Aldi vs Lidl vs UK Supermarkets

The Disruption of the British Grocery Market

The UK grocery landscape has undergone a seismic shift over the past few decades, largely due to the entry and expansion of German discount retailers Aldi and Lidl. Their unique business models and aggressive growth strategies have not only challenged the traditional ‘Big Four’ supermarkets – Tesco, Sainsbury’s, Asda, and Morrisons.

This article delves into the history of their UK market entry, their impact on the supermarket landscape, growth trajectories, market share dynamics, inter-brand competition, and the controversies that have accompanied their rise.

The Marketing Made Clear Podcast

Check out the Marketing Made Clear Podcast on all good streaming platforms including Spotify:

Aldi and Lidl’s Entry into the UK Market

Aldi and Lidl, both hailing from Germany, introduced their discount retail models to the UK in the early 1990s. Aldi opened its first UK store in Stechford, Birmingham, in 1990, while Lidl followed in 1994. Their minimalist store designs, limited product ranges, and focus on private-label goods offered British consumers a stark contrast to the established supermarkets. Initially, their presence was modest, catering primarily to cost-conscious shoppers.

Transforming the UK Supermarket Landscape

The 2008 financial crisis marked a turning point for both retailers. As economic uncertainty loomed, consumers became more price-sensitive, seeking value without compromising quality. Aldi and Lidl capitalised on this shift, emphasising their cost-effective yet quality offerings. Their streamlined operations, efficient supply chains, and focus on private-label products allowed them to maintain low prices. By 2014, their combined market share had nearly doubled, accounting for almost £1 of every £10 spent in British grocers.

Their growth prompted significant reactions from traditional supermarkets. The ‘Big Four’ were compelled to re-evaluate their pricing strategies, leading to price wars and a renewed focus on value propositions. This democratisation of discount shopping eroded the stigma once associated with bargain hunting, making it a mainstream choice across various demographics.

Growth Figures and Market Share

The growth trajectories of Aldi and Lidl have been remarkable. As of November 2024, Aldi’s market share stood at 10.4%, marking its first entry into double-digit territory. Lidl, not far behind, achieved a record-high market share of 8.1% in May 2024. This surge is even more pronounced considering that in 2012, their combined market share was just 5.4%.

Their financial performances reflect this growth. In the year leading up to December 2023, Aldi UK’s pre-tax profits soared to £536.7 million, a significant increase from £152.6 million the previous year. This surge was accompanied by a 16% rise in sales, reaching £17.9 billion. Lidl also reported robust figures, with sales increasing by 9.4% year-on-year in the 12 weeks leading up to May 2024, elevating its market share from 7.7% to 8.1%.

Competing Against Each Other and the Market

While both retailers share a similar discount model, their competition with each other is fierce. Both have embarked on aggressive expansion plans, often opening new stores in close proximity to each other. Aldi aims to operate 1,500 UK stores in the long term, while Lidl has set a target of 1,100 stores by 2025.

Their rivalry extends beyond store count. Lidl’s introduction of a loyalty app offering personalised discounts has been credited with boosting its sales, particularly in in-store bakeries where volume sales have surged by over 40%. Aldi, on the other hand, has refrained from introducing a loyalty scheme, focusing instead on maintaining its low-price leadership.

In response to their growing market share, traditional supermarkets have implemented various strategies. For instance, Asda reintroduced its “Rollback” promotion and committed to being 5% to 10% cheaper than rivals in an effort to regain lost market share. Tesco and Sainsbury’s have also adjusted their pricing strategies and enhanced their own-label offerings to compete more effectively.

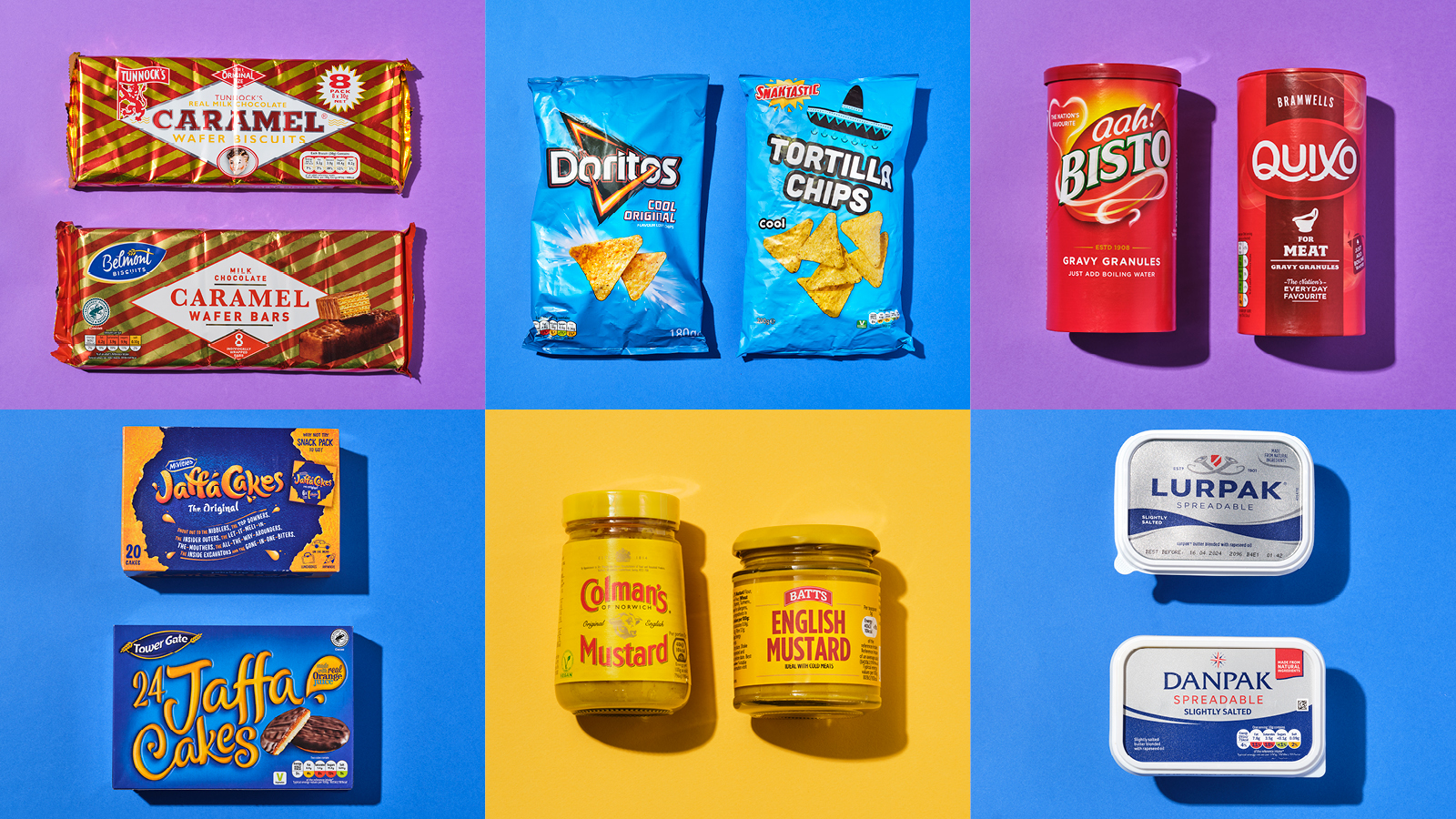

Controversies and Brand Emulation

Despite their success, both Aldi and Lidl have faced controversies, particularly concerning allegations of emulating branded products. Their strategy of offering private-label products that closely resemble popular branded items has led to legal disputes and criticisms from established brands. This approach, while providing consumers with affordable alternatives, has raised questions about intellectual property rights and fair competition.

Additionally, their rapid expansion has sometimes been met with resistance from local communities concerned about the impact on independent retailers and the homogenization of the retail landscape. However, many consumers have embraced the variety and value these discounters bring, leading to a complex dynamic between community interests and consumer preferences.

Conclusion

Aldi and Lidl have undeniably transformed the UK supermarket sector, challenging traditional retailers and each other in a relentless pursuit of market share. Their emphasis on efficiency, private-label products, and aggressive pricing has resonated with a broad spectrum of consumers, particularly during economic downturns. As they continue to expand and innovate, the competitive landscape of UK supermarkets is set to evolve further, with consumers ultimately benefiting from increased choice and value.