An Introduction to Finance for Marketers

Bridging the Gap Between Creativity and Commercial Success

Finance and marketing are clearly separate disciplines, each with their own objectives, language, and key performance indicators (KPIs). At a very top level; marketers focus on creative storytelling, consumer engagement, and brand-building, while finance professionals concentrate on revenue, costs, profitability, and return on investment (ROI).

In the modern business landscape, marketing and finance are deeply interconnected, and understanding financial principles is essential for any marketer who wants to demonstrate the impact of their work, secure budgets, and drive sustainable growth.

As Warren Buffet says:

“Accounting is the language of business”

So, I hope that this introduction to finance for marketers will cover the fundamental financial concepts, why they matter in marketing, and how financial literacy can enhance a marketer’s ability to make data-driven decisions, and speak the language of business.

The Marketing Made Clear Podcast

This article features content from the Marketing Made Clear Podcast – check it out on all good platforms.

Why Finance Matters for Marketers

Traditionally, marketing has been seen as a cost centre rather than a revenue driver. However, as digital marketing has made performance measurement more precise, businesses increasingly expect marketers to justify their spending in financial terms. Finance matters for marketers because:

- It ensures budget approval and resource allocation – Marketers who understand financial metrics can build stronger business cases for their campaigns.

- It connects marketing efforts to business goals – Aligning marketing with financial performance demonstrates its role in revenue generation.

- It improves decision-making – Knowing financial fundamentals helps marketers evaluate investment choices and prioritise high-ROI activities.

- It enhances credibility within the organisation – Marketers who speak the language of finance can communicate more effectively with senior leadership and finance teams.

By integrating financial thinking into marketing strategies, professionals can not only protect their budgets but also prove the tangible value of their work.

Key Financial Concepts Every Marketer Should Know

1. Revenue, Profit, and Profitability

- Revenue (Turnover): The total income generated by a business before expenses.

- Gross Profit: Revenue minus the direct costs of goods sold (COGS). This shows how efficiently a company produces its products or services.

- Net Profit: The profit remaining after all expenses, including operating costs, interest, and taxes, are deducted. This represents the true profitability of the business.

- Profitability Ratios: Metrics like gross profit margin and net profit margin help marketers understand how much of the revenue is converted into profit.

Understanding profitability helps marketers develop strategies that drive sustainable revenue growth rather than just short-term sales boosts.

2. Return on Investment (ROI)

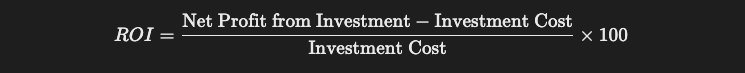

- ROI measures the profitability of an investment relative to its cost. It is calculated as:

Marketers need to prove that their campaigns generate more revenue than they cost. ROI is one of the most critical metrics for justifying marketing spend to finance teams.

See the Return on Investment (ROI) Calculator for more info.

3. Cost Per Acquisition (CPA) or Customer Acquisition Cost (CAC)

- CPA or CAC represents the total cost of acquiring a new customer, including marketing and sales expenses. It is calculated as:

Lowering CAC while maintaining or increasing revenue is key to sustainable growth.

See the Cost Per Acquisition (CPA) or Customer Acquisition Cost (CAC) Calculator for more info.

4. Customer Lifetime Value (CLV or LTV)

- CLV estimates the total revenue a business can expect from a single customer over their entire relationship with the company. The formula is:

Understanding CLV helps marketers shift focus from short-term transactions to long-term customer relationships.

See the Customer Lifetime Value (CLV or LTV) Calculator for more info.

5. Break-even Analysis

- The break-even point is where total revenue equals total costs, meaning the business is neither making a profit nor a loss. It is calculated as:

Knowing the break-even point helps marketers assess pricing strategies and campaign profitability.

6. Marketing Spend Efficiency Metrics

- ROAS (Return on Ad Spend): A specific form of ROI for paid advertising.

- Marketing Efficiency Ratio (MER): Measures overall marketing efficiency by comparing total revenue to total marketing spend.

These metrics help assess the effectiveness of marketing channels and optimise budget allocation.

See the Marketing Spend Efficiency Ratio Calculator for more info.

Financial Statements Marketers Should Understand

1. Profit & Loss Statement (P&L)

- Shows a company’s revenue, costs, and profits over a specific period.

- Helps marketers see how their campaigns impact overall profitability.

2. Balance Sheet

- Provides a snapshot of a company’s financial position, listing assets, liabilities, and equity.

- Useful for understanding financial stability and investment capacity.

3. Cash Flow Statement

- Tracks the movement of cash in and out of the business.

- Important for marketers when planning campaigns that require significant upfront investment.

Bridging the Gap Between Marketing and Finance

For marketing teams to gain financial credibility, they need to align their goals with the overall business objectives. Here’s how marketers can bridge the gap:

1. Use Data to Tell a Financial Story

- Instead of just reporting impressions and engagement, link marketing efforts to revenue and profitability.

- Example: Instead of saying “Our campaign generated 10 million impressions,” say “Our campaign generated 10 million impressions, leading to 50,000 conversions, £500,000 in revenue, and a 5x ROI.”

2. Work Closely with Finance Teams

- Collaborate to ensure marketing budgets are aligned with financial planning.

- Understand financial constraints and align marketing strategies with business growth targets.

3. Shift from Vanity Metrics to Business Impact

- Move beyond clicks and likes to metrics that impact the bottom line, such as CAC, CLV, and ROI.

- Focus on profitability rather than just revenue growth.

4. Apply Financial Thinking to Marketing Decisions

- Before launching a campaign, ask: Will this increase customer lifetime value? Will it improve profitability? How does it affect cash flow?

- Use financial models to predict outcomes before committing large budgets.

Conclusion

For marketers, financial literacy is no longer optional – it’s a necessity. You need to be able to speak the language!

Understanding finance allows marketing professionals to justify their budgets, align their efforts with business goals, and ultimately make more strategic decisions. By integrating financial principles into their work, marketers can move beyond being seen as a cost centre and instead become key drivers of business growth.

Whether you’re presenting a marketing plan to senior leadership, securing investment for a campaign, or simply trying to optimise your budget, finance will always play a critical role. The more marketers understand finance, the more influence they will have in shaping business strategy and proving the value of marketing as a revenue-generating function.