Welcome to the World of Dog Food

Exploring Consumer Behaviour in the UK

The UK pet food market is booming, and it’s not just about feeding our furry friends anymore. With pet ownership on the rise, especially since the pandemic, the way dog owners approach feeding their pets has become a topic of intrigue and transformation. Today, we explore the trends, challenges, and innovations shaping the dog food industry in the UK, including the rise of raw feeding and the key factors driving consumer behaviour.

The Marketing Made Clear Podcast

This article features content from the Marketing Made Clear podcast. You can listen along to this episode on Spotify:

The Big Picture: Global Pet Food Markets

The global pet food market is a juggernaut, valued at over $94 billion in 2023 and expected to grow at a compound annual growth rate (CAGR) of 4.4% through 2030. North America dominates the market, contributing nearly 50% of global sales, while Europe and Asia-Pacific are catching up with impressive growth rates of 4.5% and 3%, respectively.

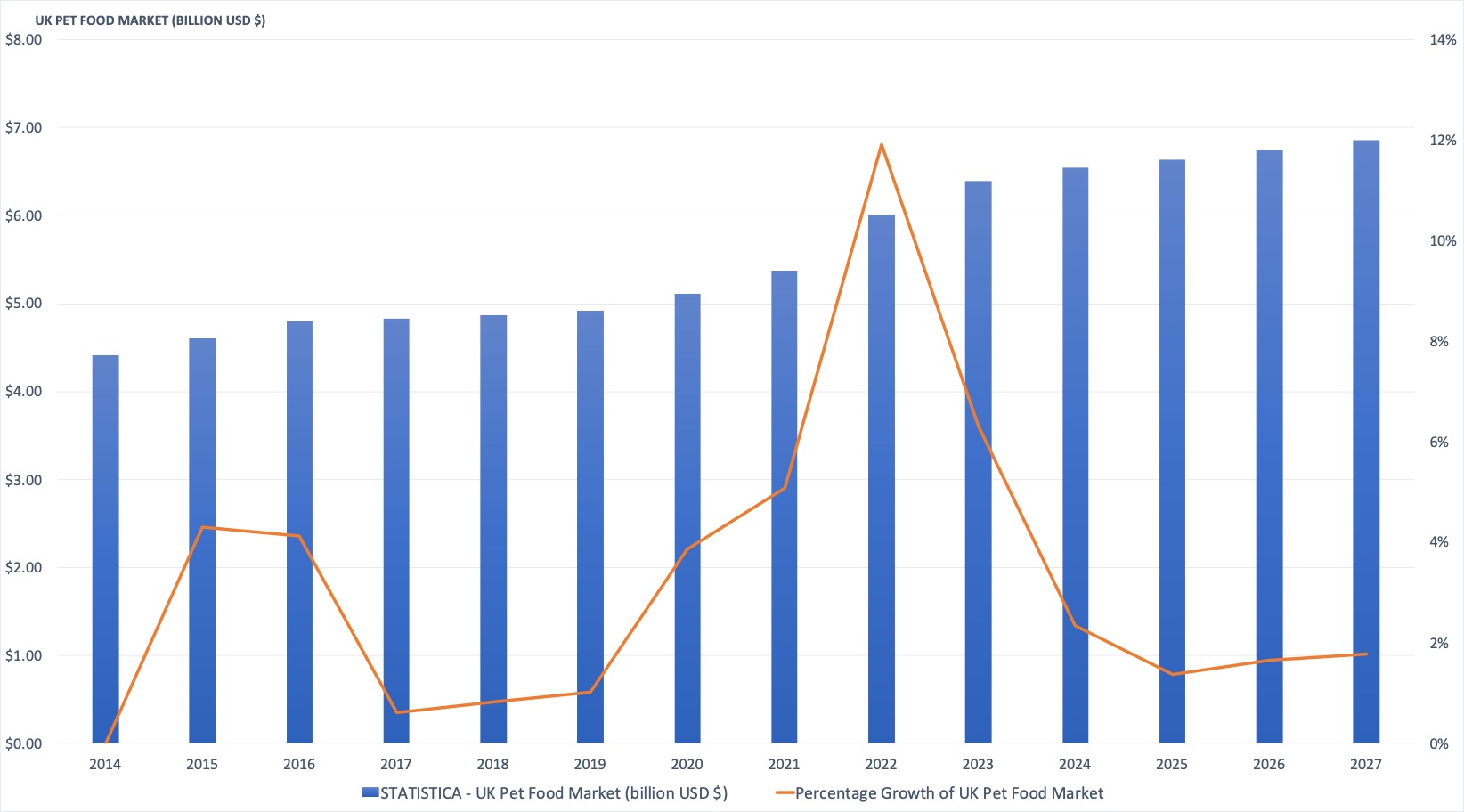

In the UK, the pet food market’s growth trajectory mirrors global trends, with the sector projected to expand by over 14% in the next five years. This surge isn’t just about quantity; it’s also about the quality and diversity of products available to consumers.

The UK Market Landscape

In 2020, the UK pet food market reached a valuation of £3.1 billion, with dog food accounting for a significant portion of this. The pandemic played a pivotal role in this growth, as over 3.2 million pets were acquired during lockdown, bringing the total percentage of UK households owning a dog to 27%.

E-commerce has also revolutionised the industry, with online sales in the pet sector growing 204% in 2020 and a further 38% in 2021. Consumers increasingly turn to online platforms for convenience and access to premium options.

Despite this innovation, the market remains dominated by the “Big Four”: Mars, Nestlé, Procter & Gamble, and Colgate-Palmolive. These giants own many dry food brands and have significant stakes in veterinary practices, influencing recommendations and consumer choices. However, premium and niche brands are rising, challenging their dominance.

Dog Food Categories: The Rise of Raw Feeding

Dog food generally falls into four main categories: dry, wet, raw, and niche diets. While dry and wet foods hold an 80% market share due to their convenience and affordability, they often rely on synthetic additives and preservatives – an issue that has spurred the rise of raw feeding.

Raw dog food, made from fresh, minimally processed ingredients like raw meat, bones, and offal, is growing in popularity as part of the broader “real food movement.” Advocates argue that raw diets are “species-appropriate,” aligning with a dog’s natural dietary needs.

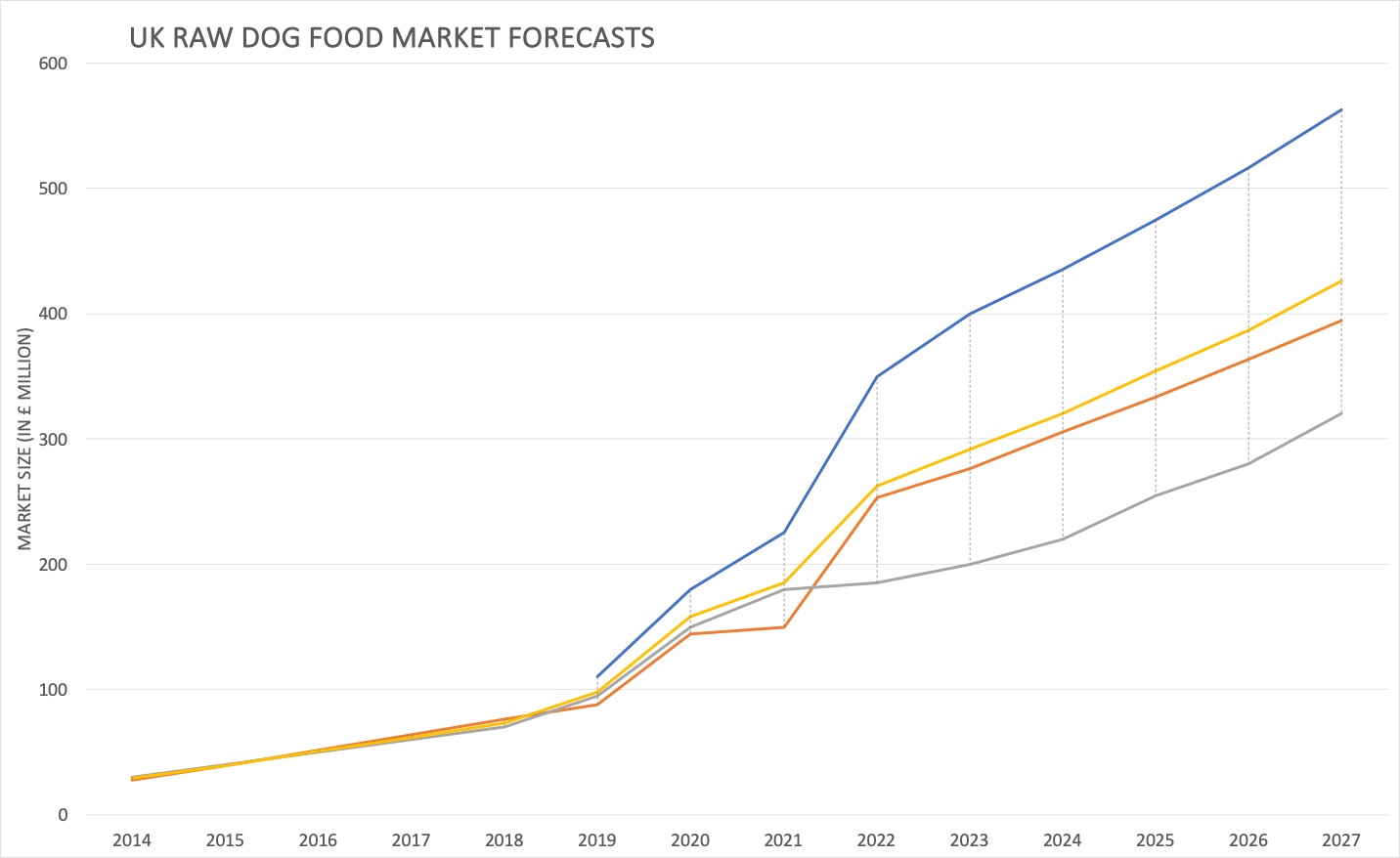

Between 2012 and 2016, the raw dog food market in the UK grew from 2% to over 6% of total sales. Today, it’s estimated to hold a 15-20% share and continues to grow rapidly. However, this growth isn’t without its challenges. Traditional pet food companies and some veterinarians have voiced concerns about raw feeding, citing issues like safety and nutritional balance.

In response, organisations like the Raw Feeding Veterinary Society (RFVS) and groups like Raw Pet Medics are providing education and research to counter these claims, advocating for the health benefits of raw diets.

Spotlight on Paleo Ridge

One company leading the raw feeding revolution is Paleo Ridge, a UK-based brand founded in 2014. Their ethos revolves around providing premium, species-appropriate dog food with strong ethical and environmental standards.

Paleo Ridge’s origin story is a powerful one. After the founders’ dog was diagnosed with cancer – a condition they linked to its diet – they switched to raw feeding, which gave their beloved pet an additional seven years of life. This story resonates with many raw feeders who see the diet as a pathway to improved health and longevity for their pets.

Financially, Paleo Ridge has seen tremendous growth, becoming the fastest growing raw dog food brand in the UK.. But beyond the numbers, their success highlights a broader shift in consumer preferences towards healthier, more natural options for their pets.

Why Consumer Behaviour Matters

Understanding consumer behaviour is essential to navigating the evolving pet food industry. Factors like health consciousness, ethical concerns, and the influence of veterinarians all play a role in shaping decisions. While traditional vets often promote highly processed diets, groups like the RFVS are challenging this narrative with evidence-based advocacy for raw feeding.

For marketers, these insights are invaluable. Knowing what motivates dog owners – from health benefits to convenience – can help brands tailor their messaging and products to meet these needs effectively.

What’s Next?

The UK pet food market is at a turning point. With rising demand for premium and raw options, brands must adapt to meet consumer expectations. Education and transparency will be key in building trust and encouraging more pet owners to make informed decisions about their dog’s diet.

As raw feeding continues to grow, it’s not just about feeding pets; it’s about reshaping an industry. Whether you’re a pet owner, marketer, or industry professional, there’s never been a more exciting time to explore what’s in the bowl.