfully.

Definition of the Problem

In 2008, Housexy approached us to carry out a market research project to define the current status of the brand. We accepted this project and conducted research to discover the shortcomings of the brand and to identify any discrepancies between Housexy and customer perceptions.

After the success of the initial project Housexy have asked us to conduct a strategic based market research project. This project will add theoretical concepts and present strategies to solidify Housexys positioning and brand intentions for the long and short term.

Housexy’s current fans are thought to be loyal and are consistent in the purchase of Housexy material. However, Housexy has a comparatively small market share among its competitors in the UK. One of the main competitors of Housexy is Hed Kandi. Hed Kandi has a huge dominance in the UK, it is understood that there is almost 100% awareness of the brand in the Clubbing Industry.

Another key problem of Housexy is, it has powerful brand awareness internationally but events in UK aren’t selling well. There seems to be a lack of awareness of the brand in the UK so this project will help to come across this problem by finding out the target consumers and segmenting them with exact marketing strategies.

The previous project identified some key areas in which further research was needed. However with the given time frame and resources we could not effectively solve these problems. These problems were mostly within the domain of strategic understanding.

Therefore, the overriding problem is that further structured research is needed to be able to analyse the four key areas that effect Housexys strategic objectives, these are as follows:

- Company (Housexy)

- Market (Funky House/Clubbing & Leisure)

- Competitor (Hed Kandi et al)

- Consumer (Segmentation)

Aims & Objectives

This project is focussed on the long-term planning and sustainability of Housexy’s current and potential strategies:

There is one objective that is split in to four sub-objectives. The main objective is to link the market research from the previous project with marketing theory and further detailed research and observation.

The main objective is split into the following areas which we will explore in their own right:

- Company Analysis

- Market Analysis

- Competitor Analysis

- Consumer Analysis

i) Company Analysis will use;

SERVQUAL Gaps Model, Kaplan & Norton Balanced scorecard & Service Blueprint: This will involve an in-depth study of what kind of service Housexy is currently providing. The Housexy system can then be considered in relation to other models so we can offer other ways of running the company.

ii) Market Analysis will use

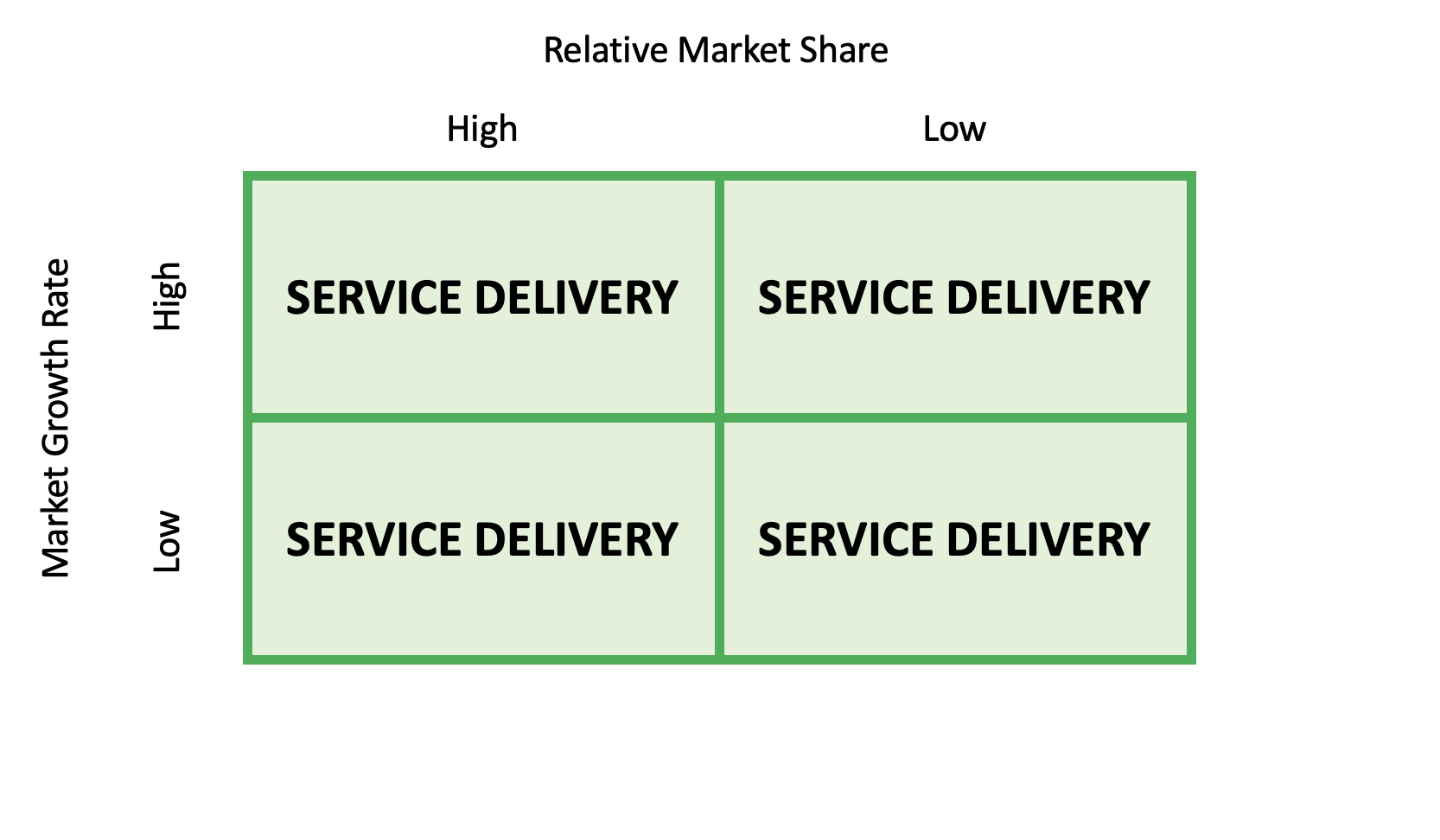

Boston Growth Share matrix: This is also part of company analysis, it will involve mapping the attractiveness of the Leisure market (not just the Dance Music market). We will reassess the possibilities within the Leisure market to see if there are any new gaps.

iii) Competitor Analysis will use;

Competitor Information System & Porters Five Forces: This will attempt to match Housexy against the competitors within the market (linking with the Market Analysis).

iv) Consumer Analysis will use;

Segmentation & Consumer behavior: The ultimate aim is to use the segmentation statistics of the old project ans well as looking at how Housexy could better reach and realise their target markets.

Introduction to Concepts

The following information identifies the concepts and data that have/has been used in each area of this project:

Section 1 – Company Analysis

- Company Background

- The Kaplan and Norton Balance Scorecard

- The SERVQUAL Gaps Model

- Company Blueprint

Section 2 – Market Analysis

- Market Background (Leisure & Clubbing)

- The Boston Growth Share Matrix

Section 3 – Competitor Analysis

- Competitors Background

- CIS – Competitor Information System

- Porters Five Forces

Section 4 – Consumer Analysis

- Consumer Background (From previous project)

- Segmentation

- Consumer Behaviour

These concepts and processes have been deemed to support the research and development issues that have been asked of this project.

Research Design & Methodology

This project will mostly rely on Qualitative research methods. This is because we are trying to look at how to improve the strategic strategies and understanding of these strategies withing Housexy.

Section 1 – Company Analysis

- Qualitative Research

- Archival Search of Housexy

- Interviews with Housexy vs. Consumer Perception

- The Kaplan & Norton balanced scorecard

- The SERVQUAL Gaps Model

- Process Blueprint

Section 2 – Market Analysis

- Qualitative

- Leisure trends

- Clubbing trends

- The Boston Growth Share Matrix

- Opportunities available

- Market Variations

Section 3 – Competitor Analysis

- Qualitative Research

- Archival Searches of Companies

- Heightened Interest in Hed Kandi

- The Boston Growth Share Matrix

- The SERVQUAL Gaps Model

- Financial Aspects

- Events Frequencies

- Album Frequencies

Section 4 – Consumer Analysis

- Qualitative and Quantitative

- Consumer Segmentation issues

- Web Analytics

- Social Networking

- Blogging & Forums

- Consumer Interaction/Participation

- Semantic Scaling

- Consumer Behaviour theories

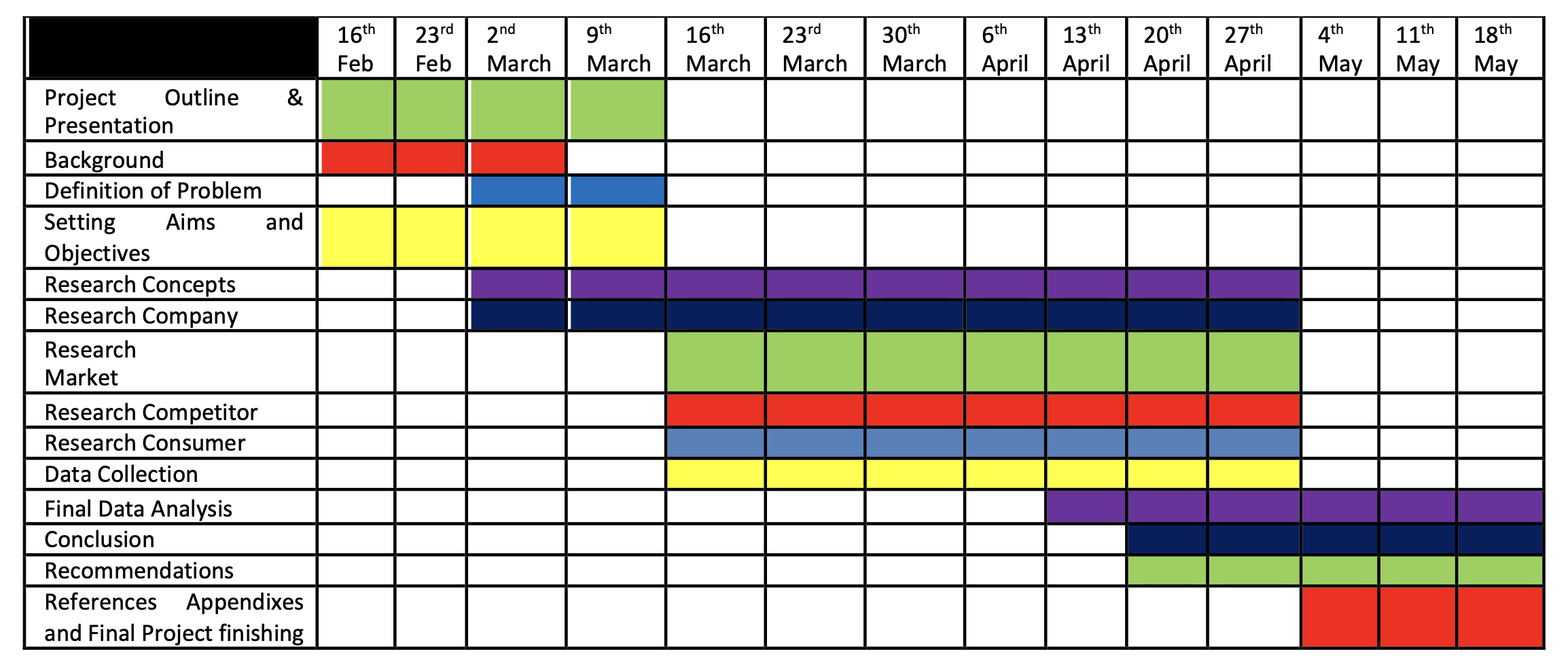

Time Plan

Our time plan is as follows:

Section 1: Company Analysis

As described in the project background section; Housexy is a record label and club tours brand owned by Ministry of Sound that creates revenues from two main sources:

- Album releases and

- Tours

Albums are sold worldwide, the album releasing procedure is integrated into Ministry of Sound’s album release programme; therefore the focus of this project will be on the sales of tours in the UK.

A common misconception is that the tours department arrange UK and International tours themselves, however this is wrong. The tours department look to source out potential clients (promoters) who then apply to host a Housexy night(s). A number of variables are negotiated including which can be anywhere from £1,000 to £10,000.

Brands such as Hed Kandi (the main rival) and Housexy are usually bought in for a night at a nightclub to bolster underperforming nights or to compete against other branded nights that can be seen as successful or to raise the status. This is why ‘Brand Power’ plays such a key role in Housexy’s fortune.

This section (Section 1 – Company Analysis) will be combining the findings of new research and research previously used in Housexy Project 1. By using theory based marketing models to try and determine Housexy’s current status we should be able to highlight future possibilities available to Housexy.

SERVQUAL Gap-by-Gap study:

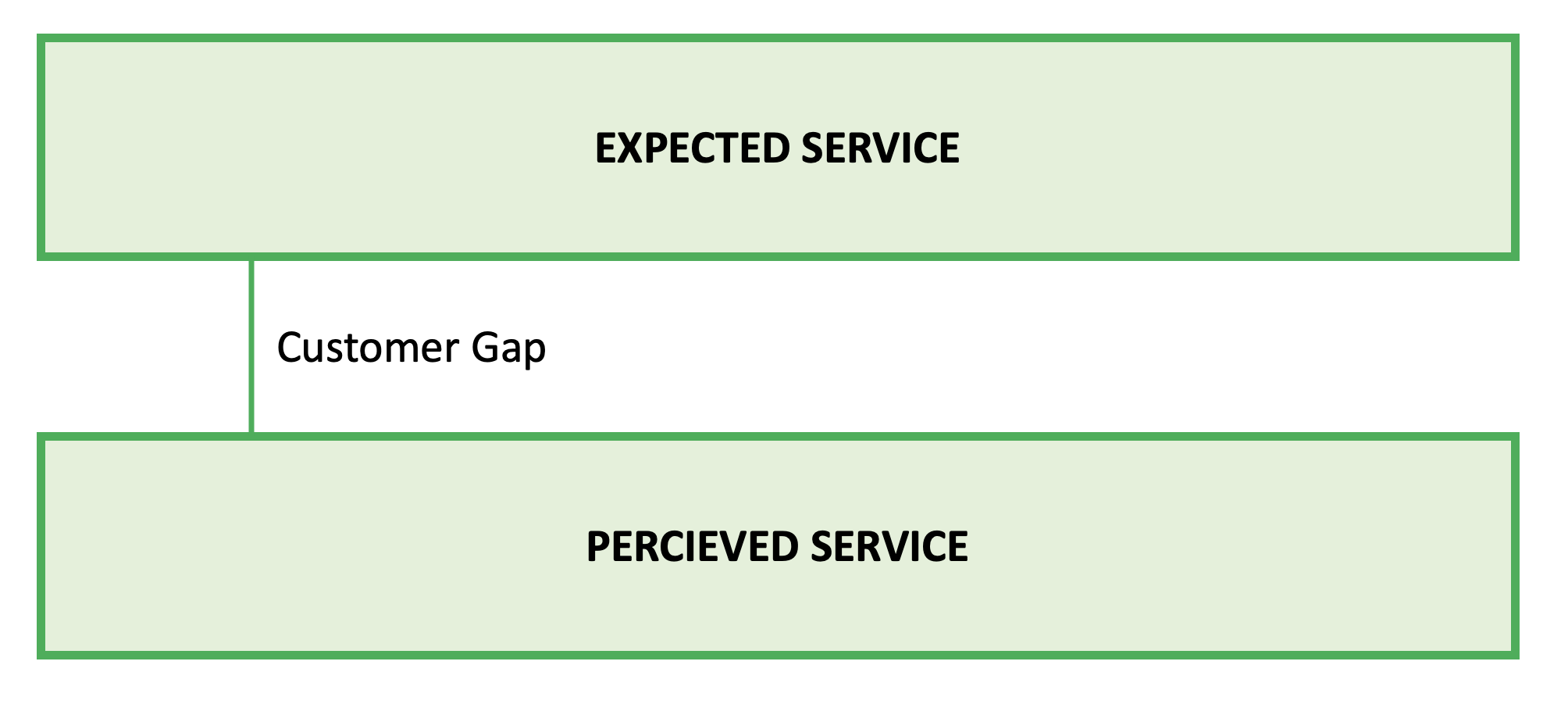

The Consumer Gap:

The consumer gap is the gap between ‘expected service’, and ‘perceived service’:

“To close the all-important consumer gap, the gaps model suggests that four other gaps-the provider gaps-need to be closed. These gaps occur within the organisation providing the service (hence the term provider gaps).”

(Zeithaml 2009)

This gap will be closed if the following four gaps are closed. This section will therefore study Housexys current standing with each gap.

Gap 1: The Listening Gap

Gap 1 is defined as:

‘The difference between customer expectations of service and company understanding of those expectations. ‘

( Zeithaml 2009)

Therefore, Housexy must have processes of interaction, if they fail to listen effectively they will be left lacking the understanding of their customers expectations. In this way, Housexy should be using social media such as Facebook and MySpace coupled with looking at the reactions of posters on Youtube. This will identify and shortfalls of their albums/events as well as highlight aspects of their product/service that have made a positive impact.

Gap 1 has many crossed interests with Gap 2. If the service design doesn’t allow employees to gain feedback from customers there will be an inevitable listening gap. Likewise, unwillingness to listen by employees will result in a gap. In Housexys case it would seem that they are listening to what their customers are saying. They use social media to interact with customers who buy the albums and attend the events as well as keeping in contact with promoters who have paid to host shows. In fact, Housexy have demonstrated an understanding of a focus on loyalty by looking to drive repeat purchases with a range of incentives.

As discussed earlier, employees play the most important role in closing Gap 1; After the employees listen to the customers, there must be a process whereby information can be passed on to the decision makers. The positive aspect of Housexy is that the employees are empowered to make most of the decisions.

A shortcoming relating to Servqual gap 1 is that Housexy do not carry out their own independent research studies (apart from those relating to this project) therefore it is possible that strategic drift could occur.

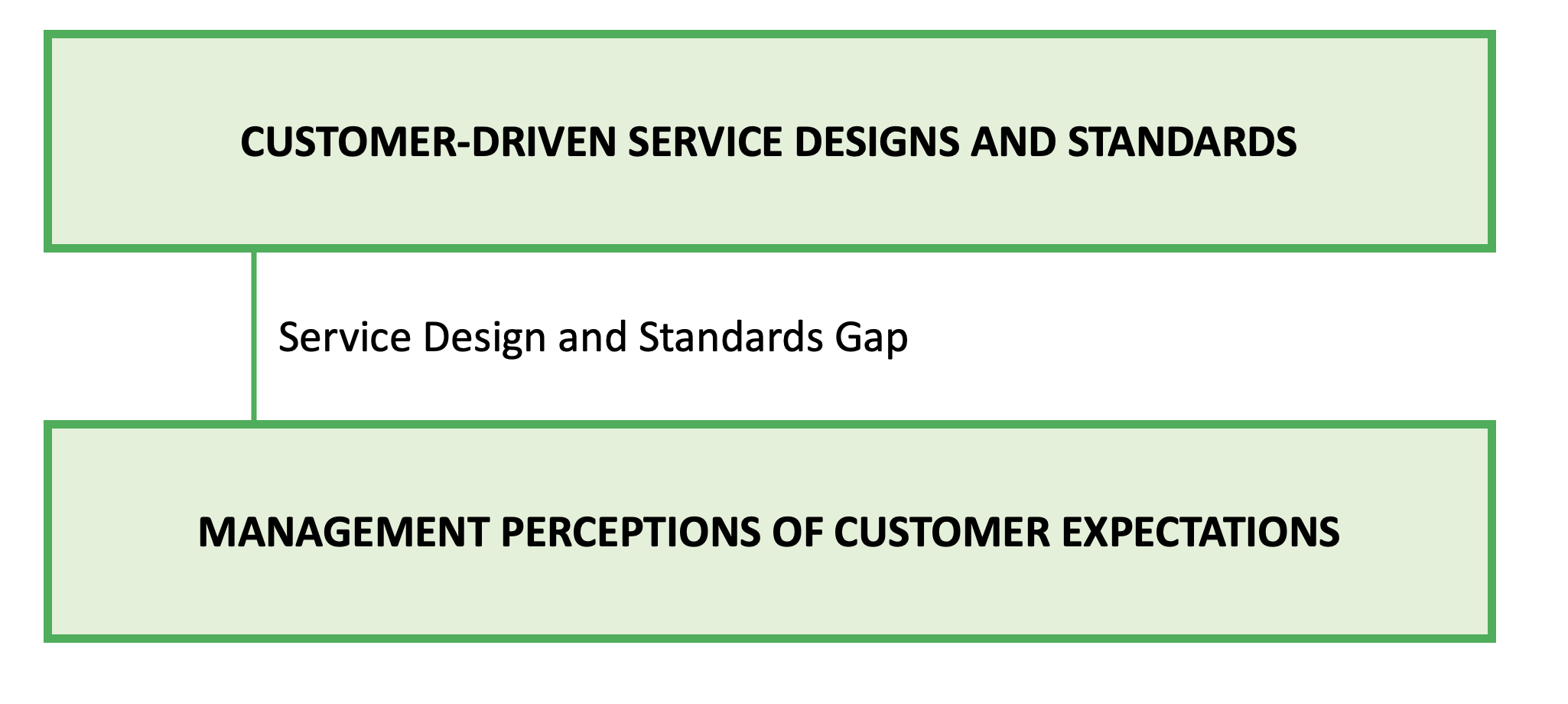

Gap 2: The Service Design and Standards Gap

Housexy operate from the office of Ministry of Sound, Elephant & Castle. Their service delivery is fairly standardised alongside the services of the other brands operated by Ministry of Sound.

Album releases are standardised and fit a process which most UK companies abide by. Service delivery for tours is focussed on email contact with the client (promoter) who is responsible for the marketing and running of the event.

Expectations of MOS from Promoters must constantly be tracked.

‘The presence of service designs and performance standards that reflect those accurate perceptions. A recurring theme in service companies is the difficulty experienced in translating customer expectation into service quality specification that employees can understand and execute’

( Zeithaml, 2009)

It is evident that Housexy has a good service design, however it lacks development. Issues such as being involved in the sponsorship of fashion events are not catered for easily under the current service design.

Housexy’s standards are focused towards making an impact on advertising and on a particular night. Therefore the focus of the staff is creating grandeur and character around the brand. In their instance, customer driven standards could be improved with more support towards the promoter. This would exceed promoter’s expectations and drive loyalty.

Housexys staff therefore need to set service quality goals.

Housexy are adaptable due to the incorporation into Ministry of Sound. This means when customers have additional request (such as dancers) these can be arranged with the affiliated companies.

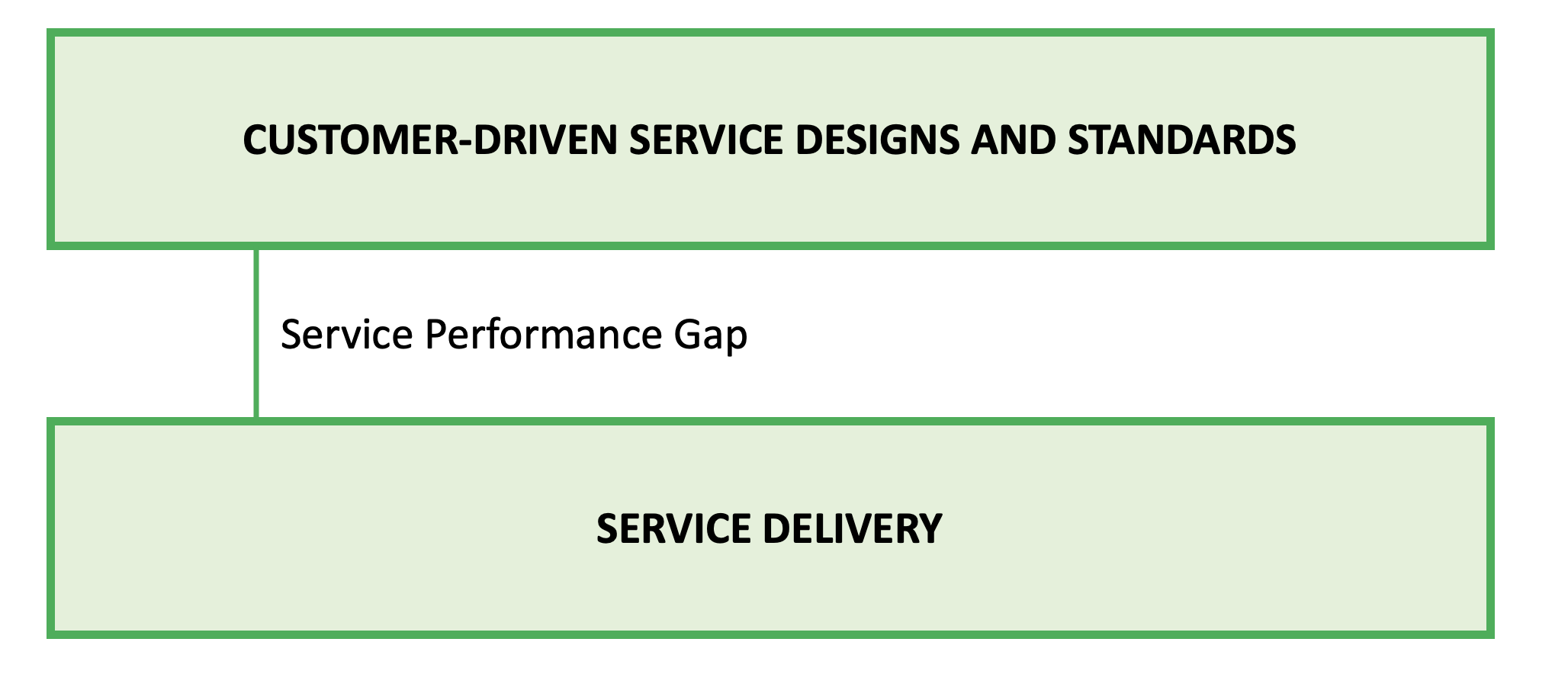

Gap 3: The Service Performance Gap

Housexy’s service is defined by the operations of a small number of people who are part of a larger group that service a wide variety of brands and departments of MSHK (Ministry of Sound).

This section earlier identified a possible shortcoming; customer service design. Therefore these defections may have caused problems in the way service delivery is positioned for customer service focus.

‘The discrepancy between development of customer driven service standards and actual service performance by company employees.’

(Zeithaml, 2009)

It can be seen that Housexy (and Ministry of Sound) runs on a lean recruitment policy. However, roles are defined by department and due to a certain amount of standardisation, cover is offered by other department staff of MSHK in case of illness or leave. The only conflict that exists is that of the competition (Hed Kandi) being in the same office.

Technologies are widespread and a variety of platforms are available to interact with Housexy staff:

- defined land lines

- 2 personal mobile numbers

- Ministry of Sound email

- Microsoft messenger contacts (MSN)

- Websites of associated interests

- Myspace

All of these give the notion that ‘the door is open’ to clients. By adding a client on Facebook/Myspace, the likelihood that they will hear positives regarding your brand is heightened – this also works in the same way for MSN whereby discreet conversations can be initiated which may result in repeat sales.

This section also earlier declared that the employees of Housexy are fairly empowered. However this is because Housexy is a small brand. Teamwork is evident when dealing with Housexy as requests are dealt with swiftly, this would also draw one to feel that employees have control of their duties and are not unsure of specific requirements.

Housexy currently seem to have around the right amount of DJ’s to cope with the demand. It is possible to try and smooth peaks and valleys of demand to cope with certain excesses. However, the client’s needs are usually cemented to a specific date.

An area in which a gap most probably will always exist is that of the client fulfilling their responsibility when taking on the brand for a club. Therefore there must be discretion and quality control from Housexy on the events that they endorse. However, this must be seen as a balance, dictated mainly by demand. Customers may also have a negative/positive effect on others. This means Housexy should maintain their level of service with consistency to create positive word of mouth.

Housexy must be very careful as to who it operates with, such as which agents they use to act as intermediaries as when offering a service that has a 3rd party inclusion, the actions of that 3rd party impact upon the image of Housexy.

Therefore the following balances should be addressed and defined between Housexys staff:

Costs vs. Rewards

Quality vs. Consistency

Empowerment vs. Control

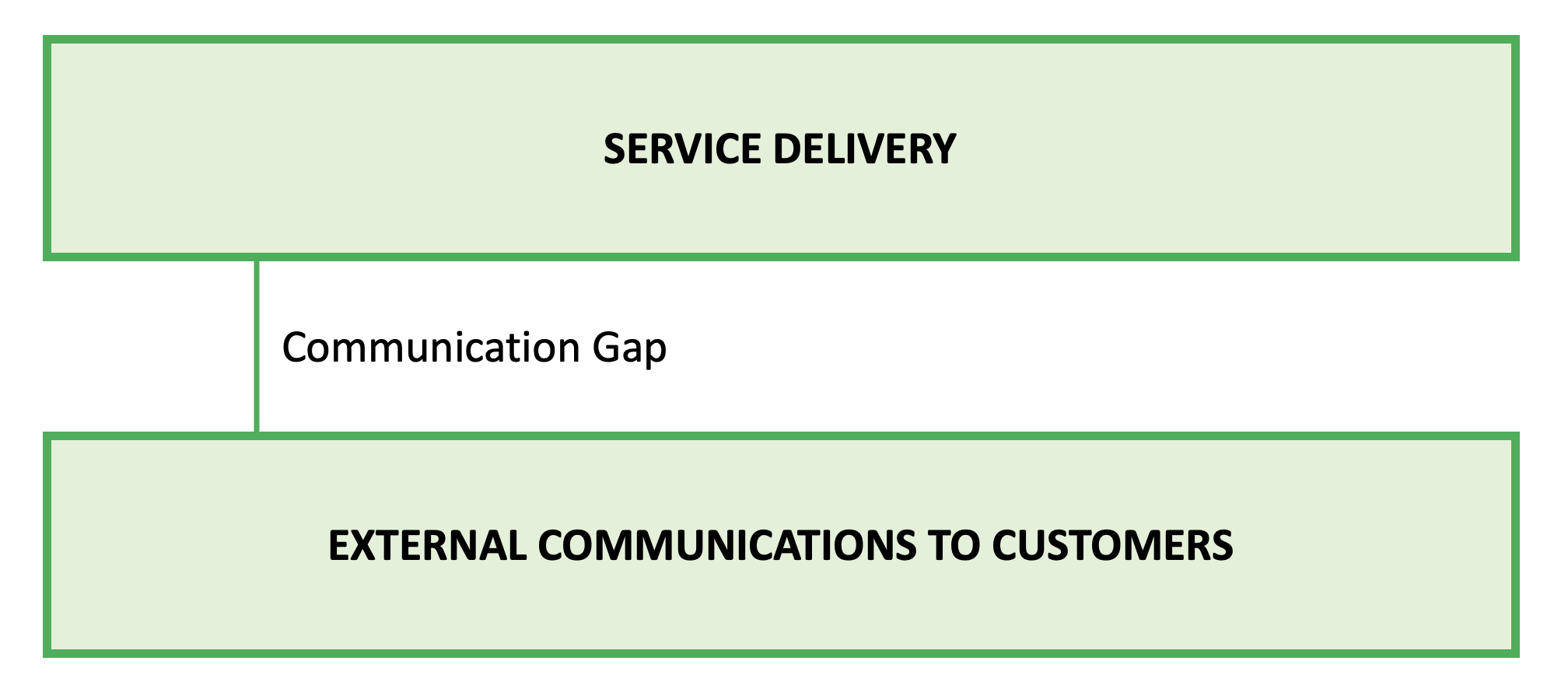

Gap 4: The Communication Gap

In the first Housexy project, it was ascertained that Housexy’s external communications (advertising) was inadequate. This can still be said of the brand specific advertising, however, Ministry of Sound advertising is still high. It is when enquiries are made to Ministry of Sound that Housexy needs to make its impact.

‘The difference between service delivery and the service provider’s external communications. Promises made by a service company through its media advertising, sales force, and other communications may potentially raise customer expectations, the standards against which customers assess service quality.’

(Zeithaml, 2009)

As Housexy’s service is B2B, it is not reliant on the marketing of its services on a large scale. After a large amount of research, this study could not provide any specific places in which Housexy could reach the majority of the B2B market without also imposing its sales program on the general customers. Therefore there should be a focus on brand awareness as a whole.

Integrated marketing communications which are treated as an ongoing campaign would help the staff of Housexy by explaining to promoters and clients what they can expect. This is achieved in a way by the .PDF that can be sent out to clients when they are discussing booking Housexy. A flaw exists here because some promoters that would book Housexy may not know of the possibilities.

Interactive marketing makes up the majority of Housexys internal and external marketing. This again highlights the importance of gap 3.

Efforts to close gaps 1-3 should give Housexy a good understanding of marketing/communication objectives that will evoke more accurate expectations of the company. This may also help combat cognitive dissonance from people that have interacted with the brand. Educating customers will help personalise the experiences people have with Housexy and create more of an understanding. By giving the company this focus, people should view the music/brand as specialist as opposed to commercial.

Zeithaml, 2009 says that companies should offer physical evidence that there service is of a high quality. In the case of Housexy, this would include:

- Evidence that their DJ’s are of a high quality

- Evidence that their staff can organise everything that is offered

- Evidence that Housexy’s parties are popular (worldwide)

- Any other supporting evidence that heightens Housexys grandeur

However, it is important that the physical evidence does not over-promise, this means insuring the message is coupled with instructions that any venture will need the commitment of the promoter.

In this projects dealings with Housexy (mainly interviews) it can be noted that there is a consistency of understanding of the policies that the company has set about. This would denote that there is positive horizontal communication within the company.

Pricing strategies also effect Gap 4, the higher the price, the higher the expectation. Housexy is not the highest valued company in its immediate market; therefore it should not be the highest priced brand. Ministry of Sound are in an enviable position where they can strategically price Housexy below Hed Kandi, the main competitor (also under MOS).

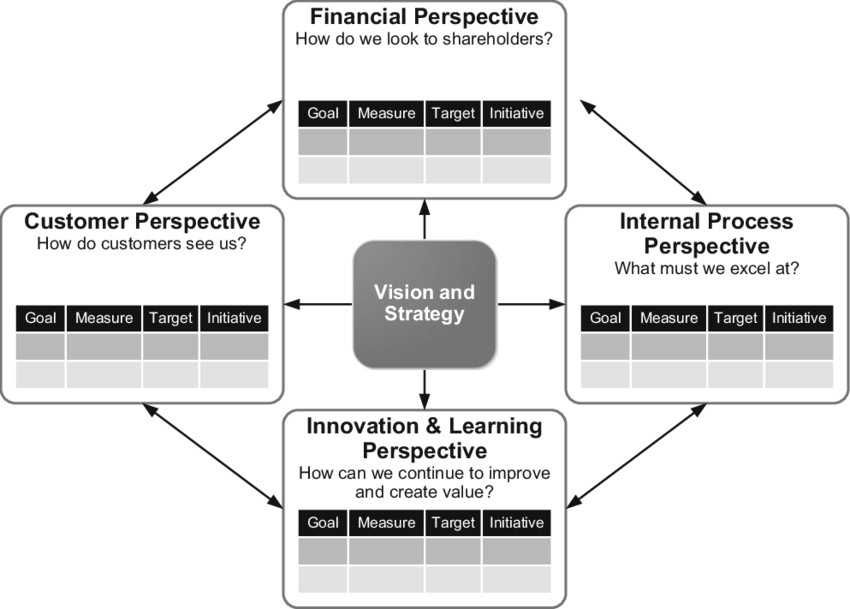

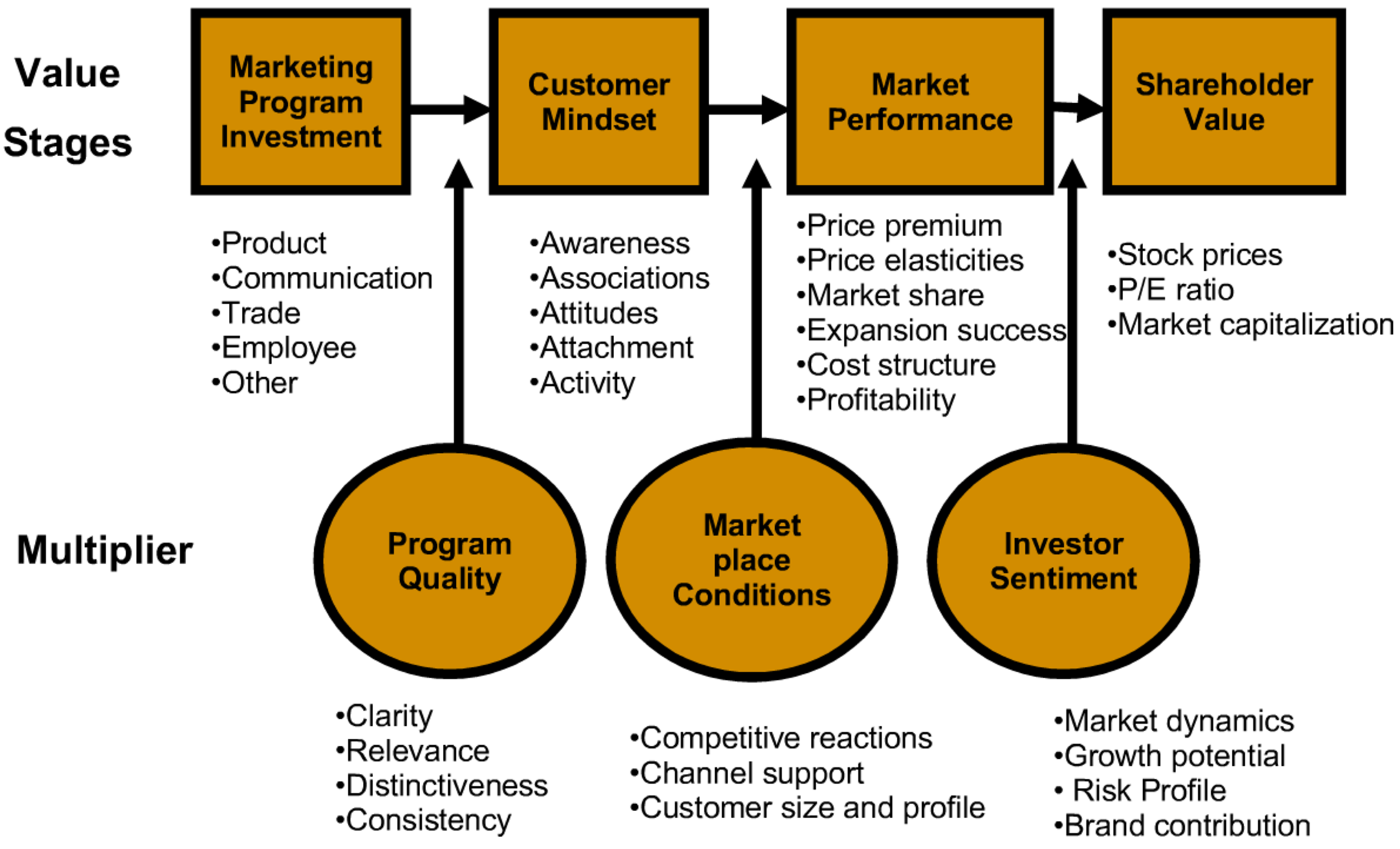

The Kaplan and Norton Balanced Scorecard

(Page 234, Groucutt, Leadley & Forsyth. 2004)

The purpose of this section is to determine Housexy’s “Vision and Strategy”. Each sub-section will review Housexy’s standings for benefit of understanding in the continuation of this project. This study will be of importance when considering long-term strategy.

Customer

Objectives – Housexy’s objectives are split between albums and tours audiences. The customer base for tours and events are then split between promoters and general consumers (clubbers/clients & customers of the promoters). Therefore Housexy can only fulfil their objectives by satisfying all these groups of customers. Segmentation must exist in some form to ensure customer satisfaction, acquisition and then retention can occur.

Measures – Housexy need to therefore ensure excellent customer service standards as well as ensuring quality control of any materials/shows released under the Housexy brand. Housexy should provide assistance and encouragement to promoters so that every experience customers have with the brand is as best as it can possibly be.

Targets – An obvious target for Housexy is market share. Market share is fairly poor in the UK, therefore by trying to tackle this domestic problem, greater worldwide shares should also be achieved.

Initiatives – On top of positive experience, Housexy need to drive brand loyalty. This should be attempted across all mediums to all customers. Competitions to keep customers engaged in Housexys affairs and guest-listing for touring events to improve attendances are positive contributors. Quality give-aways were also fairly popular according to the Housexy research in project 1. Housexy should also strongly consider regularly using dancers and live elements to create positive associations with their events. (See appendix 1)

Financial

Objectives – Housexy’s financial objectives are tied into the objectives of MSHK (formerly Ministry of Sound) which turns over ‘£100 million’ a year (Sherwin, 2004). However, this for the directors of MSHK, makes Housexy financially insignificant and expendable. Therefore, in the interests of the brand Return on Investment (ROI) is paramount. Sustainability is also a key objective for Housexy, leading the move from tactics to strategy:

- Return on Investment

- Maintain and develop market share

- Increase wealth of brand

- Improve shareholder value

- Improve economic value

Measures – Housexy must ensure that any investments made by MSHK can be measured so that decisions can be related directly to return on investment. Also any requests for extra finance should be accompanied by the persuasion of a long-term view on investment. (See ‘Communications’ section)

Targets – Financial targets will be set by MSHK.

Initiatives – Initiatives should exist when offering Housexy’s service to promoters, this will drive repeat purchases. Initiatives should also exist in the form of bonuses to staff of Housexy, including DJ’s, loyal dancers and musicians.

Internal Business Processes

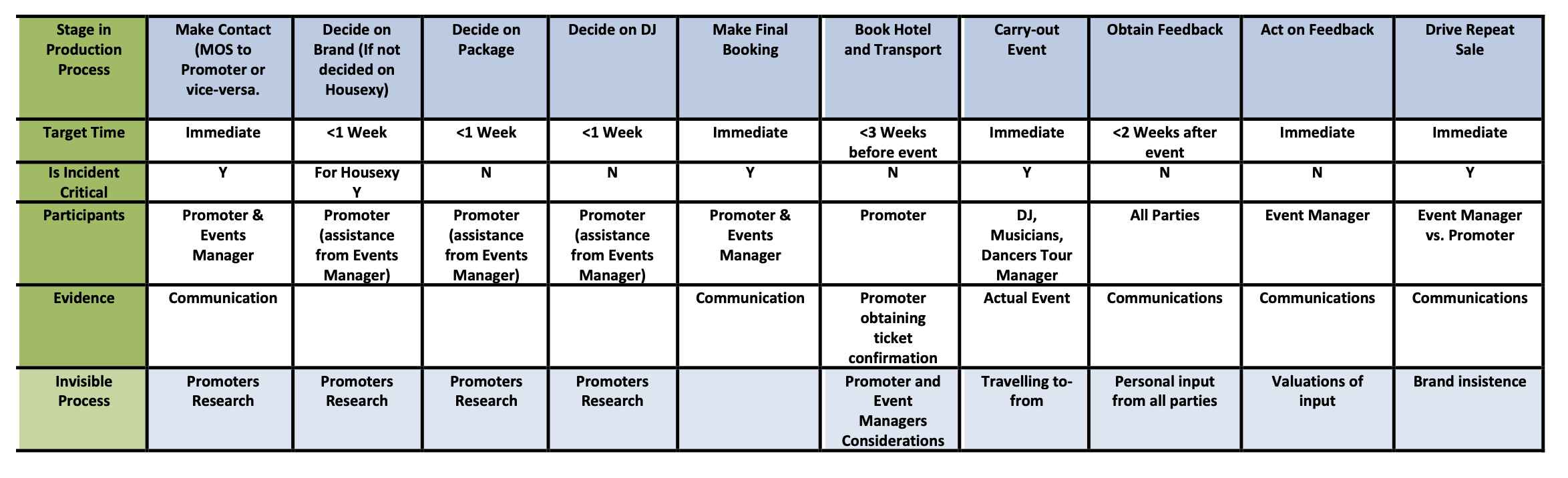

Objectives – Internal business processes can be seen in the company blueprint (below). These processes are again linked to return on investment and offering shareholder value. Processes should be constructed to offer smooth operations, whilst also portraying to delegates, perceptions of control and competency.

Measures – Self assessment and pier assessment will be key in finding ways in which the service process can be modified in order to improve Housexy’s service delivery. Housexy office employees are also in the positive situation of working alongside all other MSHK staff giving innovation a wider cache.

Targets – A long term cycle should be adopted by Housexy if it is to execute a switch from tactics to strategy. This means abolition of short-termism by MSHK.

Initiatives – Initiatives include a better working environment to the staff of Housexy, a more integrated and innovative service and a better prospect for potential clients.

Learning and Growth

Objectives – To compete in the ‘funky house market’ long-term, which may evolve to another market (closely positioned to fashion), Housexy must improve its infrastructure and capabilities. At the moment the brand is weak and exposable. However, with more B-2-B connections and presence the company will be able to improve market share and take on an attacking stance against its competitors.

Measures – Housexy are ensuring the quality of their DJ’s remain high with quality staff in Housexy. As the status of their DJ’s rises, so will the status of Housexy.

Targets – The targets for learning and growth perspective are simply the constant improvement of the people who give a face to the brand.

Initiatives – Initiatives exist for good learning and growth schemes in the form of return on capital employed. The justification is as follows:

Employee Skills lead to – Higher Process Quality and Improved Process Cycle Time which leads to – On-Time Delivery which improves – Consumer Loyalty which reaches the goal of – Return on Capital Employed.

Relative Strategies (for the attention of Housexy staff):

To effectively complete a transition to strategy based operations, Housexy should consider the following strategies on which they should operate:

‘Revenue Growth and mix: Developing products and services, reaching new customers and markets, modifying the marketing mix to provide higher value-added capacities.

Cost reduction/productivity improvements: Reducing direct and indirect costs, and the sharing of resources to gain overall improvements.

Asset utilisation/investment strategy: The most effective use of assets through reducing working and physical capital levels.’

(Groucutt, 2004)

Company Blueprint

The company blueprint (below) shows a simplified version of the current business process between a Housexy events manager and a promoter. This blueprint can be used to determine how the service can be modified, this relates to the internal business process of the Kaplan and Norton Balanced Scorecard.

Conclusion

Keeping up with the expectations of Housexy’s clients/consumers is of the utmost importance if the company is to progress as a brand and compete effectively. It seems that the brand offers a standardised service whereas in order to compete with the market leaders it should customise service delivery.

The measurement of satisfaction is extremely important. This will not only give clients the idea that you care about them but also give valuable information to the brand, this should therefore be further integrated into the service blueprint as a critical incident.

The high emotional involvement in clubbing means loyalty is achievable through positive associations and quality consistency.

Housexy is well known but not promoted well therefore, it is necessary to change this and create awareness. Further attention will be paid to this issue in the Communication section of this project.

The quality of the brand employees is a positive, therefore relationship marketing can be used to further the communications that currently seem unidirectional. Housexy has a strong and stylish image that should be used in new media ventures and campaigns.

Housexy should balance the following areas;

Costs vs. Rewards

Quality vs. Consistency

Empowerment vs. Control

Section 2: Market Analysis

Section 2 – Market Analysis

- Market Background

- Market information

- Boston Growth Share Matrix

- Conclusion

Market Background

“Over the last half-century, music has developed from a cultural fringe phenomenon into a commodity central to the developed national economies. Music is now indispensable glue for many media offerings and pervades every level of society. Music plays an essential role in the transformation of communication and distribution channels. “Music is one of the primary entertainment goods and the UK is third largest net exporter with a global market volume exceeding $40 billion”

(Kretschmer et al. 1999)

When analysing the music market(s), it is difficult to separate leisure and late-night economy from music industry so while looking at music market it is going to be also analyse late-night and leisure market.

Market Information

According to Mintel (2006) “the nightclub industry has continued to evolve in the past two years; driven by increased competition in the late night market and changing customer habits and expectations”. Nightclubs mainly target students who are aged between 18 and 25. Mintel (2002) , state that around 55 % of these customers are men. This data also reflects Housexy’s main target customers according to the information concluded in the initial market research project.

According to (Gluhak, A. et al) “the mixture of music, dancing and the presence of other enjoying people have made clubbing to become one of the most important recreational activities for people, preferably on weekends.” As mentioned before, the nightclub industry has continued to evolve in the past two years. This would imply that there is a high emotional involvement in clubbing which Housexy can carefully exploit.

There is a lot of competition between night clubs to target more customers. This competition is mainly managed through price promotions on drinks or entry prices targeting student groups. In addition to this, night clubs try to offer well-known DJs to attract consumers to gain more market share in high street late-night market. So in this competition it is also important for record label companies like Housexy to promote their DJs to this clubs because most of the consumers are looking for good atmosphere and quality music.

Essentially, the brand is the most important aspect that makes a nightclub approach Ministry of Sound to host Housexy. Secondly, access to quality DJ’s and fulfilling the additional requirements of the promoter as completes the customer promise alongside the quality deliverance of the night.

According to Skinner et al. (2005, p. 122) in the late night economy, “music is the key attractor and alcohol is the core service”. As a result it is clear that to satisfy their target consumers, Housexy must focus on being the quality service provider of music and image.

The Emergence of House Music and Housexy:

“Beginning with 1970s disco, and particularly with 1980s house, DJs often blurred the line between simply spinning 12-inch singles for crowds and making the music themselves. As was true of 1970s disco, the patrons of clubs that played house music were predominantly Black, working class, urban, and often gay; but by the time house music reached the UK in the late 1980s, the audience demographics changed, and so did the music” (Gilbert & Pearson, 1999).

House music is a style of electronic music that emerged in the early 1980s; House music is strongly influenced by elements of soul, funk music and disco music which was initially popularized in Chicago in mid 1980s. In 1986 Steve Hurley’s ‘Jack Your Body’ song became the first in UK lists and spread all around Europe. In a short amount of time, House music has become a cultural phenomenon in the clubbing and music industry and has solidified its place within the dance music genre. This makes it a stable (sub)genre for Housexy to base itself upon.

Housexy was introduced to the Dance music industry in 2005 as a Funky-House brand (initially) to rival the highly successful brand Hed Kandi. Since 2005 Housexy introduced 12 albums and has toured clubs all around the world.

When looking at the music market, it can be divided into three main categories. It is essentially broken up into three forms in which music is sold:

- The artist album

- The Single

- The Compilation

Housexy sell compilation albums that are mixed by DJs that include a joint venture album with Playboy. “Theme compilations are created either around a musical theme such as disco, rock or a certain period in music history 70s, 80s and 90s” (Gotlib, 2004).

“In the UK compilations serve a wide range of needs both from the consumers and the record companies” (Gotlib, 2004). Compilation albums are created from already-released songs to reduce licence and production costs. However, a “company needs to license all the recordings that are not part of its own catalogue” (Gotlib, 2004, p.36). In addition to licensing, compilations must also be properly advertised. “Compilations need to rely more on advertising and branding” so live performances of the artists are crucial to promote sales.

Hence, record companies give artists tour support money and “most artists go on a international tours to promote their album release” (Gotlib, 2004 p.38). Housexy can integrate the release dates of their albums with the timings of artists releases. This will stand the company in a better bargaining position for signing tracks and offering DJ’s as part of a touring package.

Housexy in less than three years has events on six continents, 9 albums on global release and a cutting edge roster of musical talent which has a personality no other party brand can boast. Taking to the International platform has allowed Housexy to become a sought after party lifestyle-party brand, offering an uplifting experience of music and visual entertainment. Offering a sexy, fun and cosmopolitan feel to all of its parties, Housexy also delivers the operational and post-event support to improve on all future events.

Lastly, the most important part of selling process in compilations is packaging. “Good artwork can create brand loyalty” (Gotlib, 2004, p.44). The following photos are examples of Housexy albums:

Housexy’S Products and Boston Growth Share Matrix:

“The Boston Consulting Group (BCG) growth share matrix is a proprietary portfolio model that considers market growth rate and the product’s relative market share”(Dibb and Simkin, 2001, p.86).

Boston Consulting Group (BCG) growth share matrix enables to classify company’s position into four basic types;

– Stars are company or product with a dominant share of market.

– Cash Cows have a dominant share but low forecast for growth.

– Dogs are struggling to have a market share and also have low forecast for growth.

– Question Marks have a small market share in a growing market and require lots of investment to build and capture more shares.

For the Boston Growth Share Matrix model to be applied, it must be clarified that the best situation is to have a strong business position in this attractive market by selling compilation albums and touring.

Housexy has three classifications of products/services, that are: compilation albums, UK tours and international tours.

Housexy’s international tours can be described as being in the stars position according to Boston Growth Share matrix. This is because they are one of the market leaders in international touring leading to a fast growing loyalty for these tours and substantial profit. Housexy needs to contilually improve its market coverage to protect its position in stars area.

On the other hand, tours in the UK in the dogs area because Housexy has a comparatively small market share, although, its current fans are thought to be loyal and are consistent in the purchase of Housexy material. Events in the UK aren’t selling well as there seems to be a lack of awareness of the brand in the UK.

Housexy’s main competitor Hed Kandi has a huge dominance in the UK, it is understood that there is almost a 100% awareness of the brand in the Clubbing Industry it is clear to say that Hed Kandi’s both UK and international tours are in the cash cows area. Housexy needs to specialise thier segmentation of the market to shift into this area.

Lastly, compilation album sales are in cash cows area. It can be said that Housexy’s compilation albums are profitable products that need to generate more cash to maintain market share among the competitors like Hed Kendi and Housexy needs to “use excess cash to support research and growth elsewhere in the company” (Dibb and Simkin, 2001).

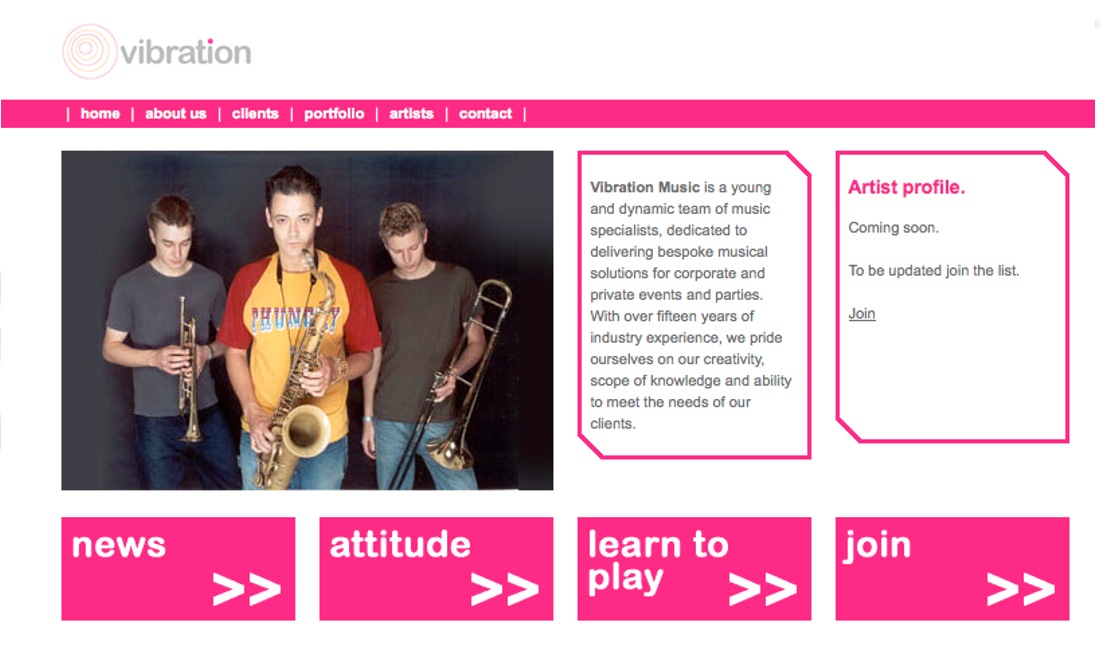

Brand Loyalty and Growth:

“Loyalty is the consumer-to-brand bond that ensures future purchase. It is the degree to which a brand meets – or even exceeds – expectations that consumers hold for the ‘ideal’ product or service in its category”(Culshaw, 2008). Housexy as a brand offers a sexy, fun and cosmopolitan feel; this becomes apparent when looking at the packaging of album covers and from its communications (as seen on its web site www.housexy.com). The high quality artworks from album covers match the image of sexy and funky house music. This can, in some ways create loyalty through consistency.

When discussing consumers: “Emotional considerations are vital in the decision-making process” (McCasland and Davis, 2005). For Housexy, in the leisure and night club industry; passion and being sexy are the common considerations in customer’s decision making process (according to Project 1 research). In addition, a brand must present an “expected level of functional performance” (McCasland and Davis, 2005) therefore, it is clear to say that Housexy must focus on offering sexy, funky-house music as customers who choose to attend a Housexy event, want to listen to funky-house music and see the ‘sexy’ imagery.

As mentioned before, Housexy as a brand have a small market share among its competitors (in the UK), so Housexy needs to attract more customers while growing the brand. At this point, Burden (2006) suggests some strategies for brand growth.

The first strategy is “brand growth source” that is the same actions that the brand has made in the past. The key decision is to determine where the majority growth of the brand will come from:

- New buyers who never use your product or service

- Existing customers used your product or service

Housexy should be careful about determining their target customers, because growth of the brand may come from the mixture of these two.

The second strategy is about focusing on a specific target audience. For this, Housexy need to perform segmentation (as discussed in section 4: Customer Analysis), this then means they can use targeted advertising and promotion to increase the brand’s image rating. Tracking studies should be used to measure awareness and purchase intentions over time. This will also help to measure the effectiveness of any media campaigns. In addition to this, sending media representatives to good events will also create positive associations with the UK market. Moreover, web 2.0 tools such as Wikipedia, Facebook, and MySpace should definitely be used because they are extremely effective tools for both advertising and market research.

The third and last strategy is communication; actual communication should not be at the least considered stage, and it must be in every process while focusing on brand growth. This is because word of mouth can create posetivity in people’s mind.

Communicating a common message is also crucial in focusing on a brand. For instance, Nike’s ‘Just do it’ creates a long-term brand communication message. It intends to maximise effectiveness in peoples’ mind when they hear the brand name. Housexy do not currently have an accompanying message (that may be changed in the future) which should be considered.

Following in this context, it is hard to say whether Housexy has a powerful and effective communication message to be permanent in customers’ mind. “The most trivial and apparently inconsequential characteristics of brands can be the most important factors in shaping consumer perception” (Sutherland, 2003, p.41).

A big question exists for Housexy ; do they need more customers to grow the brand? The suitable theory fits here to answer this question is ‘double jeopardy’ which was discovered by William McPhee in the 1930s. McPhee discovered that DJs and comic strips that were popular had more listeners and of those audiences, they were tuning in to them for longer each day. McPhee (1963) thought that:

“It was odd that less popular DJs should suffer in two ways – not only did they have fewer listeners but those listeners didn’t listen to them for so long” so he called the pattern “double jeopardy”.

So, as double jeopardy discovery tells us, it is crucial that to be a bigger brand Housexy need lots more customers, this will lead to more brand involvement which heightens brand awareness and purchase intentions.

Conclusion

Consequently Housexy needs:

- to develop targeting strategies

- to segment the market carefully

- to develop strategies to increase the brand awareness

Section 3: Competitor Analysis

Section 3 – Competitor Analysis

See Appendices for Project 1 info on Competitors.

- Company Background

- The Experiment

- Conclusion

In order to build awareness of the Housexy brand a competitor analysis will need to be undertaken to gain an understanding of why other companies currently have a larger market share than Housexy. The main objectives of the competitor analysis is to identify the main competitors, understand their strategic planning and find areas which Housexy can build upon in the long term. An in-depth competitor analysis can allow Housexy to find any vulnerability competitors may have and give planning to how to best exploit it.

From data obtained in the research project [Appendix 1] it is clear that Housexy’s main competitors are Hed Kandi and Kinky Malinky, both of which have a larger market share than Housexy.

As a competitor analysis is a time consuming and sometimes expensive exercise we will only be advising Housexy on what goes into a competitor analysis and the importance of continuing the research.

CIS – Competitor Intelligence System

Housexy should have a CIS in place to use as a starting point for the competitor analysis. A CIS will include a checklist of all of the resources which Housexy can use to analyse their competitors. This checklist should be amended as time goes on because new resources will become available and old ones will become redundant.

The CIS will allow Housexy to see what information is needed to undertake a detailed competitive analysis, who should use the information and how. There are five principal steps in establishing a CIS which Housexy should follow. [Adapted from Wilson and Giligan pg. 251, 2005].

- Setting up the system

- Collecting the data

- Analysing and evaluating the data

- Understanding the conclusions

- Incorporating the conclusions into the competitive strategy

In this report we will discuss all of the steps although we will focus on steps one and two, as they will be the most time consuming and complex for Housexy to organise.

Step One

The first step is setting up the system. It must be decided upon what information is needed and who will use the outputs from the system and how.

Below is a list of all the areas in which Housexy need to find information on, on their competitors.

- Sales – Number of units sold, sales by product line, sales by trend, market share, share trends.

- Customers – Customer profiles, buying motives, patterns of usage, depth of brand loyalty, identity and image, satisfaction levels.

- Products – Breath and depth of the product range, comparative product performance levels, new product policies, investment in R&D, new product introduction and modifications, size assortments, new packaging.

- Advertising and Promotion – Expenditure levels and patterns, effectiveness, product literature, sales promotions, customers’ brand preferences, image and levels of recognition.

- Distribution and Sales Force – Types of distribution networks used, relationships and the balance of power, cost structures, flexibility, special terms and the existence of agreements.

- Price – Cost levels, cost structure, list prices and discounts by product and customer type.

- Finance – Performance levels, margins, depth of financial resources, patterns of ownership and financial flexibility.

- Management – Objectives, philosophy and culture, expectations, attitudes to risk, identity of key executives, organisational structure, investment plans, key success factors.

- Other.

The table below from Wilson and Giligan [2005] shows what sources of data can be used in setting up the CIS.

| Recorded Data | Observable Data | Opportunistic Data |

|---|---|---|

| Market Research | Competitor Activity | Suppliers, Distributors, Interviewing Ex Employers |

Recorded Data

This is the most difficult, and most time consuming part of the CIS as there is very little written about the industry. Articles in the business press will give an idea of how well competitor companies are doing although a lot of time will need to be spent properly researching competitor’s backgrounds and finding information on sales figures. Housexy will be able to purchase some of this information from market research companies such as Nielsen Retail Audits and Media Monitoring Services Ltd.

Observable Data

Observable data is really primary research. Looking at competitors prices, promotions, advertising and even attending Hed Kandi or Kinky Malinky hosted nights to see what they offer which Housexy don’t. Speaking to staff while they are working will also give insight to the level of training required how happy staff are to work for the company. It is also important to see what drinks are on offer during these nights and what merchandise is available. It is even possible to purchase competitors CD’s to see what offers they have inside, or the quality of the packaging. Looking at where competitors CD’s are located within shops gives an indication of the relationship with the distributor. Housexy should also start to collect company advertisements, leaflets and other forms of marketing. This will help Housexy to get a better idea of how much competitors spend on their advertising and promotions.

Opportunistic Data

Opportunistic data is finding out what you can, when you can. Who are their suppliers? How much do suppliers charge the competition in comparison to Housexy? Who are Hed Kandi’s or Kinky Malinky’s customers? Could they be swayed towards purchasing Housexy products and services? How brand loyal are they? Some companies even go as far as to hire private investigators in order to find out information about their customers.

Using the Data

Having decided what information is needed Housexy must now decide who will use it and how. This is very important. If the right parts of the company don’t get the information they require then poor decisions will be made, based on guess work rather than actual facts. As we know that Housexy don’t have a dedicated marketing team it is hard for us to suggest who should use the information although we can suggest the ways in which it can be used.

By looking at which products are on offer during competitor’s nights Housexy can decide how popular they are and make the decision that it is something they should or shouldn’t do. An example of this is the merchandise. If there are people at Hed Kandi wearing their T-shirts or discussing other products then they can be deemed to be a success. The types of drinks on offer are also an important thing to consider. What type of drinks is being purchased? How much are they being sold for? These may be things which are down to each individual venue but it is still something that Housexy can have some influence upon.

Pricing is a very important factor to remember. Housexy can take the option to become a premium brand, adding an air of exclusivity to their product or they can undercut their competitors to bring in more customers. Promotions are also a big factor of why customers may attend an event. What promotions are the competitors offering? Do they work? Is there something similar that Housexy can offer?

Step Two

The second step in the CIS is actually collecting the data. This should be continuous and continual and can be very time consuming. Housexy cannot stop collecting competitive research data as industries are always changing. New products are launched all of the time and competitors may change the way in which they do things. If data collection stops then Housexy will not know why a tactic of a competitor is working or not. Often knowing why competitors have made mistakes can stop other companies from making the same ones. Competitive complacency can occur when data collection stops. This can lead to a number of disastrous results to the company. Competitive complacency often emerges within a well established market and leads to the statuses of companies remaining unchanged and can also lead to firms losing their place within the market if another company, possibly a new entrant, use it to their advantage. Housexy must use its data collection as a tool to topple its competitors from being market leaders but also to put itself in a strong position to maintain its market share should any new companies enter the market. A good example from a different industry of competitive complacency is the troubles which Marks and Spencer found themselves in during the mid to late 1990’s after years of being the market leader. Marks and Spencer forgot that customers are constantly changing and therefore lost a great deal of their customers.

Step Three

The third step is analysing and evaluating data. This can again be a very time consuming task although makes all other steps irrelevant if not undertaken. Analysing and evaluating the data will allow Housexy to come up with the conclusions needed to build their strategic marketing plan. Careful analysis must be undertaken to make the most of the data collected. If some of the data is ignored then an important element could be missed and incorrect decisions made.

Step Four

Housexy must now ensure that, after the careful analysis and evaluation has been undertaken that they make the right decisions and spread their knowledge amongst the correct departments. The marketing department can now use the data to justify any budget requests from the finance department. They can also show production departments way which competitors do things which may save them money. They can also use the money to negotiate better deals with suppliers and distributors.

Step Five

Incorporating these conclusions into the subsequent strategy and plan, and feeding back the results so that the information can be developed further. This step is fairly clear, although until the competitive strategy is in place we are unable to comment.

Porter’s Five Forces

To help Housexy start their competitor analysis for the CIS we have used Porters five forces to look at the nature and intensity of the competition [Wilson and Gilligan pg. 348 2005]. Porter’s five forces are an important part of the competitor analysis as it reminds us that current competitors aren’t the only threat and Housexy must be prepared for any future competitors which may try to break into the market. Porter’s five forces are detailed below.

- Industry competitors and the threat of segment rivalry

- Potential entrants to the market and the threat of mobility

- The threat of substitute products

- Buyers and their relative power

- Suppliers and their relative power

Industry competitors and the threat of segment rivalry.

As previously discussed Housexy’s two main competitors are Hed Kandi and Kinky Malinky. Hed Kandi is Housexy’s largest competitor, claiming that their music has almost become a genre in its own right. This statement shows how powerful a brand Hed Kandi has grown to become. Originally launched in 1991 Hed Kandi boasts a catalogue spaning over 80 albums, 3 top ten singles and a host of top 40 singles. It is important to remember that Hed Kandi, like Housexy, is not just a record label. Hed Kandi also hosts club nights all over the world as well as having its own radio program and lots of various merchandise products ranging from beauty products right through to tents. Hed Kandi also has a very powerful website showcasing all of their products in a very easy to use and appealing way, with videos of previous events in the ‘Kandi Vision’ section and downloads of new music on offer. Hed Kandi’s full product range is detailed below.

- Record Label

- Club Nights

- Merchandise – Hair Straighteners, Post Cards, T-Shirts, CD’s, Key Rings, Tents, Perfume, Artwork

- Downloads available from download.com

- Competitions

- Kandi Vision Videos

Kinky Malinky is an up and coming record label. Kinky Malinky began lift as a tour organiser and only recently moved into the record label business. In comparison to Hed Kandi, Kinky Malinky’s website seems a lot less flashy with everything available to view from one page. Kinky Malinky’s product diversity includes very similar items to Hed Kandi, although is not as wide ranging. Unfortunately company information of Kinky Malinky is not as widely available so there we had to focus simply on the items which Kinky Malinky offer on their website. Kinki Malinki’s product diversity is detailed below.

- Record Label

- Club Nights

- Merchandise – Hair Straighteners, T-Shirts, CD’s, Bags

- Downloads

- Competitions

- Videos

- Forum Discussions

From looking at the competitions product diversification it is clear that Housexy are missing out on a number of areas which both Hed Kandi and Kinky Malinky are both capitalising upon. Housexy doesn’t have any merchandise available from the website and when customers visit the store they are actually directed to the Ministry of Sound online store.

As the type of segment that Housexy is targeting are very image and culture conscious merchandising is a great way of increasing brand awareness among the target group. T-shirts can provide instant recognition of the brand and encourage others to find out more. The Hed Kandi tents are a great way of advertising the brand at festivals, which Housexy should consider. Items such as hair straighteners and perfume really move the competitors from being record labels to becoming large brands within the industry. A move for Housexy could be creating their own line of clothes for customers to wear to their events.

Potential entrants to the market and the threat of mobility

The market which Housexy operates within is under constant threat of new companies entering the market and claiming market share. Both of Housexy’s main business areas, tours and the record label need to be better positioned to withstand new entrants.

Firstly the way in which the tour business operates, in that customers approach Housexy to apply for a club night, means that there aren’t many barriers to entry. A new company could start approaching customers offering free nights to get them established. Other than the contracts which Housexy currently has with clubs and exclusivity deals there are other barriers to entry which Housexy could put into place.

The problem which Housexy faces with relation to the record label comes from the development of technology. It is becoming easier and easier for individuals to produce music from their own homes, circulate it via the internet and possibly start their own record label. Internet sharing sites as well as social networking sites make it easier for new records to reach thousands of people in a very short amount of time, therefore promoting them to a higher level far quicker than ever before. Housexy needs to start working with these up and coming artists and sourcing new music in ways which will mean that they will sign to the Housexy record label.

The threat of substitute products.

This again features on the threat of new companies such as new record labels and tour companies entering the market and undercutting Housexy. The best way for Housexy to tackle this is to ensure that the services they offer are the best in the industry. Often if a company is cutting costs then the first thing to be cut is staff training, therefore the event may be cheap, or the music may be good but if the service is poor then customers will complain and the company will lose business.

Suppliers and their relative power

Housexy must make sure that they develop a positive relationship with their suppliers. If one of their suppliers, of CD cases for example, gets an offer from a competitor to pay more for the cases then they will expect Housexy to also pay more. This could be a tactic by a more powerful supplier to attempt to price Housexy out of the market. If the supplier is unhappy with Housexy then they may choose to put the prices up inline with the competitors. Housexy must also be careful that their supplier has a big enough operation that they will still be able to supply them should the suppliers receive a larger order. If Hed Kandi order 5,000 CD cases and Housexy order 1,000 but the supplier can only supply a total of 5,000 then it will be Housexy that loses out.

Buyers and their relative power

The contracts which Housexy put in place with the venues they host tours in will help to protect them from any problems that may arise in this section but this is not permanent. Contracts will come to an end and Housexy must do all that they can to get customers to renew their contracts. Competitors will try to pull big contracts away from Housexy so a strong professional relationship will help.

Conclusion

From our research into Housexy as a company it was clear that they are not undertaking an in-depth enough competitor analysis. By using our recommended CIS Housexy will be able to undertake a through competitor analysis and ensure that this process is ongoing. The CIS is designed to guide Housexy through the competitive analysis procedure by showing what information is needed and how it should be used. An important part of the competitor analysis is not only looking at current competitors but also potential new competitors. By building a strong company position Housexy will be able to hold their market position against any new arrivals.

Section 4: Consumer Analysis

- Segmentation for Housexy

- Consumer Behavior

- Conclusion

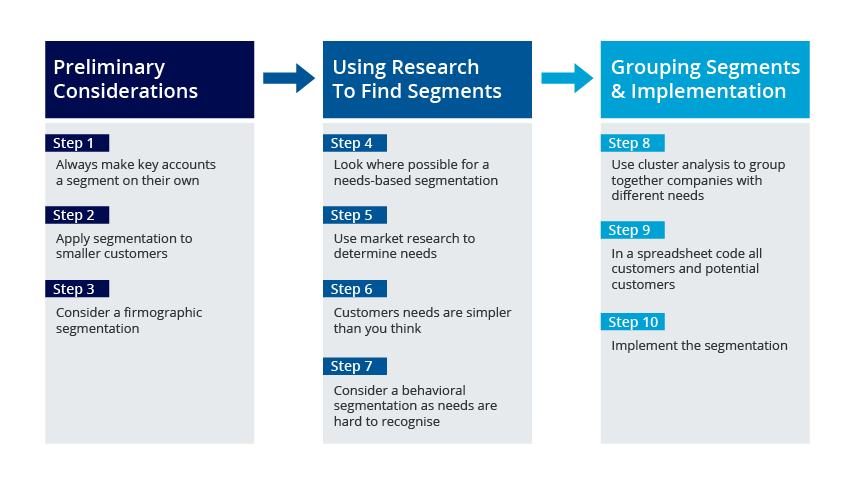

Segmentation for Housexy

‘Market segmentation is defined as the process dividing a large market into smaller segments of consumers that are similar in characteristics, behaviour, wants or needs. The resulting segments are homogenous with respect to characteristics that are most vital to the marketing efforts.’

(Hutchinson Et. Al. 2006)

STEP 1: Always Make Key Accounts a Segment on Their Own

According to Hague (2009); ‘Every company needs to segment its customers.’ Customers are individuals who should be treated differently to satisfy their needs. Hague argues that companies B2B accounts are all treated individually because of their profitability. Because of this, other customers attain less focus. However, general customers are still key to the future of the brand. In Housexys case this means that there must be just as much focus on the general audience as there is on the promoters.

If we consider the 80/20 rule; ‘which determines that 20% of customers account for 80% of turnover’, we should look at Housexy and determine the 20% of customers that account for their 80% of profit. This would help the company in terms of targeting. Although contradictory to the previous paragraph, ensuring future business. This is the process of identifying ‘Key Accounts’.

‘It is quite reasonable therefore that such large and crucial customers should be treated as individuals, scoping products and services to exactly meet their needs.‘ (Hague, 2009)

For Housexy, this segment is promoters of clubs who purchase brands for club-nights.

STEP 2: Apply Market Segmentation Analysis to the Smaller Customers

Even though the other 80% of customers make up 20% of the brands revenue, the customers need to be segmented properly so that services can be designed to maximize the profitability of the relationship.

Without segmentation; the remaining 80% of customers ‘will either be treated as all the same (in which case many will be disappointed by an offer that does not suit them) or, equally unsatisfactory, an attempt will be made to treat each and every one as a special accounts, swallowing up a huge resource and yielding very little in the way of profit.’ (Hague, 2009)

STEP 3: Consider a Firmographic Segmentation (Firm being Promoter)

Hague states that the key question is; ‘how to segment?’ Segmentation can take place upon physical attributes ‘such as they are in a certain region, or classified in a particular industry.’ (Hague, 2009)

For Housexy’s customers, segmentation will involve regional information for the UK and then segmentation through similarities in countries: Skandinavia, Eastern Europe etc.

As well as geographic segmentation; club size, club entry price, average age of the clubs customers or any other variable effects the needs of that promoter.

Housexy could also segment their consumers according to industry grouping, this would mean that a needs assessment would clarify exactly what is to be offered up-front to the customers from that segment. (dancers wouldn’t need to be offered to fashion shows)

STEP 4: Look for a Needs Based Segmentation

Industry segmentation does not completely solve Housexys problem. However, qualitative market research conducted on the current customers Housexy has. Needs such as imagery and DJ Status will give Housexy knowledge so that when they approach a promoter, the most targeted and therefore most tempting package can be offered.

If Housexy can position their package properly, they will gain a competitive ‘edge’, as most companies simply send a PDF file that displays their general offerings.

‘A segmentation based on needs is, in theory, the ideal as it gets to the heart of marketing; that is the identification and satisfaction of customers needs’ (Hague, 2009)

This brings us to step 5:

STEP 5: Use Market Research to Discover Needs

On option could be that all reasonable services that Housexy could offer are outlined. Then, demand for these needs should be researched. This would be service-to-consumer research. Alternatively, needs could be assessed using Hague’s method:

‘The first and very obvious problem is that needs are difficult to recognise. Certainly it is possible for market researchers to devise questions which ask people what they require from suppliers, though this is not without some difficulties. How do we decide whose needs are to be satisfied? Is it the needs of the company, or the needs of the department that is involved in choosing the supplier, or is it the needs of the individual within the department who is a key decision maker?’

This scenario exists for Housexy and has been discussed throughout this project. From the ground up, Housexy has the following customer groups

- General Consumers (Clubbers)

- Nightclub Promoters

- Nightclub Owners

Also discussed earlier in this project is information on the needs of these customer groups. Customers want music to listen to (and possibly a culture to attach to). Nightclub promoters want one of two things; (a) a night of particular profitability or (b) a night that will raise the status of the nightclub ensuring future interaction. Nightclub owners seek profits, long term and/or short term.

With these considerations, we can understand how to approach each of these groups when targeting new/repeat purchases. However, other variables exist:

‘At a company level, there could be an overriding need to choose suppliers that offer quality products, suppliers that are committed to the market, and suppliers that can be trusted. And yet, at a personal level, the purchasing manager may think he has to drive down prices to demonstrate that he is doing an excellent job.’

(Hague, 2009)

This would mean that when market research is conducted, the ‘purchasing manager’ (in our case, the promoter) may say that his interests are price driven whereas that company is actually looking for high quality products and service.

Another complication in needs segmentation is that needs inevitably change, especially in taste-based industries such as the music industry. Not only does this mean that regular market research should be conducted to keep the company well positioned, but services should be able to cope with varying demand. Demand will also play a part in the needs of the clubs, in the current recession, less demand will be linked with a need to keep cost as low as possible.

Needs based segmentation is the ideal method for Housexy and it will help to consistently keep on top of the expectations and needs of its consumers.

STEP 6: Customers Needs are much Simpler Than You Think

According to Hague (2009), the list of customers needs (in each segment) should be relatively short. This is because there will usually only be a few factors involved in the decision making process for consumers.

‘This is the action of cognitive misers. People are economical with their mental resources and make decisions based on just one or two criteria rather than a multi-attribute utility decomposition [1] . Some of these criteria could be in the following list

- Quality products

- High levels of sales service

- The excellent reputation of the company

- Low prices

- High levels of technical service

- On time and reliable delivery

- Ease of doing business with the supplier’

(Hague, 2009)

All of the above criteria relate to the needs expressed in the preparatory research (in appendices, from market research project: Project 1). However, as branding is of such importance to promoters, number 3, the reputation of the company, will be key. Criteria 5, 6 and 7 will affect repeat purchase.

Due to the smaller scale of Housexy’s operations, they can then discuss the criteria with promoters to check that the results fit in with general consensus.

STEP 7: Consider a Behavioural Segmentation if Needs Can’t be Recognised

As discussed previously, customers needs are always changing. It is not always possible to predict consumer expectations using needs based segmentation, therefore, behavioral segmentation can be used for hidden needs.

‘For example, some companies exhibit considerable loyalty to suppliers while others are constantly switching. This simple classification based on behavior may be a good indication of the needs of the customers. Some preferring a long-term partnerships and being prepared to pay for this while others roam the market seeking cut price deals wherever they can.’

(Hague, 2009)

Another instance where behavioral segmentation could work is dividing promoters who have specifications for Housexy to tend to versus promoters who are looking for Housexy to guide them through the process, discussing all available possibilities. This could be said to be customers who know what their clubbers want and those who don’t.

If Housexy divide these customers properly, company offering sheets (PDF) can be designed so that it displays to customers exactly what they are looking for.

‘Not surprisingly, companies that exhibit the behaviour of a tightly scoped brief are more likely to be driven by price and basic transactions whereas those that are more open to suggestions could value service and be prepared to pay for it.’

(Hague, 2009)

STEP 8: Use Cluster Analysis to Group Together Companies with Different Needs

The next process following on from market research is to cluster the respondents in terms of similar answers (using SPSS or similar). Hague states that ideally clustering should ‘generate two, three, four or five clusters. It is unlikely that a segmentation with more than five clusters will be useful as each segment requires a distinct and different offer.’ This will balance the needs of the market with the efficiency of the brand.

‘It is not unusual in segmentation analysis of this kind to find that a significant proportion of the population (often around 50%) requires the full package of criteria. They want a bit of everything from the list.’

(Hague 2009)

The facet of segmentation that will be of the most use to Housexy will be linking identifiable segments with specific needs. Examples include:

- Smaller clubs react better to being offered an up-front simplified package including branding décor, a small DJ and no tour manager.

- Fashion events react better to a big DJ and limited décor.

Simply put, this means that when an events manager approaches the club/client, the club are more likely to take notice as the product is suited to their needs.

The next problem is new/potential clients:

‘Having achieved a segmentation based on customers’ needs, a procedure is required for placing new customers into an appropriate segment. This should not be difficult as the points spend question can be asked of new customers and their answers will enable them to be classified accordingly. The points spend question should also be repeated every six to twelve months with current customers to ensure that any changing needs are recognised and addressed.’

(Hague, 2009)

STEP 9: In a Spreadsheet, Code all Customers and Potential Customers

As Housexy (Ministry of Sound) already operate most function on spreadsheets, this should not pose a problem. However it is important that Housexy’s staff implement segmentation for every customer; otherwise untargeted approaches will be made possibly spoiling the opportunity for business to be conducted.

The main criteria for segmentation will depend on the outcomes of the research. Ongoing research will help Housexy to maintain the grouping of segments and refine the process differentiation for each segment.

Spreadsheets will then help Housexy with their direct mailings and external communications. Also measuring dips in sales to particular segments, identifying strategic drift.

STEP 10: Implement Segmentation

‘Having established a segmentation based on either customers’ needs or behaviour, the final and arguably one of the most difficult tasks is to implement it. Each segment by definition requires a different offering. The offering, or as we prefer to refer to it the customer value proposition (CVP), must be recognizably different and distinctive for each segment. Where claims have been made for the value proposition, these must be defendable in that it should be possible to demonstrate and prove to customers that the wonderful claims that distinguish it really are true.’

(Hague, 2009)

As Housexy is a smaller-scale operation to many competitors, therefore the impact could be huge, both in the market and on its staff. Therefore the process should involve the input of all staff to ensure that it will not be shunned.

‘It also requires them to be trained in asking the “killer questions” that determine which segment customers and potential customers fall into.’

(Hague, 2009)

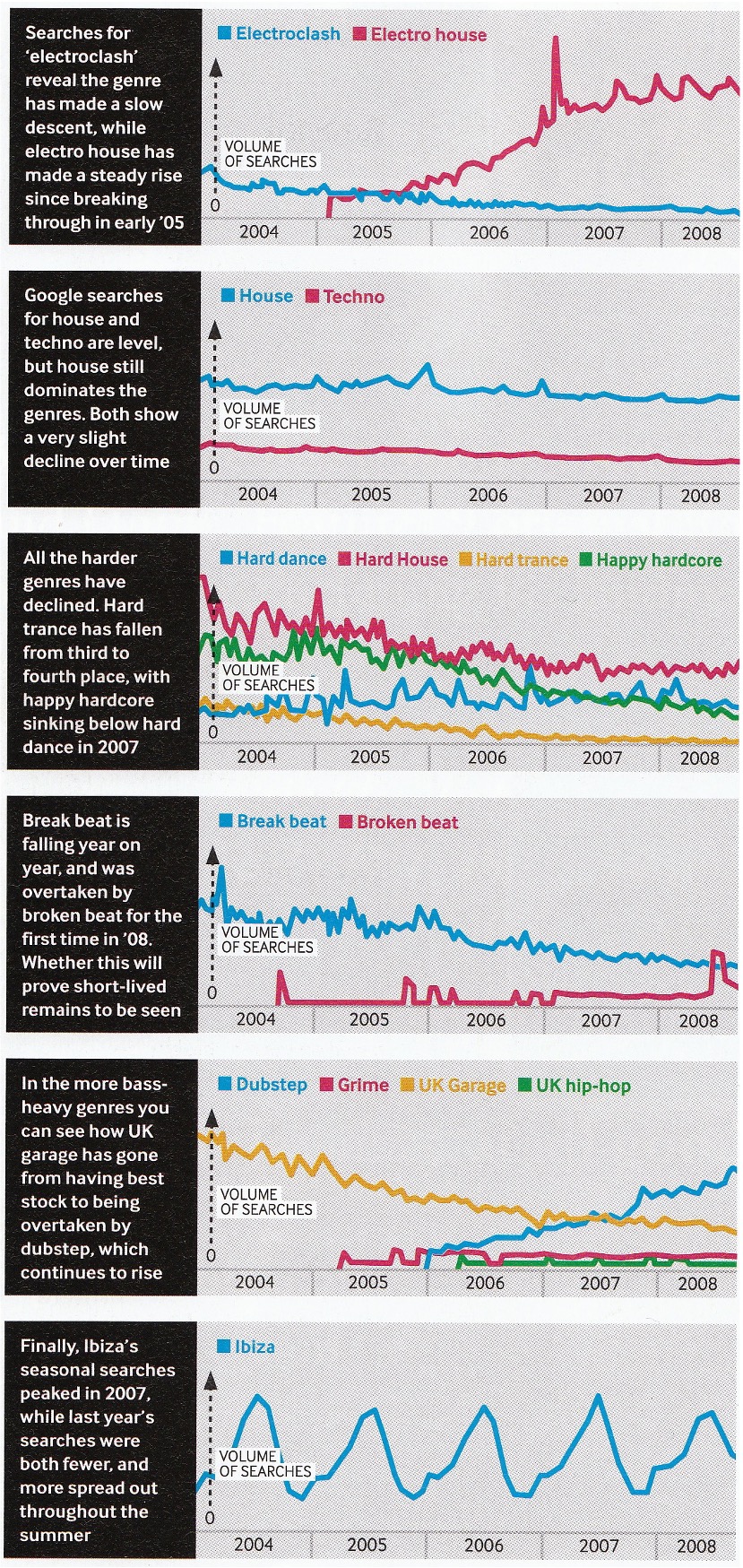

Monitoring Clubbing Perspectives

A matter that was discussed earlier in this section was that of keeping up-to-date with consumer (a) ‘clubber’ perspectives/expectations/needs.

After the introduction of tracking studies to maintain an understanding of a classic ‘needs’ list. Periodic research, to maintain the sustainability of the brand should be carried out.

Consumer behavior will be discussed in the subsequent section, however, analytics (displayed left From Mixmag, 2009) can be used so that housexy can affiliate themselves with the best terminology for the music it represents.

Consumer Behaviour

By dividing the target market into segments Housexy can research and analyse consumer behaviour to find ways to better target them with their marketing activities. A study by Christina Goulding from the University of Wolverhampton titled ‘Dance Culture and Consumer Behaviour: can marketers learn lessons from the ‘rave’ generations?’ (2000) looks into why consumers attend club nights such as those held by Ministry of Sound (and Housexy). Goulding states that ‘the whole market and associated markets are by their nature volatile and heavily competitive. Consequently, it takes a great deal to keep pace with what the consumer wants, maintain a reputation and stay ahead of the growing competition’. This highlights the importance for analysing consumer behaviour and keeping this analysis ongoing.

One of the key features of the study by Goulding (2000) is a look into one of the UK’s ‘super-clubs’ Miss Moneypenny’s. Although Miss Moneypenny’s is no-longer a direct competitor of Housexy, important lessons can still be learnt from their customers. Goulding interviewed a club goer called ‘Sash’. In the interview Goulding gets an insight into why people attended nights in Ministry of Sound and Miss Moneypenny’s. The most important factors are detailed below.

- The difficulty of getting in

- The status of having been there

- The music that is played

- The dj’s at the club

- Dress codes

- National and international reputation

This list will give Housexy a good starting point from which to work from when deciding ways to attract new customers.

One of the most important factors from the above is the difficulty of getting into the club as this can work both for and against Housexy. The more exclusive a tour is perceived to be the more popular it will become. People will want to attend just to see what it is like, although if the tour gains the image of being to difficult to get into then numbers could start to drop off as customers don’t imagine that they will ever be able to get into the club.

As we have already seen image is very important for the consumers of Housexy so the status of having been there must leave the customer is a positive light. Housexy need to be able to give their tours a unique status that will impress their consumers. Their national and international status is one of helping to improve this. International tours give Housexy a better brand image as customers can brag that they went to a Housexy night in Ibiza or Reckjavic or even Bangladesh.

Consumers develop their perceptions of the Housexy brand through different types of learning. Housexy can take advantage of these learning processes to make their tours and CD releases more prominent when consumers are making their decisions as to which clubs to attend or which CD’s to purchase. One type of learning theory is Classical Conditioning. Solomon et al describe classical conditional as occurring ‘when a stimulus that elicits a response is paired with another stimulus that initially does not elicit a response on its own’ (2002). Given time and enough exposures to the paired stimulus consumers will form an association between the two stimuli and so each will evoke the same response, whether they are seen together or separately.

Housexy can take advantage of this transfer of meaning in a number of different ways to improve their brand reputation. The ways we recommend are detailed below.

Repetition

If Housexy can have their message seen by consumers a number of times, some believe as few as three [Solomon et al, Pg. 71, 2002], then the consumer will remember the message when making their next purchasing decision. The first viewing will serve to create awareness of the product or service being advertised, in the second viewing the consumer will take more notice and recognise its relevance and the third viewing will serve as a reminder. The amount of repetitions needed to evoke a reaction can vary from consumer so Housexy must ensure that their target market is exposed to the message a sufficient number of times. Housexy must be careful however, as too much exposure to a message can cause ware-out, which is when a consumer becomes so used to seeing the advert that they stop paying attention. To decrease the chance of this happening Housexy must vary the way which their messages are presented.

Product Association

Housexy can pair their tours and CD releases with a positive stimulus and this will transfer the same positive feelings to the Housexy brand. Positive stimulus for Housexy can be the backing music on the adverts, the imagery used or even a famous dj who is well known and popular throughout the industry. A popular dj will mean that consumers will associate them and their style of music with Housexy.

Stimulus Generalisation

This relates to branding families of products and product line extensions. By branding product line extensions with the same Housexy image they will receive the same status as Housexy. As discussed in the competitor analysis section Housexy could launch some similar products to their competitors such as hair straighteners and build upon their brand. Housexy could also allow films or TV programs use their logo and tie in their products. One exploitation of using stimulus generalisation is look-alike packaging. Housexy could package their CD’s to look like that of a competitor, although this will not be recommended for Housexy as it would lose Housexy’s own brand identity.

Stimulus Discrimination

Housexy can encourage stimulus discrimination by promoting the unique attributes of their brand, compared to their competitors. This will help consumers to differentiate between Housexy products and rivals.

The table below shows some marketing tactics consistent with classical conditioning principals.

| Unconditioned or Previously Conditioned Stimulus | Unconditioned or Previously Conditioned Response | Example |

|---|---|---|

| Exciting event – tour | Excitement, Attention | Product advertising during related event eg. Shipwrecked (T4 – Hangover TV), or MTV |

| Popular music | Positive mood | Background music in record stores to encourage |

| Familiar voices | Relaxation, feeling of security | Column 3 Value 3 |