Calculating Cost Per Acquisition / Customer Acquisition Cost (CPA/CAC)

A Free Guide and Calculator

Customer Acquisition Cost (CAC) otherwise known as Cost Per Acquisition (CPA) is a fundamental metric that every marketer should understand. It provides a clear picture of how much your business spends to acquire each new customer, helping you assess the efficiency of your marketing and sales efforts. Whether you’re running paid ads, executing content strategies, or managing sales teams, knowing your CAC ensures you can allocate resources effectively and sustainably grow your business.

To make it easy for you to calculate your CAC, we’ve embedded a Free CAC Calculator below. But before diving in, let’s explore what CAC is, why it’s important, and how you can use it to fine-tune your marketing strategies.

What is Customer Acquisition Cost (CAC)?

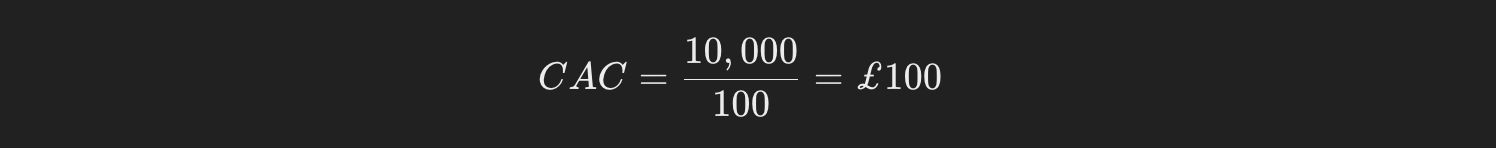

CAC represents the total cost of acquiring a new customer, including all marketing and sales expenses. It’s calculated using the formula:

For example, if you spend £10,000 on marketing and sales in a month and acquire 100 new customers, your CAC is:

This means it costs your business £100 to gain one new customer.

The Free Customer Acquisition Cost (CAC/CPA) Calculator

We hope that our free CAC/CPA Calculator helped you to measure the effectiveness of your marketing campaigns. Simply input your total marketing and sales expenses and the number of new customers acquired to get instant results.

Customer Acquisition Cost (CAC)

CAC: £-

Why is CAC/CPA Important?

- Measure Marketing Efficiency

CAC/CPA helps you evaluate the efficiency of your marketing and sales activities. A lower CAC indicates that you’re acquiring customers cost-effectively. - Set Sustainable Growth Goals

Understanding CAC/CPA allows you to ensure that your acquisition costs are balanced against the revenue generated by each customer. - Optimise Budget Allocation

By tracking CAC/CPA across different campaigns or channels, you can identify the most cost-effective methods of acquiring customers and focus your budget accordingly. - Improve Profit Margins

High CACs can erode profit margins, but by reducing acquisition costs, you can improve the overall profitability of your business.

How to Use CAC/CPA for Decision-Making

CAC is most effective when used alongside other metrics like Customer Lifetime Value (CLV). By comparing CAC with CLV, you can assess the long-term profitability of your customers. For example:

- If CLV > CAC: Your business is likely profitable.

- If CLV < CAC: You may need to revisit your marketing and sales strategies to reduce costs or increase revenue per customer.

We hope that our free CAC Calculator helped you to measure the effectiveness of your marketing campaigns.

Tracking and optimising your CAC regularly can help you improve efficiency, scale your business sustainably, and maximise the return on your marketing investment.