Key Financial Terms

The Primary Financial Terms Every Marketer Needs To Understand

As marketers, we often find ourselves caught up in the excitement of crafting campaigns, analysing engagement metrics, and perfecting brand messaging. But understanding the financial landscape is just as crucial. A solid grasp of key financial terms not only helps you communicate effectively with other departments but also ensures your campaigns are aligned with broader business objectives.

Here are the key financial terms every marketer should understand:

The Marketing Made Clear Podcast

This article features content from the Marketing Made Clear Podcast – check it out on all good platforms.

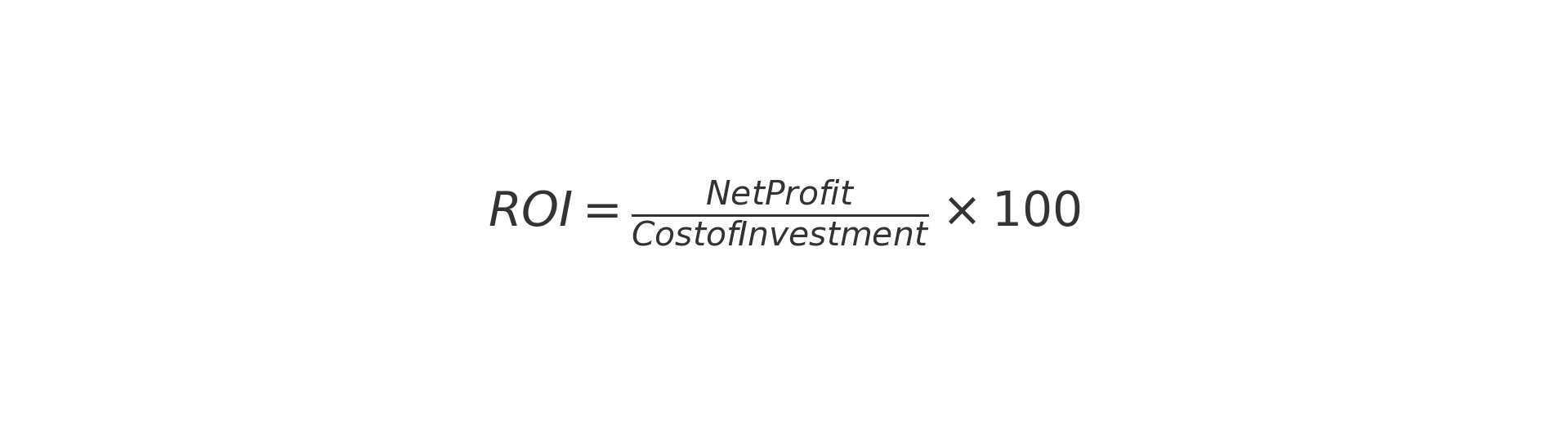

1. Return on Investment (ROI)

ROI is perhaps the most critical metric for marketers. It measures the profitability of a campaign by comparing the revenue generated to the cost of running the campaign.

For example, if you spend £10,000 on a campaign and it generates £20,000 in revenue, your ROI is 100%. Understanding ROI helps you identify which campaigns are worth repeating and which need improvement.

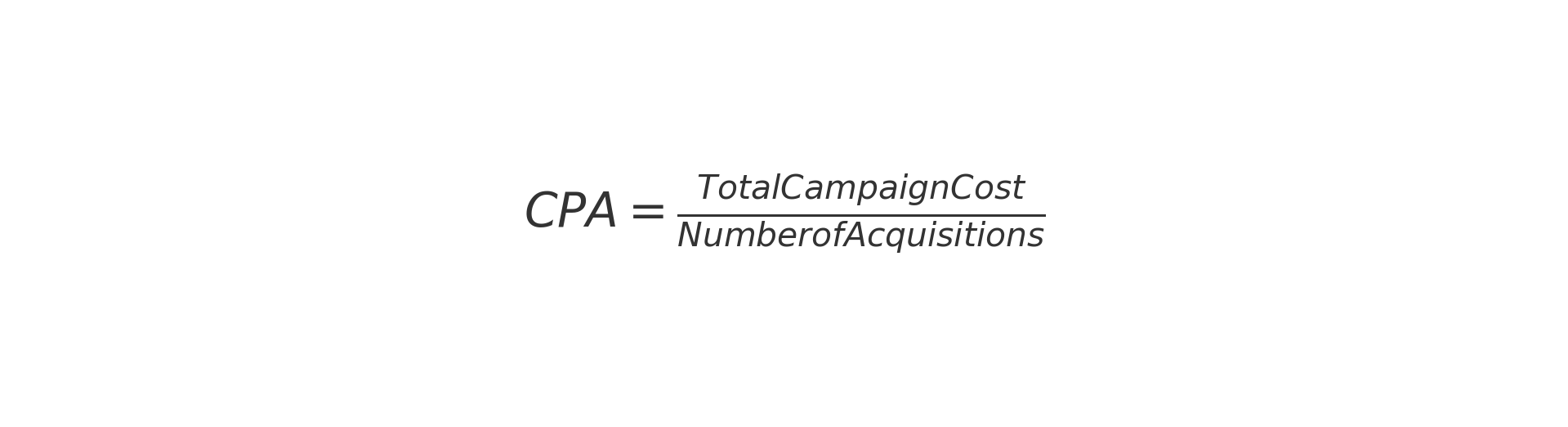

2. Cost Per Acquisition (CPA/CAC)

CPA or Customer Acquisition Cost (CAC) measures how much it costs to acquire a single customer through a specific campaign.

For example, if a Facebook ad campaign costs £5,000 and brings in 500 new customers, your CAC/CPA is £10. This metric is essential for understanding the efficiency of your campaigns.

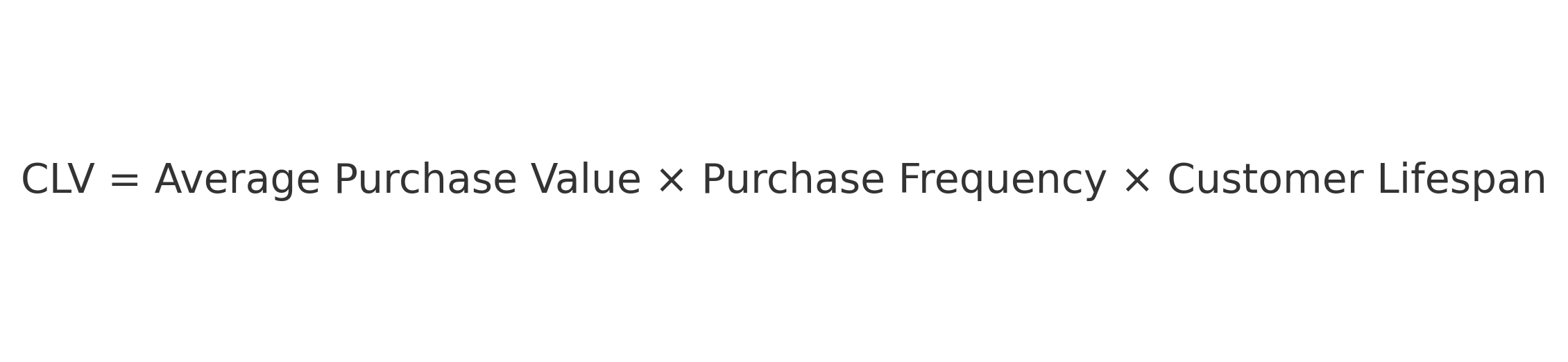

3. Customer Lifetime Value (CLV)

CLV estimates the total revenue a business can expect from a single customer over the duration of their relationship with the company.

If a customer spends £50 per transaction, makes 5 purchases per year, and remains loyal for 3 years, their CLV is £750. Knowing CLV helps marketers justify investments in customer retention strategies.

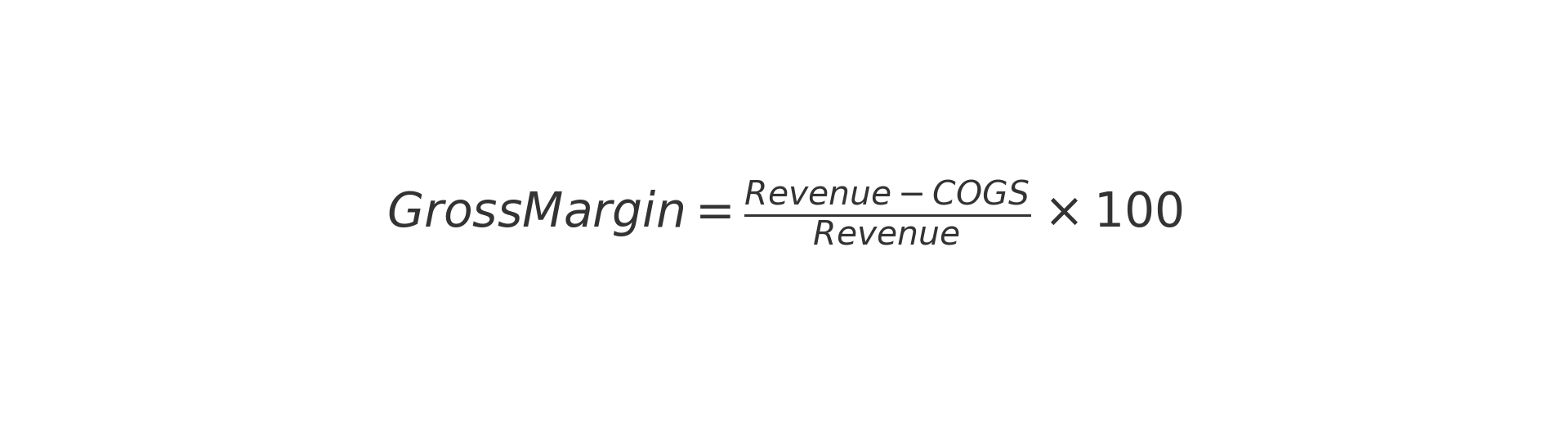

4. Gross Margin

Gross margin represents the percentage of revenue left after deducting the cost of goods sold (COGS).

For example, if your revenue is £100,000 and your COGS is £40,000, your gross margin is 60%. Understanding gross margin helps marketers focus on campaigns that drive the most profitable sales.

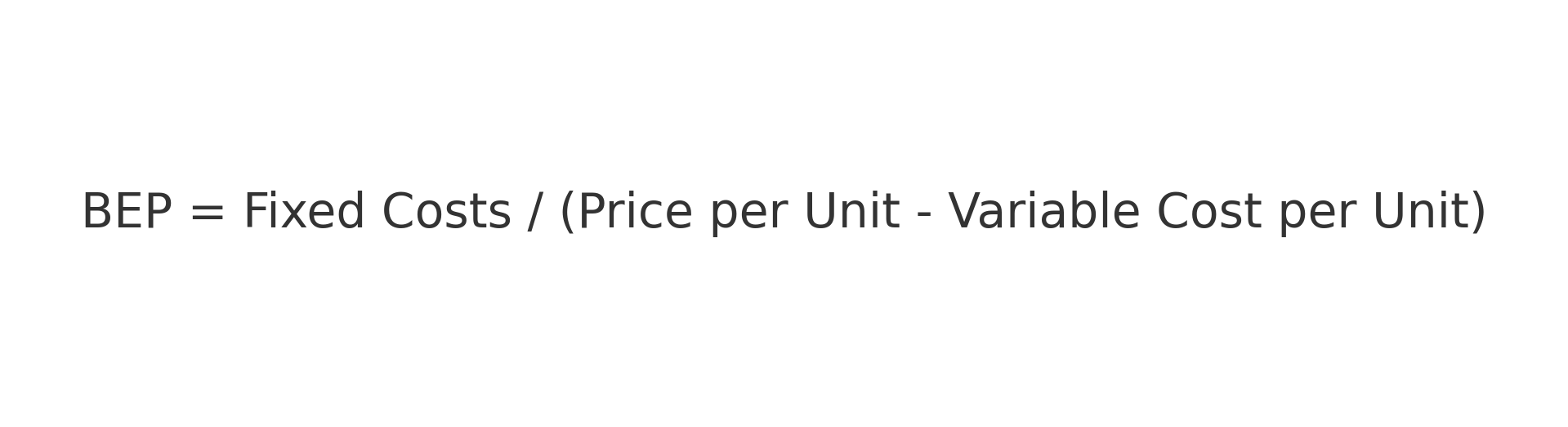

5. Break-Even Point (BEP)

The break-even point is the point at which total revenue equals total costs, meaning the business is neither making a profit nor a loss. For marketers, it’s crucial to know how many units need to be sold to cover campaign costs.

This helps in setting realistic sales goals and pricing strategies for campaigns.

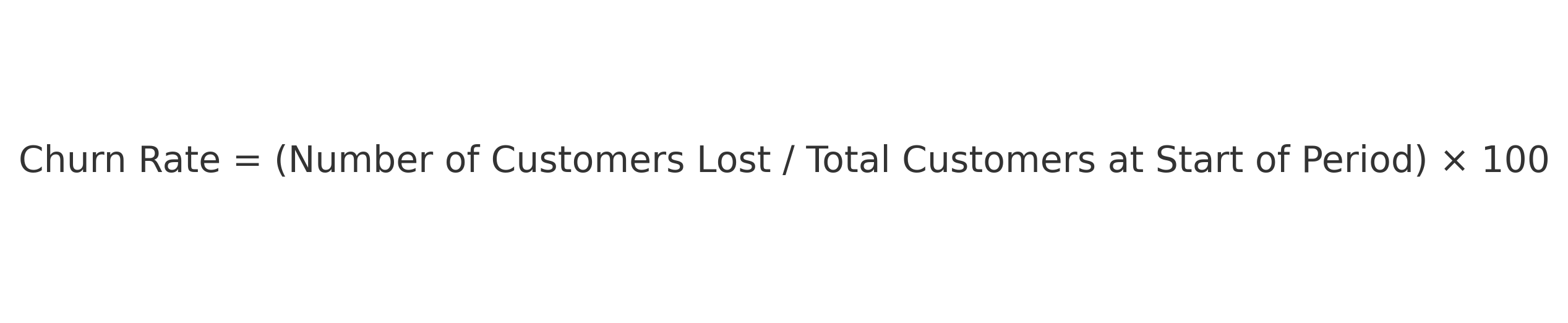

6. Churn Rate

Churn rate measures the percentage of customers who stop doing business with a company over a specific period.

If you start the month with 1,000 customers and lose 50, your churn rate is 5%. High churn rates can indicate dissatisfaction and may require targeted retention campaigns.

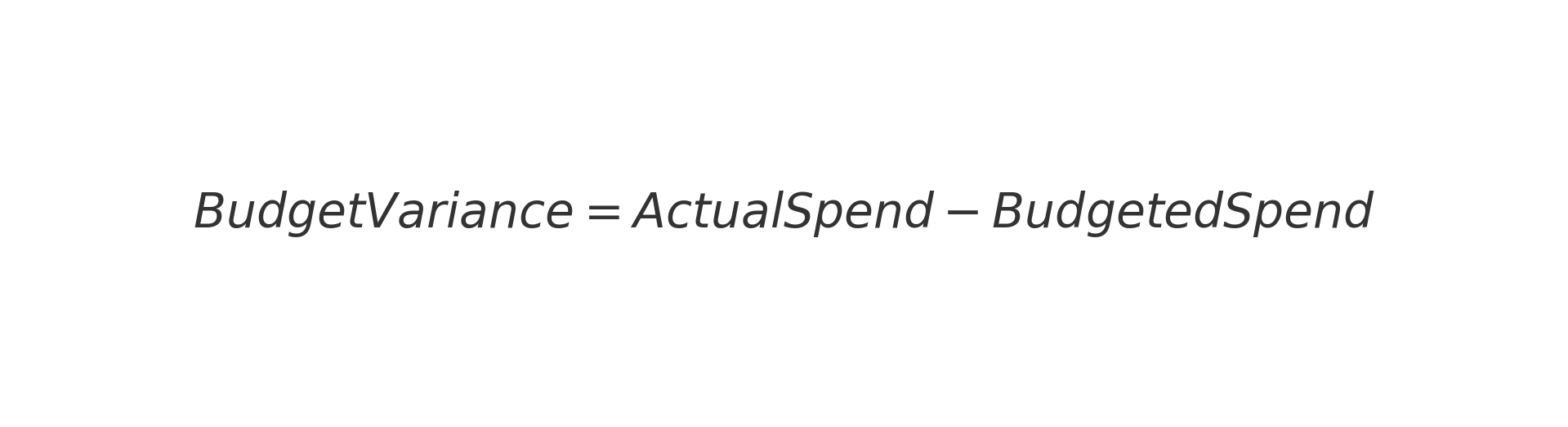

7. Budget Variance

Budget variance is the difference between the budgeted amount and the actual amount spent.

For marketers, monitoring budget variance ensures campaigns stay on track financially and helps avoid overspending.

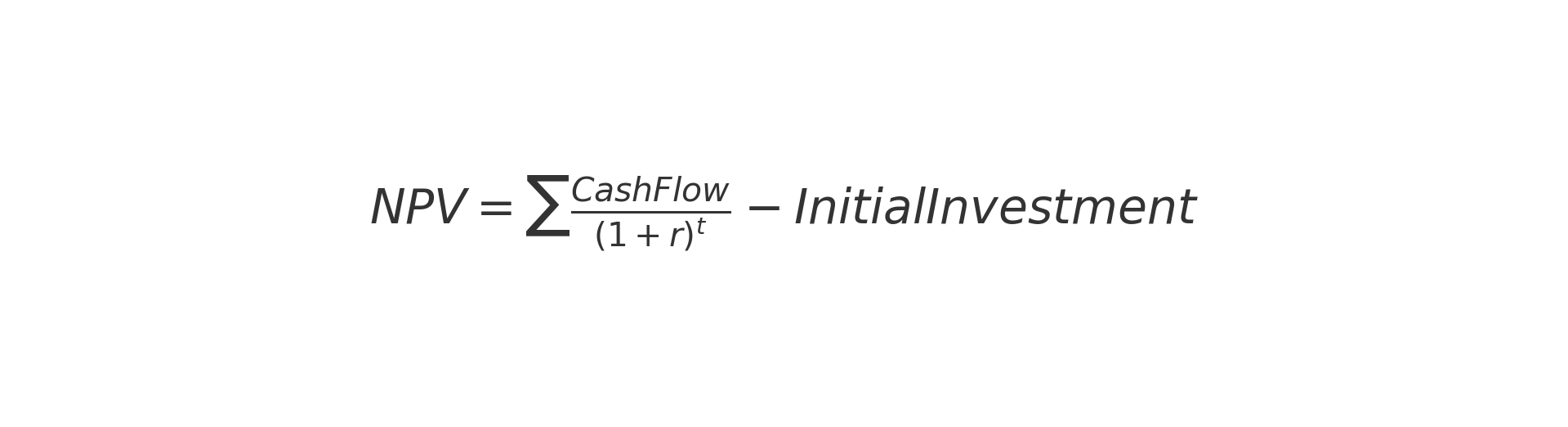

8. Net Present Value (NPV)

NPV calculates the value of future cash flows generated by an investment, discounted to the present value. While it’s more common in finance, understanding NPV can help marketers assess long-term projects like brand building or product launches.

Where:

r is the discount rate

t is the time period

9. Run Rate

Run rate projects future performance based on current results. For example, if a campaign generates £20,000 in revenue in one month, the annual run rate would be £240,000.

Run rate helps marketers predict whether campaigns are scalable and sustainable in the long term.

10. Working Capital

Working capital represents the funds available to a company for its day-to-day operations.

Marketers need to understand this metric when planning budgets, as limited working capital can restrict campaign possibilities.

Why These Terms Matter

Marketing is no longer just about creativity; it’s about delivering measurable results that drive business growth. By understanding these financial terms, marketers can:

-

Communicate effectively with finance teams.

-

Make data-driven decisions.

-

Align campaigns with broader business objectives.

-

Demonstrate the value of marketing efforts to stakeholders.

As Philip Kotler, the “Father of Modern Marketing,” once said,

“Good companies will meet needs; great companies will create markets.”

By bridging the gap between marketing and finance, you can not only meet needs but drive strategic growth.

Start incorporating these financial insights into your marketing toolkit today, and you’ll stand out as a marketer who truly understands the bigger picture.