Calculating Your Break-even Point

A Free Guide and Calculator

The break-even point is a critical financial metric for any business. It tells you exactly how much you need to sell to cover your costs, without making a profit or a loss. Once you’ve hit the break-even point, every sale beyond that contributes to your profits. This makes it an essential tool for decision-making in pricing, budgeting, and forecasting.

To make calculating your break-even point simple, we’ve included a Free Break-even Point Calculator below. But before you dive into the numbers, let’s break down what the break-even point is, why it matters, and how you can use it to guide your business strategy.

What is the Break-even Point?

The break-even point is the level of sales at which total revenue equals total costs. In other words, it’s the point at which your business neither makes a profit nor incurs a loss. It’s calculated using the formula:

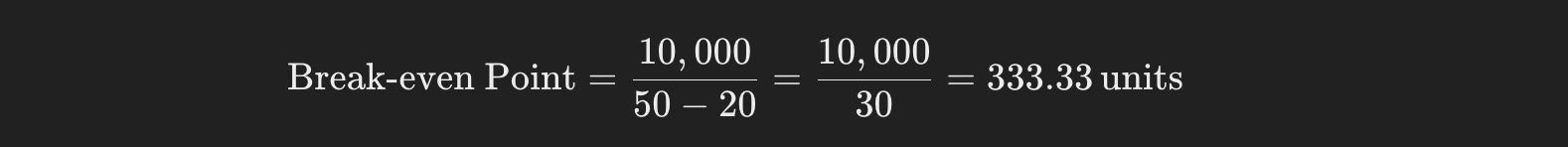

Let’s say your fixed costs (e.g., rent, salaries) are £10,000, your product’s selling price is £50 per unit, and your variable costs (e.g., materials, shipping) are £20 per unit. The break-even point is calculated as:

This means you need to sell 334 units (always round up to the nearest whole unit) to cover all your costs. Every unit sold beyond this point contributes directly to your profit.

The Break Even Point Calculator

We hope that our Free Break-even Point Calculator below to quickly determine the sales volume you need to reach profitability. Simply input your fixed costs, selling price, and variable costs per unit, and the calculator will do the rest.

Break-even Point

Break-even Units: -

Why is the Break-even Point Important?

- Understand Profitability Thresholds

Knowing your break-even point helps you determine when your business will start making a profit, providing clarity on your financial performance. - Set Realistic Sales Targets

It gives you a clear goal for how much you need to sell to ensure your business is viable. - Guide Pricing Decisions

By understanding your break-even point, you can evaluate whether your current pricing strategy is sufficient to cover costs and generate profit. - Plan for Business Growth

Calculating your break-even point helps you identify how changes in costs or pricing affect your profitability, allowing you to plan for scaling up.

How to Use the Break-even Point in Decision-Making

The break-even point isn’t just a static metric; it’s a dynamic tool for evaluating your business strategy. For example:

- Adjusting Pricing: If your break-even point is too high, consider increasing your prices or reducing variable costs.

- Launching New Products: Use the break-even formula to assess the viability of new products or services.

- Forecasting: Factor the break-even point into sales and revenue forecasts to set achievable goals.

We hope that our Free Break-even Point Calculator below to quickly determine the sales volume you need to reach profitability.

By regularly tracking your break-even point, you’ll gain a deeper understanding of your business finances and be better equipped to make informed, profit-driven decisions.