Nike vs Adidas

A Historic Marketing Rivalry from Origins to Today

In the world of sports marketing, few rivalries are as iconic – or as instructive – as that between Nike and Adidas.

What began as two very different companies on opposite sides of the globe has evolved into a relentless global competition for cultural relevance, consumer loyalty, and market dominance. Nike, born from the running tracks of Oregon (USA), built its empire on innovation, speed, and the idea that anyone can “Just Do It.” Adidas, founded in post-war Germany, rooted itself in heritage, authenticity, and a belief that through sport, we have the power to change lives.

Over the decades, these two titans have shaped not just the athletic wear industry, but the way brands connect with consumers.

Their campaigns have become case studies.

Their shoes, cultural artefacts.

Their logos – symbols of identity.

Whether through billion-dollar endorsement deals, award-winning adverts, or high-stakes ambush marketing, Nike and Adidas have continuously raised the bar. For marketers, this is more than a rivalry – it’s a masterclass in strategy, storytelling, and staying relevant in a world that never stops moving.

The Marketing Made Clear Podcast

Check out the Marketing Made Clear Podcast on all good streaming platforms including Spotify:

Formation and Early History

The Nike–Adidas rivalry was born from two very different origin stories on separate continents. Adidas traces its roots to 1920s Germany with Adi Dassler crafting sports shoes in a small town workshop. Dassler’s shoes gained international fame when sprinter Jesse Owens won four gold medals at the 1936 Berlin Olympics wearing them. After World War II, a feud split the Dassler brothers – Adi formed Adidas in 1949, while his brother Rudolf founded Puma.

In these early decades, Adidas dominated global athletics, from Olympic tracks to football pitches. A landmark moment came in 1954: underdog West Germany won the FIFA World Cup final in heavy rain, aided by Adidas’s innovative screw-in stud boots that let players adapt to the muddy field. This “Miracle of Bern” not only highlighted Adidas’s inventive spirit but also cemented its cultural status in Europe’s post-war sports scene.

Meanwhile, Nike emerged from the running boom in post-war America. In 1964, Phil Knight (a middle-distance runner turned Stanford MBA) and his coach Bill Bowerman founded Blue Ribbon Sports in Oregon, initially as a distributor of Japanese Onitsuka Tiger running shoes. Knight had theorised that low-cost Japanese running shoes could challenge the German dominance (Adidas and Puma) in the U.S. market. By 1971, the company launched its own brand – renamed Nike after the Greek goddess of victory – and unveiled the iconic Swoosh logo.

Bowerman’s relentless tinkering epitomised Nike’s early ethos of innovation: famously, in 1971 he poured rubber into his wife’s waffle iron to create a new gridded sole for better traction. The resulting “waffle” sneaker debuted as the Nike Waffle Trainer in 1974, offering runners excellent grip without metal spikes. This breakfast-table invention would change running shoes forever and set Nike on course to challenge Adidas’s supremacy.

By the late 1970s, Adidas was an established giant in performance sportswear, known for quality and a three-stripe trademark, while Nike was a lesser-known upstart gaining traction (quite literally – pun intended) among track athletes. The cultural contexts of their foundings foreshadowed their brand personas: Adidas grew from the austere, craftsmanship-focused post-war German sports culture, and Nike from the freewheeling, entrepreneurial spirit of 1960s America.

These origins laid the groundwork for a rivalry that would span decades and continents.

Evolution of Brand Strategies Over Time

Despite both companies selling athletic apparel and footwear, Nike and Adidas have fostered distinct brand strategies that have evolved with consumer trends. From early on, Nike positioned itself as the rebel with a cause, blending performance with attitude. In 1977, Nike’s print ads proclaimed;

“There is no finish line,”

signaling a shift from mere products to a philosophy of endless self-improvement. This approach culminated in 1988 with the birth of Nike’s defining slogan;

“Just Do It,”

which urged everyday people to push their limits. The campaign’s bold, inclusive tone (it featured athletes of all shapes, ages, and abilities) struck a cultural nerve and dramatically broadened Nike’s appeal. Through the 1990s and 2000s, Nike continually refined its voice: equal parts innovator and inspirer. The brand’s messaging embraced personal achievement, often intertwined with social commentary – for example, a 1995 women’s fitness ad declared;

“If You Let Me Play”

highlighting the benefits of girls in sports, and more recently the 2018 Dream Crazy campaign (narrated by Colin Kaepernick) championed social justice in sport. Nike’s target demographics expanded from hardcore athletes to aspirational youth culture worldwide, leveraging a cool, edgy image that resonated from American inner cities to emerging markets. The company’s willingness to take risks in messaging (even at the cost of controversy) has reinforced its image as a challenger of the status quo in sports marketing.

Adidas, by contrast, built its strategy on authenticity and heritage, though it too has adapted over time. For much of the 20th century, Adidas projected a no-nonsense focus on athletic excellence – it was the shoe worn by Olympic medalists and World Cup heroes, and that credibility was its marketing bedrock.

In the 1980s, however, Adidas’s utilitarian image started to seem flat to a new generation. The brand got an unexpected boost from hip-hop culture when Run-DMC’s 1986 song “My Adidas” became an anthem, leading Adidas to sign the rap group in an early example of music endorsement. This signaled a subtle strategy shift: sportswear as culture wear.

By the mid-1990s and 2000s, Adidas leaned into its dual identity: Adidas Performance for athletes, and Adidas Originals for lifestyle and streetwear. The company’s long-running slogan;

“Impossible is Nothing,”

launched in 2004, encapsulated both high-performance ambition and personal inspiration, echoing Nike’s motivational tone but with Adidas’s historical gravitas (the phrase was famously inspired by boxing legend Muhammad Ali). In the 2010s, under rising competition, Adidas made a conscious pivot to emphasise style, creativity, and collaboration. It tapped into the sneakerhead and fashion markets by resurrecting classic sneakers (Stan Smith, Superstar), teaming up with designers and celebrities (from Stella McCartney and Yohji Yamamoto to Kanye West and Pharrell Williams), and embracing sustainability as a brand pillar (e.g., shoes made with recycled ocean plastics).

These moves shifted Adidas’s positioning to be seen as the stylish, innovative underdog – a brand as comfortable on Paris runways and music videos as on football fields. By embracing both sport and style, Adidas broadened its target demographics, appealing strongly to millennials and Gen-Z consumers who blur the line between athletic gear and everyday fashion.

Korn – Adidas Hits the “Counter-Mainstream”

I also have to shout out my favourite band growing up, Korn – who are heavily associated with Adidas, from Jonathon Davis (singer) wearing old-school tracksuits and the band even published a song A.D.I.D.A.S. – a cheeky nod to the brand. Much later, Korn took part in a collaboration with the brand. This kind of adoption helped position Adidas as a brand that could feel at home in the “counter-mainstream”.

Throughout their evolutions, both brands have remained marketing powerhouses by staying culturally relevant. Nike often leads with a top-down approach – using elite athletes and powerful storytelling to inspire the masses – while Adidas tends to work more bottom-up – leveraging cultural trends, collaborations, and its authenticity in core sports to win fans.

Both brands deliver a feeling, a specific value that goes beyond functional benefits of the shoes, highlighting how emotional branding has been key for both.

Yet, despite similar goals, their personas diverge: Nike is the relentless innovator that says;

“anyone with a body can strive for greatness,”

…and Adidas is the passionate craftsman that says;

“through sport, we have the power to change lives”

These distinct voices have shaped some of the most iconic marketing campaigns in history.

Major Advertising Campaigns and Creative Direction

Both Nike and Adidas have produced memorable advertising campaigns that not only sold shoes but also built cultural legend. Nike’s marketing playbook in particular has become the stuff of advertising lore – bold, provocative, and often award-winning.

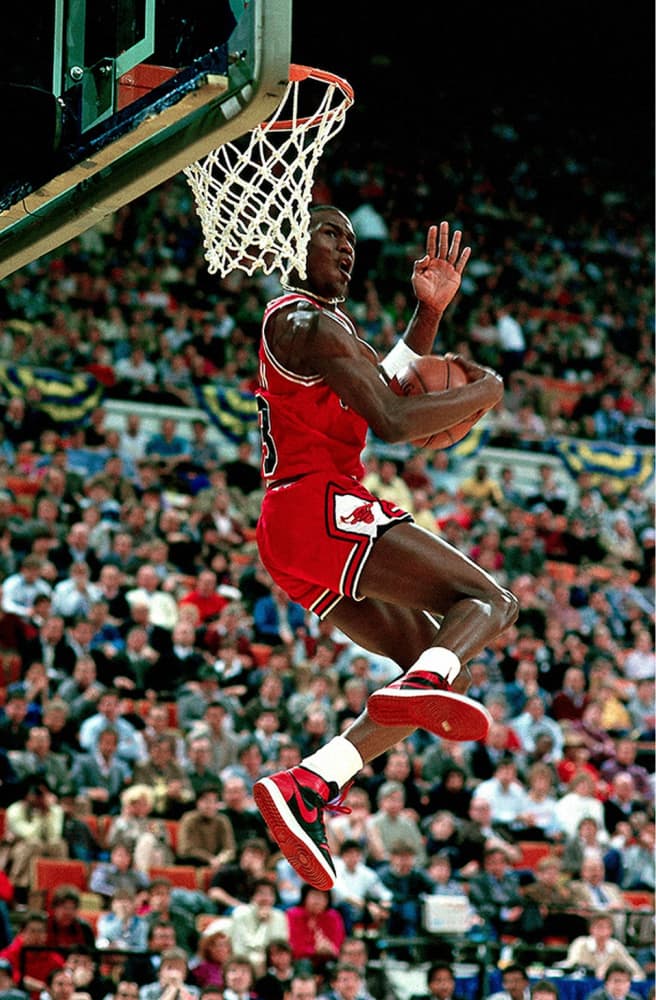

Enter Michael Jordan

One of Nike’s earliest hits was its series of 1980s commercials featuring basketball rookie Michael Jordan alongside filmmaker Spike Lee (as Mars Blackmon).

These witty ads (“It’s gotta be the shoes!”) made Air Jordan sneakers a pop-culture phenomenon. In 1988, Nike’s “Just Do It” TV spots – featuring everyday athletes and closing with the swoosh logo – set a new benchmark for empowering advertising. The campaign was not only a sales success but a creative masterpiece, later enshrined by Advertising Age as one of the top taglines of the 20th century.

Nike’s partnership with agency Wieden+Kennedy yielded a string of iconic campaigns through the 1990s: “Bo Knows” (a humorous take on two-sport star Bo Jackson’s versatility), “Lil’ Penny” (featuring a trash-talking puppet sidekick to Penny Hardaway), and breathtaking international ads like “Good vs Evil” (1996, depicting Nike athletes in a gladiatorial football match against demons). Each spot reinforced Nike’s edgy cool and its knack for tapping into youth zeitgeist.

Nike’s creative direction often plays on grand themes of greatness and imagination. A standout example is the

“Write the Future”

…campaign for the 2010 World Cup – a three-minute cinematic ad by director Alejandro Iñárritu, showing star footballers like Wayne Rooney and Cristiano Ronaldo in flash-forward scenarios of triumph or failure. Despite not being an official sponsor of that World Cup, Nike’s blockbuster ad stole the show and even won the Cannes Lions Film Grand Prix for 2011.

Two years later at the 2012 London Olympics, Nike pulled off another marketing coup with;

“Find Your Greatness.”

While Adidas had paid heavily to be the Games’ official sponsor, Nike’s campaign featured everyday athletes in places around the world named London (London, Ohio; Little London, Jamaica, etc.), implicitly piggybacking on Olympic fever without ever infringing trademarks. The clever campaign generated huge buzz – a classic case of Nike’s ambush marketing outmanoeuvring Adidas’s official rights.

Nike and Adidas – Modern Campaigns

In recent years, Nike has continued to produce talked-about work: the 2018 ad;

“Dream Crazy”

…(honouring athletes who stand up for beliefs), and the 2020

“You Can’t Stop Us”

…montage (celebrating global sports resilience amid a pandemic) both earned widespread acclaim for their emotive storytelling. Nike’s creative formula blends star power, cinematic storytelling, and an undercurrent of rebellious energy – a formula that has kept it at the forefront of advertising for decades.

Adidas, for its part, has also delivered notable campaigns, albeit with a different flavor. A signature Adidas tagline;

“Impossible is Nothing,”

…anchored many ads in the 2000s and remains associated with the brand’s ethos of overcoming odds. A 2004 campaign under that banner even brought Muhammad Ali (via archive footage) into the ring with his daughter Laila Ali, symbolically sparring across generations. In the early 2010s, Adidas launched;

“Adidas Is All In,”

…a global campaign uniting its sports, street, and style silos under one message. That campaign’s hero spot, directed by Romain Gavras, mashed up athletes (Lionel Messi, Derrick Rose), pop stars (Katy Perry) and designers, set to a pumping soundtrack – portraying Adidas as a brand at the heart of youth culture. This reflected a strategic creative direction for Adidas: to highlight the brand’s crossover between sports performance and lifestyle. The effort paid off in making Adidas feel cool again for a new generation.

Later, Adidas Originals (the lifestyle division) produced the award-winning 2017 campaign;

“Original Is Never Finished,”

…which remixed Frank Sinatra’s classic My Way and featured a kaleidoscope of modern icons like Snoop Dogg and skateboarder Gonz. The ad’s message – that creativity is an endless evolution – captured Adidas’s push into the creative/cultural realm and earned accolades (including D&AD and Clio awards) for its bold visual style.

In creative terms, Adidas often leans on its heritage and authenticity – for example, celebrating the 50th anniversary of the Superstar sneaker with a nostalgic campaign – or on collaborative energy, such as ads featuring its celebrity partners from Beyoncé to Ninja (of Die Antwoord) to world-renowned athletes like Messi. While Nike’s ads typically shout “heroism”, Adidas’s best ads often whisper “credibility” and “originality.” Even without Nike’s mammoth ad budget, Adidas has managed to produce culturally resonant work by staying true to its brand DNA of sport fused with art.

Not every campaign from these rivals is a home run, but their hit rate is remarkable. From Super Bowl commercials to viral social media clips, Nike and Adidas have set marketing benchmarks. Each successful campaign further solidifies Nike’s image as the emotive innovator and Adidas’s as the authentic storyteller, ensuring that their rivalry extends beyond products into the very stories and symbols of sports culture.

Product Positioning: Innovation, Design and Endorsements

Both Nike and Adidas understand that great marketing must be backed by great products. Over the years each has honed product positioning strategies that play to their strengths – whether it’s Nike’s relentless innovation in design and technology, or Adidas’s balance of performance and lifestyle appeal.

Nike’s product strategy has long revolved around cutting-edge innovation and bold design. From the beginning, co-founder Bowerman’s ethos was to;

“make the shoe lighter and the athlete faster.”

This led to inventions like the waffle sole and, in 1979, the introduction of Nike Air – cushioning technology using pressurised air units, which became visible in the iconic Air Max line by 1987. Nike positioned itself as the brand for those who want the latest and greatest gear to gain an edge. Signature shoe lines with top athletes became a cornerstone of this approach: the Air Jordan line (debuting 1985) not only revolutionised basketball footwear with its technology and style, but also illustrated Nike’s savvy use of athlete endorsements to build product hype.

Nike and Adidas – Celebrity Endorsements Revisited

By signing Michael Jordan – after Adidas famously passed on him (now a true WTF moment), Nike effectively outmanoeuvred its rival and created a multibillion-dollar sub-brand (Air-Jordan) that remains hugely influential. Nike repeated this playbook across sports: from Tiger Woods in golf to Serena Williams in tennis to Cristiano Ronaldo in global football, Nike sought the biggest names and gave them signature shoes or apparel collections. The strategy sends a message that

“Nike is what champions wear,”

…and by extension, weekend warriors and teens will covet the same gear.

Nike also isn’t shy about premium pricing for innovation. It routinely launches new technologies – Zoom Air cushioning, Flyknit knitwear uppers, self-lacing sneakers, etc. – at the high end of the market, using tech as a justification. Marketing for these products emphasises performance benefits and sometimes futuristic appeal (consider the limited-edition Mag self-lacing shoes inspired by Back to the Future or the latest Nike Adapt series controlled via smartphone). Yet, Nike balances this by maintaining a broad range; while top-tier products create halo effects, Nike’s volume comes from affordable versions and classics (like the perennial Air Force 1).

Design-wise, Nike often opts for bold, instantly recognisable aesthetics – from the Swoosh itself to the striking silhouettes of shoes like the Air Jordan III or the Vaporfly. Coupled with savvy drops and scarcity marketing (e.g., limited “sneaker drops” that fuel hype on social media), Nike has mastered the art of making its products status symbols.

Adidas’s product positioning has historically emphasised performance married with style. Adi Dassler’s guiding principle was to listen to athletes’ needs – a tradition that gave rise to innovations like the first screw-in football studs (1954) and the lightweight AdiZero track shoes.

In the modern era, Adidas has continued to innovate (for instance, introducing Boost foam cushioning in 2013 in collaboration with BASF, which offered a new level of energy return for runners). Initially, Boost technology was a slow burn, but Adidas’s persistence – and some serendipitous marketing when Kanye West was spotted wearing all-white Ultra Boosts on stage in 2015 – turned it into a huge success. The Ultra Boost running shoe became a crossover hit, embraced by both marathoners and “sneaker-heads”, epitomising Adidas’s knack for blending function and fashion. This was a direct challenge to Nike’s Flyknit and React technologies, kicking off a “foam wars” competition in running shoes.

Adidas Classic sneakers like the Stan Smith (tennis shoe) or Superstar (basketball shoe) are continually reintroduced, often in collaboration with designers or artists, positioning them as retro-cool staples. This retro strategy differs from Nike, which tends to retro its iconic Jordans and Air Maxes but focuses more on new models. Adidas found that a portion of consumers, especially in lifestyle segments, crave the authentic and timeless look – so Adidas Originals line makes old shoes new again, often with fresh colourways or limited editions that drive demand.

In terms of pricing, Adidas, like Nike, covers a wide spectrum. It sells £229/$300 limited-edition Yeezys, but also plenty of £55/$70 classics. However, Adidas often strategically prices some of its flagship running or football shoes slightly below Nike’s, aiming to be a value alternative without sacrificing quality. This can be seen in how Adidas marketed its Adizero and Predator boots in football against Nike’s Mercurial and Tiempo boots – by emphasising unique features (like Predator’s swerve-enhancing fins or Adizero’s lighter weight) and the notion that Adidas gear is the choice of real footballers who value technical excellence.

Ultimately, both companies use product strategy as a marketing lever: Nike sells a future of sport – high-tech, elite, individualistic – while Adidas sells a community of sport – authentic, stylish, inclusive. That difference is evident whether it’s a Nike self-lacing basketball shoe drop on a Nike SNKRS app, or an Adidas limited-edition retro sneaker collab revealed at a pop-up event. Each approach has cultivated devoted followers and contributed to the brands’ financial success in different product categories.

Google Trends shows Nike as drawing the most search interest over time:

Global Market Penetration and Regional Strategies

From hometown dominance to conquering overseas markets, Nike and Adidas have each crafted strategies to grow globally – often literally playing on each other’s turf. In their international chess match, North America, Europe, and Asia have been key battlegrounds, while emerging markets present new fronts.

United States (North America)

This has traditionally been Nike’s stronghold. As an American company, Nike understood the U.S. consumer deeply and secured early dominance through basketball (Michael Jordan and the NBA), American football (signing NFL stars and later the NFL uniform deal in 2012), and collegiate sports.

By the 1990s, Nike was ubiquitous in U.S. sports and youth culture, while Adidas – despite its 80s hip-hop cameo – struggled to break the Nike lock. In the 2000s, Adidas attempted a major push by acquiring Reebok (a U.S. brand with strong NFL/NBA presence) in 2005. The acquisition initially aimed to give Adidas a combined market share to rival Nike, but integration issues and Nike’s continued innovation meant Adidas still trailed.

However, around 2015-2017, Adidas enjoyed a renaissance in the U.S., nearly doubling its market share (from ~6% to ~11%) on the back of trendy products like the Superstar re-release, Boost-equipped sneakers, and the buzz from Kanye West’s Yeezy line. This period even saw Adidas momentarily surpass Nike’s Jordan Brand in U.S. sneaker sales – a shocking development that signalled Adidas was learning to “think American” in style and marketing.

Nike responded by doubling down on product innovation and direct-to-consumer efforts (expanding its own retail stores and online sales). By late 2010s, Nike retained roughly mid-30s% of U.S. athletic footwear market vs Adidas’s low-teens%, but the gap had narrowed from earlier decades. The U.S. remains a key battleground where Nike’s brand is engrained (just ask any NBA fan or high-school sneakerhead), yet Adidas continues to invest heavily – signing young stars (like an NFL quarterback Patrick Mahomes and NBA’s James Harden) and rolling out American-focused marketing (such as collaborations with US college sports and streetwear influencers).

The latest twist (2023–2024) shows Adidas gaining some U.S. ground again while Nike faced headwinds with inventory and sales dips. The North American market, therefore, is a see-saw fight, but Nike’s home advantage still gives it the edge – as evidenced by Nike’s often greater cultural visibility, from Super Bowl ads to being the default gear for many American kids.

Europe

In the European theater, Adidas has the home-field advantage and a rich legacy, especially in football (soccer) and running. Throughout the 1970s and 1980s, Adidas leveraged its deep connections to European football clubs and tournaments to stay number one in its region, while Nike was largely seen as an outsider.

Nike’s big break in Europe came in the 1990s when it aggressively went after football: signing the Brazilian national team in 1996, then star players (like Ronaldo, the Brazilian phenomenon, and later Cristiano Ronaldo for Portugal) and elite clubs (starting with a deal for F.C. Barcelona in the late ‘90s). Nike’s flashy football commercials (like the 1998 airport ad with the Brazil team, or the 2002 Secret Tournament cage match) were essentially global marketing but resonated strongly with European youth.

Over time, Nike gained significant share in Europe, particularly in the UK and Southern Europe, though Adidas still held sway in Germany and much of central Europe. In more recent years, the two are neck and neck in many European markets.

Adidas’s strength is its ingrained football partnerships – for instance, being the official sponsor/provider for the UEFA Euro tournaments and many top clubs ensures Adidas is highly visible to European sports fans. Nike counters this by its dominance in global stars (e.g., in 2021, of the top 10 highest-paid footballers, a majority wore Nike boots) and by pushing into sports that Europeans follow beyond football (Nike is huge in global basketball fandom via the NBA’s popularity, and in running/fitness communities).

Additionally, Adidas has used style as a differentiator in Europe: its Adidas Originals stores in cities like London, Paris, Berlin attract fashion-conscious consumers, whereas Nike’s flagship stores emphasize tech and experience (e.g., Nike Town London is a temple to innovation). Both brands approach Europe not as one market but a mosaic: customizing campaigns by country (you’ll see different football stars in Nike’s ads in France vs. England, for example) and aligning with local cultural moments (Adidas might sponsor local music festivals or youth events, Nike might host running challenges and sneaker launches in trendy neighborhoods).

The result is a competitive stalemate of sorts – Nike often claims a slightly larger share of the overall Western Europe athletic market, but Adidas is not far behind and in some countries remains #1. Europe is perhaps the region where the brand loyalty is split: you’ll find ardent Adidas loyalists who wear three-stripes head-to-toe, and equally ardent Nike fans – a testament to how both marketing approaches have carved out distinct fanbases.

Asia (especially China)

Over the last two decades, Asia – and China in particular – has been the growth engine every sports brand covets. Nike moved early in China, entering the market in the early 1980s and steadily building a presence, including sponsoring the Chinese national basketball team and opening Nike stores as status symbols for the rising middle class.

Adidas also made China a priority, especially around the 2008 Beijing Olympics where Adidas was a major sponsor. For much of the 2010s, Nike held a lead in Chinese market share, capitalising on its strong global brand and popular basketball line (Chinese consumers have been huge fans of Air Jordan and Nike Basketball shoes).

Adidas, however, often grew faster in percentage terms by focusing on fashion-sports fusion that Chinese youth found trendy – for instance, Adidas’s Stan Smith and Superstar had a massive fashion moment in China around 2015, and the Yeezy craze was international, including Chinese hype-beasts.

Both brands face stiff competition from domestic Chinese brands (Li-Ning, Anta, etc.), which have national pride on their side. In response, Nike and Adidas have tailored some products to local tastes (Adidas launched shoes with Chinese New Year themes; Nike has done city-specific releases).

In recent years, political and social factors have also played a role: both Nike and Adidas experienced a consumer backlash in China in 2021 due to statements about sourcing (Xinjiang cotton concerns), which showed the volatility of depending on China. As of 2024, growth in China has been uncertain – Nike saw sales slowdowns and is “struggling” by its standards in that region, while Adidas under new CEO Bjørn Gulden expressed renewed focus on China to regain momentum. Beyond China, other Asian markets like Japan and South Korea have long been sneaker-fashion hotbeds: Nike’s historical edge in those (thanks to things like Michael Jordan’s global appeal and Nike’s savvy distribution) was challenged by Adidas during the Boost/Yeezy wave, but Nike still often holds the cultural cachet (for example, limited Nike Dunks or Jordans are huge in Japan).

Southeast Asia and India

Southeast Asia and India are newer arenas – both brands are expanding retail and e-commerce aggressively in countries like India, Indonesia, and Vietnam, often using cricket or badminton for Adidas in India, and basketball or running for Nike, to connect with local sports culture. In summary, Asia is where the next billion consumers lie, and Nike vs Adidas in this region is a high-stakes game of who can localise global brand appeal more effectively. So far, Nike’s global prestige gives it a slight edge, but Adidas’s tactical partnerships (like sponsoring e-sports teams or K-pop stars) are ways it’s fighting back.

Emerging Markets (Latin America, Africa)

In Latin America, Adidas historically had strength due to football (being the kit maker for teams like Argentina and Mexico), but Nike made huge inroads by sponsoring the Brazilian national team (a deal that began in the 90s and continues) and star Brazilian players. Brazil, as a cultural hub of football, was a springboard for Nike across South America. Today, Nike is extremely popular in Brazil, Mexico, etc., often seen as a aspirational brand. Adidas maintains a strong presence especially around World Cup cycles and through its ownership of brands like Reebok (which had popularity in some Latin markets for fitness). In Africa, both brands are working to grow in markets like South Africa and Nigeria. Nike, for example, sponsors the Nigerian football team and has released Nigeria’s national jersey that became a global fashion hit in 2018. Adidas has sponsored the South African national team and some African athletes. Both are also investing in grassroots programs (Nike has done youth sports initiatives in Africa, Adidas has done shoe donation drives and local creator hubs) as a way to build brand loyalty in developing economies. While these regions contribute less to the bottom line than the big three (US, EU, China), they are strategic for long-term growth and also for brand image – being seen as truly global and inclusive.

The global market penetration can also be seen in the companies’ numbers. Nike, being larger, has a more balanced geographic split (about 40% North America, 25% Europe/Middle East/Africa, 15% China, 20% rest of Asia/LatAm in recent years), whereas Adidas derives a bigger chunk from Europe and has been trying to raise its U.S. share. Both have poured resources into flagship stores in world cities (New York, London, Tokyo, Shanghai, etc.) that act as marketing showrooms for their global brand image. Each opening or campaign in any region is quickly broadcast worldwide via social media, meaning a local win can become a global halo.

In sum, Nike and Adidas have globalised aggressively, but each has had to learn the other’s home game: Nike had to play football (soccer) to win globally, Adidas had to embrace celebrity and style to win in America. The result is a truly worldwide rivalry in which no market is left uncontested.

Financial Face-Off: Revenue, Spend and Product Breakdowns

When it comes to business metrics, Nike has generally towered over Adidas – yet both are massive public companies with billions in revenue and ambitious growth targets. A financial comparison reveals how far Nike has pulled ahead and how each allocates resources like marketing spend to battle for every consumer’s attention.

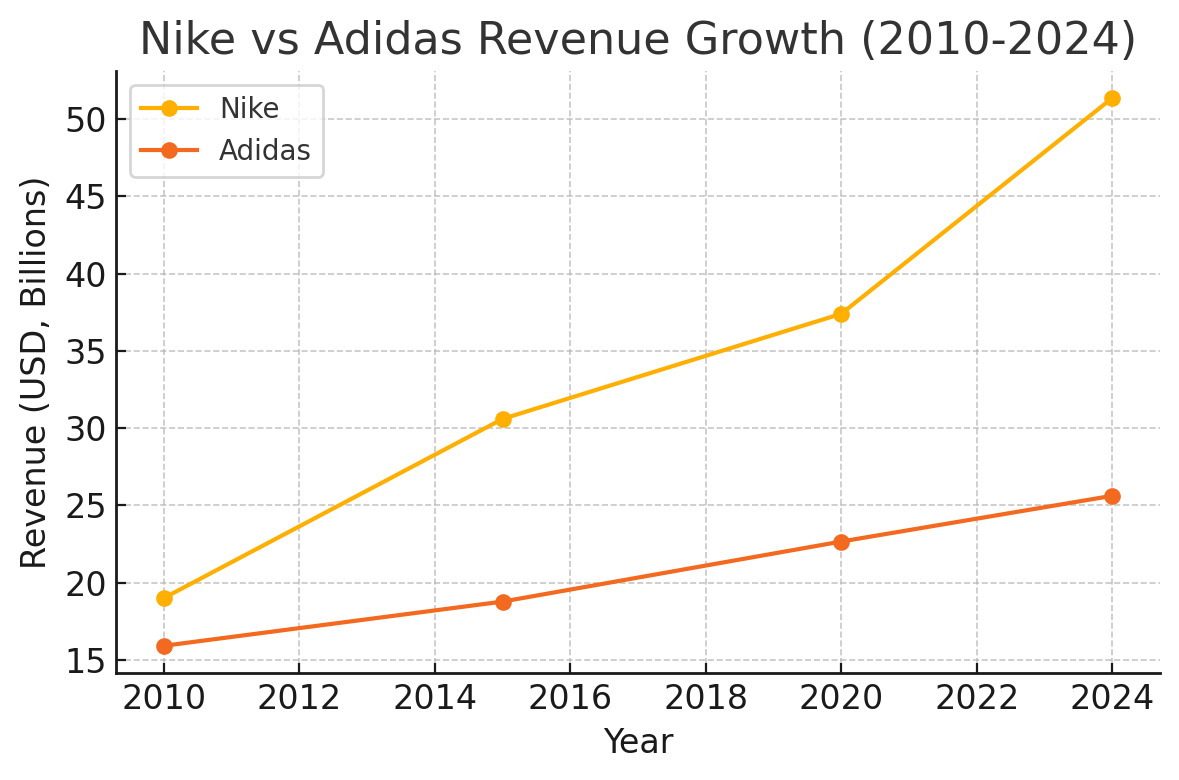

In pure revenue terms, Nike is nearly double the size of Adidas as of mid-2020s. Nike’s global revenue hit $51.2 billion in 2023 (and $51.36B in 2024), whereas Adidas’s revenue was about $23.7 billion in 2022, dipping to $23.1B in 2023 before rebounding to $25.6B in 2024. To put it in perspective: Nike alone now generates more sales than Adidas, Puma, and Reebok combined. The growth trajectories over time also differ. Nike has enjoyed steady growth over the last decade, roughly doubling its revenue from 2010 to 2020 and recovering quickly from any downturns. Adidas had strong growth spurts (for example, mid-2010s saw a surge) but also some flat or down years, and a notable hit in 2020 (pandemic year) followed by only modest recovery by 2023. The chart below illustrates the revenue growth of both giants over 2010–2024, highlighting Nike’s widening lead:

Nike vs Adidas Revenue Growth (2010–2024). Nike (orange) has seen a steeper rise, topping $50 billion by 2024, while Adidas (red) grew more modestly to around $25 billion. This gap underscores Nike’s financial dominance in recent years.

One reason for Nike’s greater scale is its dominance in the footwear category, which is the most lucrative segment of the sporting goods market. In 2022, Nike sold about $29.1B worth of footwear (about 62% of its total sales) whereas Adidas sold $13B in footwear (55% of its sales).

Nike’s footwear revenue alone is larger than Adidas’s entire business. Adidas does have a relatively larger share of apparel in its mix (around 38% of Adidas’s sales vs ~26-30% for Nike, with the remainder in equipment/accessories), but apparel generally has lower profit margins than shoes. Both companies understand the importance of the sneaker business to their bottom line – it’s where brand loyalty is strongest and pricing power highest. In 2022, Nike’s Jordan Brand by itself pulled in several billions (Nike doesn’t break it out officially, but it’s estimated over $5B), which shows how one sub-brand can rival a mid-sized company.

Adidas’s closest equivalent, the Yeezy sneaker line, was doing perhaps $1–2B annually at its peak before the partnership with Ye (Kanye West) was terminated in late 2022. The loss of Yeezy hit Adidas’s 2023 sales and profits hard (contributing to a small net loss in 2023), whereas Nike has so far avoided such singular dependency on one collaboration.

Profitability also differs: Nike has consistently higher net income. In 2024, Nike’s net profit was $5.7B, whereas Adidas’s 2024 net was about $0.83B (after a loss in 2023 due to one-time issues). This means Nike can outspend Adidas in areas like R&D, endorsements, and crucially, marketing. Indeed, Nike’s marketing budget (often termed “demand creation expense”) regularly exceeds the total revenue of some competitors!

A key figure for marketers: in 2022 Nike spent approximately $3.9 billion on marketing (including advertising and sponsorships) while Adidas spent about $2.9 billion, according to industry analysis. In absolute terms Nike outspends Adidas, but as a percentage of revenue Adidas actually invests more aggressively – about 12% of sales vs Nike’s 8%.

This reflects Adidas’s push to gain share (needing heavier marketing firepower per dollar of sales) and Nike’s larger base allowing more efficiency. Combined, the two companies pour billions into athlete endorsements, leagues partnerships, commercials, digital campaigns and more.

For example, Nike’s endorsement deals range from paying top NBA players tens of millions per year to a reported billion-dollar lifetime deal with Cristiano Ronaldo. Adidas likewise spends lavishly on deals like its long-term contracts with Real Madrid (kit sponsorship) and with Lionel Messi. Marketing spend is truly the arms race of this rivalry – one where Nike’s bigger war chest gives it an advantage, but Adidas has managed to punch above its weight by smartly targeting its investments (and sometimes riding on Nike’s cultural waves with savvy timing, as in the ambush examples discussed earlier).

From a product category standpoint, a comparative breakdown in 2022 shows how each brand allocates its business:

-

Footwear: Nike ~$29.1B (62% of revenue) vs Adidas ~$13.0B (55%). Nike dominates here, especially in North America where Nike’s sneaker sales ($12.2B in NA in 2022) alone nearly equal Adidas’s global footwear number.

-

Apparel: Nike ~$13.6B (about 26-30%) vs Adidas ~$9.1B (39%). Closer gap here; Adidas’s apparel business (which includes everything from jerseys to fashion collabs) is a larger portion of its total mix, reflecting its strong presence in sports teamwear and lifestyle clothing. Nike’s apparel includes its big NBA and NFL jersey business and lots of training wear, but footwear still overshadows it.

-

Equipment & Other: The rest would be things like sports equipment (balls, bags, etc.) and accessories. For Nike this is relatively small (perhaps ~8-10% of revenue), for Adidas as well (maybe ~6%). Adidas, for instance, sells the official World Cup soccer balls – a high-profile product but not a huge revenue driver.

What about market share in the global sportswear market?

As of the mid-2020s, Nike is still the clear #1 globally, but Adidas is #2 and trying to close the gap. Recent data shows Nike’s global sportswear market share fell slightly from 15.2% in 2023 to 14.1% in 2024, while Adidas’s share rose from 8.2% to 8.9%. This shift, albeit small, indicates Adidas gaining ground as Nike hit some headwinds. A chart from Reuters (2024) highlights this change and also notes challengers like Puma, New Balance, and emerging brands (On Running, HOKA) nibbling at the big two’s heels. Nike remains roughly 1.5x to 2x the market share of Adidas, but the convergence is something to watch, especially if Adidas’s momentum under new leadership continues and if Nike doesn’t quickly re-accelerate growth.

It’s also insightful to consider where that revenue comes from: Nike’s largest segment is its Nike brand wholesale business, but it has been shifting to more direct-to-consumer (D2C) sales (through Nike stores and nike.com) which now make up over 40% of its revenue. Adidas likewise has increased its D2C but is a bit more wholesale-heavy than Nike. Nike also has subsidiaries contributing to revenue, like Converse (acquired in 2003) and the Jordan Brand (which is internally a division but often marketed separately). Adidas had Reebok as a subsidiary until 2022, when it sold Reebok off to focus on the core brand. The divestiture of Reebok (which had about $1.5B in yearly sales) slightly shrank Adidas’s total revenue but improved its profit margins and allowed reinvestment in Adidas brand marketing.

Financially, you could say Nike plays offence – using its financial might to keep pushing into new areas (investing in tech startups, apps, and even NFTs/virtual products to create new revenue streams), whereas Adidas often plays defence – trying to optimise what it has (cutting costs when needed, focusing on core competencies like footwear and key markets). However, with the ups and downs of trends (like the Yeezy boom and bust for Adidas, or Nike’s recent inventory glut), both companies have learned to adapt quickly. After all, in the stock market and in sales, neither can afford to take the foot off the gas because shareholders and analysts are closely watching this rivalry too.

To sum up the financial face-off: Nike leads in scale and profitability, giving it more resources to fuel the rivalry, but Adidas has shown it can narrow the gap with the right hits (product or campaign) and has demonstrated resilience. For marketers, it’s a classic case study of how brand strength translates into pricing power and financial performance – Nike’s brand allows it to sell more, at higher prices, with better margins. But it’s also a reminder that challengers can find opportunities (Adidas’s resurgence proved Nike can’t become complacent). In the next section, we’ll explore some specific moments where one brand outfoxed the other, often with significant financial repercussions.

Notable Moments of One-Upmanship in Marketing

Over their long rivalry, Nike and Adidas have each had shining moments of marketing genius – and sometimes at the expense of the other. These are the tales brand managers and marketing textbooks love, where clever strategy or bold moves allowed one brand to significantly outmaneuver its competitor.

-

The Air Jordan Coup (1984): As already mentioned, perhaps the most consequential outmaneuver in sports marketing history was Nike’s signing of Michael Jordan. In the mid-1980s, Jordan was a rookie with immense promise. Adidas actually was his preferred brand (he wore Converse/Adidas in college), but in a fateful decision, Adidas reportedly passed on the chance to sign Jordan, partly because they didn’t prioritise basketball at the time and doubted a rookie could move product. Nike, hungry to make a dent in basketball, offered Jordan an unprecedented endorsement deal and his own signature shoe line. The result – the Air Jordan – launched in 1985 and exploded in popularity (helped by Nike’s savvy ads and the NBA’s “ban” of Jordan’s shoes which Nike spun into publicity). By the time Adidas realised its mistake, Nike had changed the landscape: Jordan became a global icon, and Nike became the dominant player in basketball footwear, a position it has never relinquished. This early triumph in branding (Nike built a personality-driven sub-brand around an athlete – something revolutionary then) left Adidas playing catch-up for years in the basketball category.

-

Olympic Ambush (1996 & 2012): Adidas has often been an official Olympic sponsor, which gives branding rights and on-site presence – but Nike has a history of ambushing those moments with memorable campaigns. In the 1996 Atlanta Olympics, Reebok was the official sponsor, yet Nike famously set up a “Nike Centre” nearby and many U.S. athletes (notably Michael Johnson with his golden Nike shoes) stole the limelight. By 2012, in London, it was Adidas who was the official partner, spending over £100 million for the privilege. Nike, not a sponsor, executed its “Find Your Greatness” campaign at the same time, showcasing everyday athletes in places named London around the world. The campaign was a masterclass in guerrilla marketing – viewers felt Nike’s inspirational message associated with the Olympics spirit, even though Nike never used the word Olympics or the rings. Meanwhile Adidas, despite its official status and a massive “Take the Stage” campaign, struggled to match Nike’s buzz. Studies later showed Nike achieved higher brand mention and engagement during London 2012 than Adidas. In marketing lore, this is cited as proof that creative storytelling can beat a sponsorship fee – Nike essentially hijacked Olympic glory without paying for it, leaving Adidas a bit short-changed on its big investment.

-

“Write the Future” vs. “Star Wars Cantina” (2010 World Cup): Another classic was the 2010 FIFA World Cup. Adidas, as official sponsor, had rights to the tournament and launched a flashy ad featuring celebrities in a Star Wars cantina scene, trying to fuse pop culture with football. But Nike dropped its epic “Write the Future” ad just before the World Cup. The result? Nike generated twice the online buzz of Adidas during the tournament, even though Adidas was the one on the game jerseys and match balls. Nike’s ad dominated social media and conversations, leaving Adidas’s official ads in the dust at least until later in the tournament. It was a repeat of a pattern: Nike proving that you can win eyeballs and mindshare with creativity and timing, rather than official logos. Adidas has since been more cautious to pre-empt Nike’s ambush (in later World Cups Adidas focused more on real-time marketing and leveraging its official access), but 2010 remains a high-water mark for Nike’s ambush marketing prowess.

-

Adidas’s Lifestyle Renaissance (2015–2017): Let’s turn the tables – there was a moment when Adidas outmaneuvered Nike, surprising many. Mid-2010s saw a trend shift: the rise of athleisure and casual sneakers as everyday wear. Adidas identified this wave and rode it expertly, bringing back classics and introducing new collabs. The signings of Kanye West (in 2013, product rolling out in 2015) and the debut of Yeezy Boost sneakers gave Adidas a cultural cachet Nike lacked at that moment (Nike had parted ways with Kanye, who felt stifled there). The Yeezy line created unprecedented hype for Adidas – shoes sold out instantly, resale markets boomed, and crucially, it attracted a segment of style-conscious consumers who weren’t being wowed by Nike’s then-lineup. Concurrently, Adidas had the ultra-comfy Ultra Boost and a retro revival of Stan Smiths, which together made the three stripes highly fashionable. In the U.S., Adidas suddenly was cool again, showing up on celebs and influencers everywhere. Nike, by contrast, had a relative lull around 2016 in terms of “wow” products (it was a bit between cycles on key sneaker lines and was more focused on performance runners like the Vaporfly, which didn’t yet capture the lifestyle crowd). The payoff for Adidas: by 2017, its U.S. sneaker market share jumped and it “jumped over Jumpman”, meaning Adidas Brand eclipsed Nike’s Jordan brand in U.S. sales for a period. This was an unthinkable scenario a few years prior. Adidas effectively outflanked Nike by exploiting the nexus of music, fashion, and sneaker culturewhile Nike was still relying on purely athletic storytelling. Eventually, Nike responded – for instance, collaborating with Virgil Abloh on the “Off-White x Nike” collection in late 2017 which reignited Nike’s cool factor among hypebeasts, and accelerating its direct-to-consumer hype releases. The Adidas hot streak cooled somewhat by 2018-2019, but that moment taught Nike a lesson: don’t underestimate the challenger. Adidas had scored a marketing and product positioning win, reminding everyone that Nike doesn’t have a monopoly on cool.

-

Sponsorship Swaps: Over the years, the two have traded major sponsorships like heavyweights exchanging blows. One notable moment was when Nike took over the NBA uniform deal from Adidas in 2017. Adidas had been the NBA’s official apparel provider for a decade (after inheriting it via Reebok), but chose not to renew, partly due to a strategic shift away from U.S. pro sports. Nike swooped in with a reported $1 billion deal for 8 years, not only getting the uniforms but also the rights to put the Nike logo on them – something that appears on TV broadcasts globally. This was a symbolic win for Nike (basketball is its turf and now every NBA player wears a Nike-branded jersey, even those signed with Adidas for shoes). On the flip side, Adidas has nabbed deals that Nike once had – for example, Adidas became the uniform supplier for the NHL (hockey) in 2017, taking over from Reebok/Nike, and it also replaced Nike as the kit maker for many national soccer teams over time (Nike had the French team in early 2010s, now Adidas will have it from 2023 onwards, etc.). Each such swap is usually accompanied by marketing fanfare, new designs, and an opportunity to upsell fans on replica gear. The brand that secures the deal often sees a boost in retail sales and brand visibility, while the one that loses it must compensate elsewhere. For instance, when Nike lost the Manchester United kit contract to Adidas in 2015 (Adidas signed a then-record deal), Nike doubled down on other clubs and its focus with players. These one-upmanship moments in sponsorships are like the chess moves of sports marketing – sometimes defensive, sometimes offensive, but always expensive!

-

Purpose-Driven Marketing Wins: In the 2020s, being culturally relevant and aligned with consumer values is crucial. Nike scored a major victory here in 2018 with the Colin Kaepernick “Believe in something” ad (part of the Just Do It 30th anniversary). Initially controversial (some Nike critics burned shoes in protest), the campaign ultimately deepened loyalty among young, diverse consumers and won Nike an Emmy award for Outstanding Commercial. Adidas, while supportive of various social causes, didn’t have an equivalent moment of grabbing the global conversation on a values issue. Nike’s boldness in taking a stand (however calculated it was) set it apart and garnered both kudos and attention that money can’t easily buy. In a sense, Nike outmaneuvered not just Adidas but most of corporate America in authentic brand activism. Adidas has since been more vocal about inclusivity and sustainability (it ran campaigns about ending plastic waste, and about celebrating LGBTQ athletes, for example), but the impact wasn’t as dramatic as Nike’s 2018 moment.

-

Digital and Tech Race: A newer arena of outmaneuvering is digital innovation. Nike took an early lead with the Nike+ platform back in 2006 (in partnership with Apple, hooking iPod Nanos to shoes to track runs) and later the Nike Running App and Training Club app, which amassed huge user bases. Adidas eventually responded with its Runtastic acquisition and launching similar apps, but Nike’s head start gave it a larger fitness community for years. More recently, Nike made a splash in the metaverse by acquiring RTFKT Studios (to produce NFT sneakers and virtual goods) and dropping digital collectibles tied to its brand, putting it ahead in the Web3 hype (for whatever that ends up being worth). Adidas did collaborate with some NFT projects and launched its own Into the Metaverse NFTs, but Nike’s moves were seen as more aggressive and future-forward. While these aren’t marketing campaignsper se, they are strategic marketing plays – aimed at securing the brand’s relevance with next-gen consumers. If Nike successfully builds a cool factor in virtual worlds, that’s a step ahead of Adidas. Conversely, Adidas has been outmaneuvering Nike in sustainability marketing, as mentioned – with credible products like Parley ocean plastic shoes and fully recyclable Futurecraft Loop shoes giving it a slight image edge among eco-conscious consumers. Nike is working on sustainability too (like its Move to Zero initiative, using recycled materials), but Adidas was earlier to loudly market it. It’s a quieter duel, but one that could matter more as environmental issues take center stage.

These episodes of one-upmanship show that the Nike vs Adidas battle is far from static. Each company has tasted both triumph and defeat at the hands of the other’s marketing moves. Significantly, these moments often have a lasting impact: Nike’s Jordan coup created a legacy that still pays dividends; Adidas’s Yeezy gamble shifted sneaker trends for years; Nike’s ambushes forced event sponsors to rewrite marketing playbooks worldwide. For marketing professionals, the takeaway is that in a competitive marketplace, you must constantly watch your rival and be ready to capitalize on opportunities or gaps. Nike and Adidas have effectively been pushing each other to get more creative – a rivalry that, in the end, made both stronger and gave consumers some legendary marketing to enjoy.

Conclusion

The marketing rivalry between Nike and Adidas from their humble origins to the global present day is nothing short of epic. It’s a story of two brands that started on opposite sides of the world – one born from a German cobbler’s workshop, the other from an American runner’s entrepreneurial dream – and converged on the same playing field, each determined to outrun the other. Over the decades, they have reshaped sports marketing: turning athletes into icons, slogans into social mantras, and sneakers into cultural symbols. They’ve competed not just on products and endorsements, but on ideas – What does it mean to be an athlete? What does a sports brand stand for in society? In doing so, both Nike and Adidas transcended from being mere sellers of shoes and apparel to being architects of aspirational lifestyles.

For marketers, the duel offers rich lessons. Nike showed the power of a single, unified global brand voice (“Just Do It” and the spirit behind it) and the payoff of bold risks in messaging. Adidas demonstrated how embracing your roots and then reinventing them (sport heritage mixed with contemporary creativity) can build a brand that is both authentic and cool. Nike taught us about the importance of storytelling and emotional connection; Adidas taught us about cultural relevance and timing. Both underscored that in marketing, consistency matters – but so does the agility to pivot when the consumer zeitgeist shifts.

As of today, Nike sits atop in market share and financial muscle, but Adidas is alive and kicking, as innovative as ever, ensuring Nike cannot rest easy. Their rivalry has recently expanded to new arenas – from sustainable product innovation to digital communities – suggesting the next chapters will be just as fascinating. Perhaps the greatest testament to their marketing prowess is that millions of people around the globe feel a personal loyalty to either “Team Swoosh” or “Team Three Stripes,” often for reasons that go beyond rational product attributes to emotional attachment. That is the holy grail of brand strategy.

In a witty twist of fate, each company might even credit the other for keeping it sharp. As the old sports adage goes, a true champion needs a worthy rival. Nike and Adidas have been exactly that for each other – and the scoreboard of public opinion and sales will keep reflecting their latest moves. For now, Nike may be winning on the balance sheet, and Adidas scoring points in certain culture corners, but the game is never truly over. With every World Cup, every Olympics, every viral sneaker drop, the race begins anew. And as marketers and enthusiasts, we’ll be watching, analyzing – and perhaps wearing our preferred sneakers – every step of the way.